The advisor’s guide to client risk and insurance

(Editor's Note: A monthly series introducing financial advisors to the importance of life and other insurance solutions, providing answers to client anxieties around personal risk.)

I’m an insurance fiduciary. What’s that, you ask? I’m part of a small but growing group of insurance specialists who offer their expertise in ways similar to those of a fee-only financial planner. We don’t sell product and we won’t accept commissions. The result is giving the client an objective expert to turn to for a second opinion and objectivity when considering an array of increasingly complex insurance products.

My part-time teaching career began more than 30 years ago, but more recently I taught several semesters of Risk Management and Insurance Planning to undergrads and graduate students in Texas Tech University’s School of Personal Financial Planning.

One of the first things I noticed in teaching this course was the universal expectation we would be focused entirely on insurance, despite the course name. So, I started the first class with a discussion of risk as the basis for potentially – but not exclusively – ending up on the insurance “GO” square for every financial situation.

Not all risk is the same

What’s in your risk anxiety closet? The cost of an expensive medical event? A kitchen fire? A disability that cuts off needed earned income? Those are the typical responses around the risks we know we know. But what about the risks you don’t know you know? To get over the notion of “how do I know what I don’t know?” we need to get outside the box. How about “zombie apocalypse” or “alien invasion?” Although these are not likely to pop out of our anxiety closets anytime soon, the point is to realize we all have anxieties – and the variety and degree of importance will vary from person to person.

In my experience, tolerance for investment risk and personal risk are going to be different for most people. As an advisor focused on personal risk, I want to help the client think through the things that create anxiety and concern were they actually were to occur. Because it’s not about insurance – it’s about personal risk planning.

Here’s the process of inquiry I use with clients:

- Risk identification: What’s in your anxiety closet? You would think that a client would easily be able to name the risks that provoke some level of anxiety, but that’s not usually the case. Most of us don’t want to think about these issues – so we don’t. The client will need some examples to get the conversation flowing. “Many of our clients say that experiencing a disability that stops the flow of income is a real concern …” is an example of a great way to start this conversation.

- Risk exposure prioritization: Zombie apocalypse is probably not at the top of the list, but you never know! “Of the risks you’ve mentioned, what are the three that most concern you?”

- Risk mitigation: This discussion can be very practical. If the client bungee jumps as a hobby on the weekends, I might diplomatically suggest, “Perhaps this is a hobby that can be deferred to a later time – when your family isn’t so financially dependent on you!”

- Determine financial exposure: Estimate the value of the loss were it to occur. What is the cost to replace a stolen, uninsured electric bicycle? Such risks are relatively easy to value – but the typical client doesn’t “do the math” on the cost of a permanent disability preventing them from earning what could be millions of dollars over a working lifetime.

- Transfer of financial consequences: Most of my students have a variety of potential risks and no insurance. Well, that’s not quite true. They have insurance – we call it self-insurance. And it’s true for everyone. The risks are there; some risks may occur; some may result in minor financial inconvenience, and others may have enormous consequences. We start out self-insuring everything.

Later, when we have enough at risk to be concerned, it’s probably time to evaluate the most likely risks and our financial vulnerability if/when those risks materialize. It’s at that point where we can begin to evaluate transferring the consequence of the risk to a third-party institution that will take on the burden – for a price. In some instances, we may choose to retain some of the first-dollar risk (deductibles can be a way of moderating the cost of transfer). In others – where practical and economical – we may choose to transfer all the financial consequences of loss, such as occur in a family’s loss of income due to a wage earner’s premature death.

Although it takes a little time to develop this level of rapport and “financial intimacy” with a new client, I find it leads to a deeper advisory relationship in building client trust and confidence. In future articles, I’ll share some details about emerging standards of care, issues of client best interest and product suitability, methods in which to best help our clients by becoming expert facilitators of decision-making, as well as introducing some of the conversations we have with clients based on their questions and concerns.

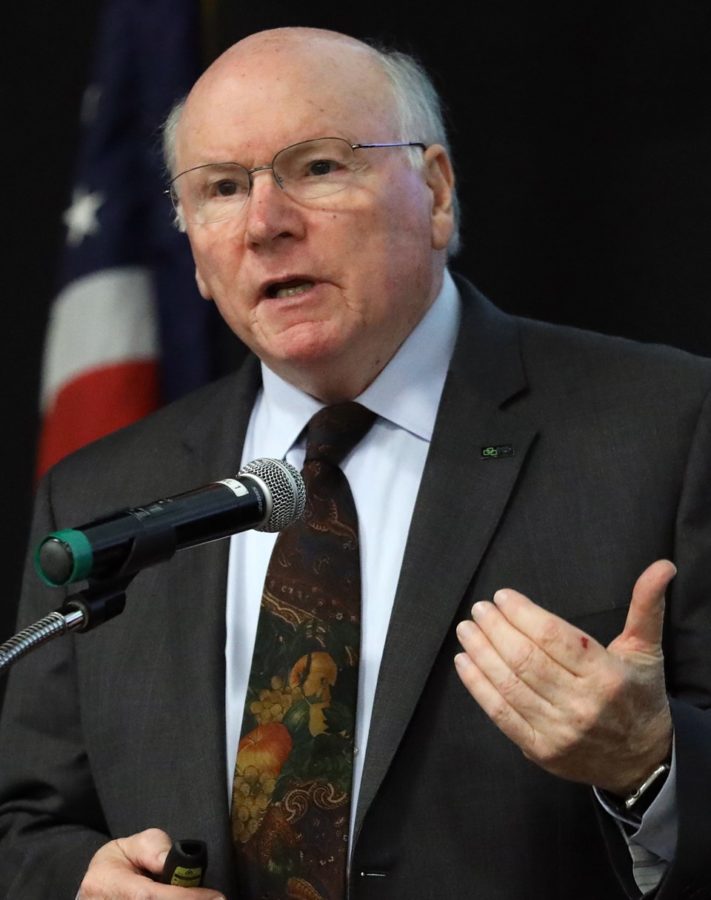

Richard M. Weber, MBA, CLU, AEP (Distinguished) is a 56-year veteran of the life insurance industry, having been a successful agent, a home office executive, a software designer, author of four books and more than 400 published articles, and an educator. He is the co-creator of Certified Insurance Fiduciary, an online program for advisors wanting to enhance the scope of their advisory services. He may be contacted at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Richard M. Weber, MBA, CLU, AEP (Distinguished), is a 57-year veteran of the life insurance industry, having been a successful agent, a home office executive, a software designer, author of four books and more than 400 published articles, and an educator. He is the co-creator of Certified Insurance Fiduciary, an online program for advisors wanting to enhance the scope of their advisory services. He may be contacted at [email protected].

Inflation, market turmoil top consumer concerns, survey finds

Can Life Insurance Rescue Your Client’s Retirement?

Advisor News

- Flexibility is the future of employee financial wellness benefits

- Bill aims to boost access to work retirement plans for millions of Americans

- A new era of advisor support for caregiving

- Millennial Dilemma: Home ownership or retirement security?

- How OBBBA is a once-in-a-career window

More Advisor NewsAnnuity News

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

- How the life insurance industry can reach the social media generations

- Judge rules against loosening receivership over Greg Lindberg finances

More Life Insurance News