Surrenders expected to rise at Corebridge, new RILA already selling strong

Corebridge Financial saw its fixed annuity surrender rate drop to 9.7% in the fourth quarter. That’s the good news.

Then Elias Habayeb, chief financial officer, delivered the bad news to Wall Street analysts on a conference call Thursday morning.

“We expect to see our surrender rate increase in the coming year with large lots of fixed and fixed index annuities exiting the surrendered charge period,” he said.

The revelation commanded the attention of analysts, who asked several follow-up questions on the topic. Corebridge reported an otherwise strong concluding quarter to 2024, with net income of $2.2 billion compared to a loss of $1.3 billion in the year-ago quarter.

Corebridge, the former life and retirement division of American International Group, remains entrenched in second place in annuity sales. The insurer is credited with nearly $21 billion in annuity sales through Q3, trailing only Athene Life & Annuity.

Habayeb and CEO Kevin Hogan stressed the overall strength of the Corebridge annuity portfolio in fending off the questions on surrenders.

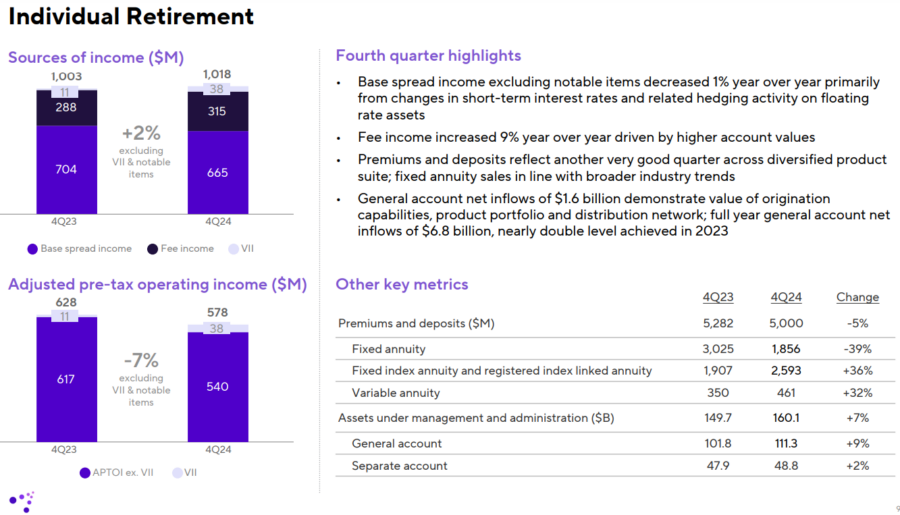

“We had higher surrenders, but we had strong sales,” Habayeb said. “The net influence of the general account was about $7 billion for the year. And we grew the general account in individual retirement by 9%. Looking into 2025, the fundamentals in the business and individual retirement are very strong.”

Fixed annuity sales represented another area of Q4 weakness, with sales skidding more than the industry average. Hogan blamed competitive pricing in the market for the sales downturn.

“We see a very robust environment for fixed annuities still, and it continues to be a very valuable product,” he said. “There's a whole new range of advisors that have discovered the importance of fixed income-like products as part of a long term retirement savings asset allocation.”

In Other News

New RILA performance. Corebridge kicked off the fourth quarter by launching its MarketLock registered indexed-linked annuity. Corebridge subsidiary American General Life Insurance Co. is issuing the product.

It’s first RILA made Corebridge the biggest annuity seller to offer products in every major category.

“Some of the largest states have yet to come online, and some of our largest distribution partners won't come online until first quarter or later in the year,” Hogan said. “But the response has been excellent. By year end, we had already received over $90 million worth of applications.”

A RILA is a long-term, tax-deferred insurance contract that's designed to help people save for retirement. RILAs work by tying the performance of the contract to one or more stock market indexes, and offering a level of protection from market downturns.

Quarterly Snapshot

- Life Fleet risk-based capital ratio of 420-430%, remained above target.

- Holding company liquidity of $2.2 billion at the close of 2024, reflecting proceeds from the September and November debt issuances to pre-fund upcoming maturities in 2025.

- Premiums and deposits were $9.9 billion, a 6% decrease from the prior-year quarter.

Management Perspective

“We launched our Bermuda affiliated reinsurer strategy in July and began ceding fixed and fixed-indexed annuity new business. By year end, we added both in-force and new business for structured settlements and term life. In total, we have ceded just over $12 billion.”

--CEO Kevin Hogan on Corebridge’s reinsurance efforts

By The Numbers

- Net Income: $2.2 billion (-$1.3 billion in Q4 2023)

- After-tax Operating Income: $701 million ($661 million in Q4 2023).

- Earnings Per Share: $1.23 ($1.04 in Q4 2023)

- Share Repurchases: $398 million in Q4 2024

- Dividend Declared: $129 million in Q4 2024

- Stock Price Movement: Stock is $32.02, down 2.2% at the end of Thursday.

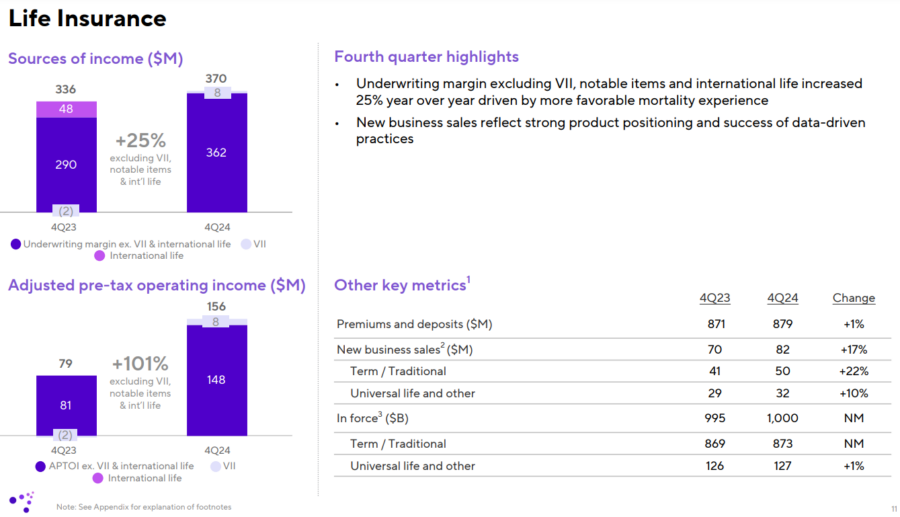

Life Picture

- Premiums and Deposits: -$879 million ($871 million in Q4 2023)

- Sales: $82 million ($70 million in Q4 2023)

Individual Retirement (Annuities)

- Premium and Deposits: $5 billion ($5.3 billion in Q4 2023)

- Assets Under Management and Administration: $160 billion ($150 billion in Q4 2023)

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

SC judge rules Atlantic Coast can stay in business; rips regulators

Federal employees: An emerging market for advisors

Advisor News

- Why aligning wealth and protection strategies will define 2026 planning

- Finseca and IAQFP announce merger

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

More Advisor NewsAnnuity News

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

- Great-West Life & Annuity Insurance Company Trademark Application for “SMART WEIGHTING” Filed: Great-West Life & Annuity Insurance Company

- Somerset Re Appoints New Chief Financial Officer and Chief Legal Officer as Firm Builds on Record-Setting Year

- Indexing the industry for IULs and annuities

- United Heritage Life Insurance Company goes live on Equisoft’s cloud-based policy administration system

More Annuity NewsHealth/Employee Benefits News

- Sick of fighting insurers, hospitals offer their own Medicare Advantage plans

- After loss of tax credits, WA sees a drop in insurance coverage

- My Spin: The healthcare election

- COLUMN: Working to lower the cost of care for Kentucky families

- Is cost of health care top election issue?

More Health/Employee Benefits NewsLife Insurance News