Study shows most retirees are financially fragile – and how advisors can help

Most retirees and pre-retirees are financially fragile with the average retiree able to withdraw about $5,000 each year from their savings, according to a recent longevity study.

A majority rely on their own instincts for retirement planning but they also say they regret not doing more planning, according to “Disconnected: Reality vs. Perception in Retirement Planning,” a study released Monday by the Stanford Center on Longevity, sponsored by the firm Finance of America Reverse (FAR).

As boomers surge into retirement, this study found the median savings of respondents between 50 and 74 was $128,000 and 55% said their financial situation was fragile or being just able to get by financially. Going by the 4% rule, respondents could withdraw an average of $5,120 annually, with 72% going by their instincts for planning and 60% saying they should have done more planning. Only 10% of respondents were very comfortable with their finances.

“As a result, the majority of pre-retirees won’t have sufficient retirement income from all sources to retire full time at age 65 under their pre-retirement level of spending,” according to the study. “Because of this situation, they may face potentially difficult decisions: They may have to delay retirement, reduce their spending, and/or utilize all their financial resources, such as home equity, to maximize their retirement cashflow.”

Financial security is valued

People do value retirement security, with eight out of 10 saying they value feeling financially secure for the rest of their lives, being able to afford care or assistance and being able to afford the lifestyle they want in retirement.

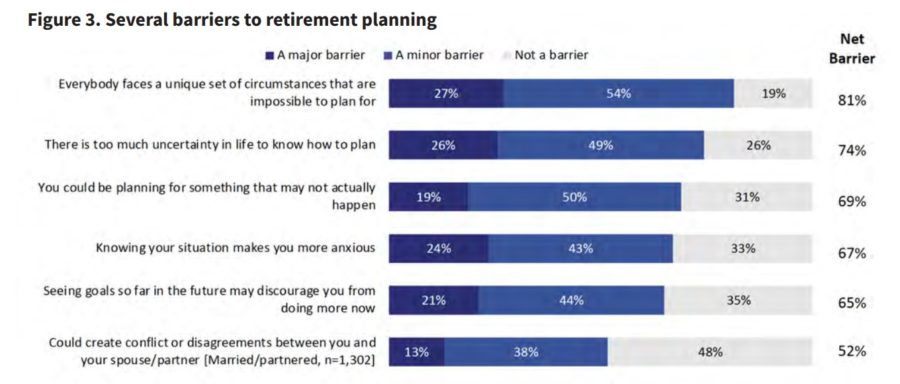

But what is keeping them from doing the planning they need? The study found some themes and the researchers offered guidance for advisors:

- People have difficulty envisioning and planning for longer lives. “Helping people develop a picture of the lives they would like in older age might help motivate them to plan, and to plan differently.”

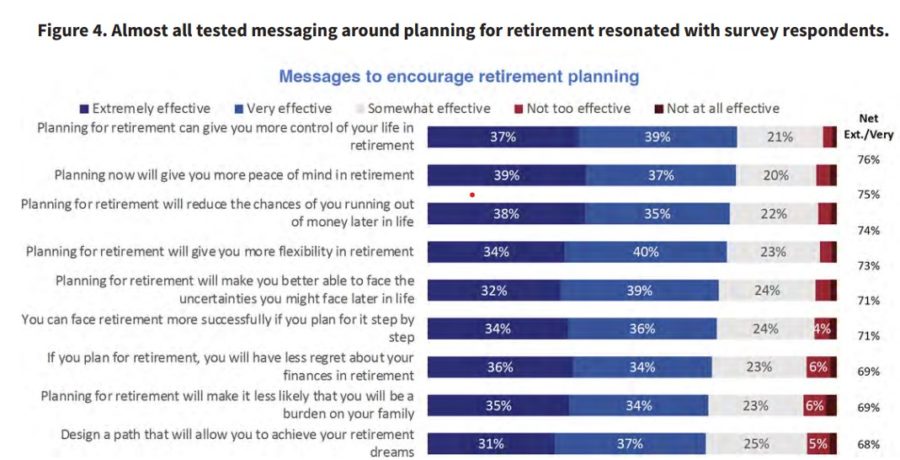

- Although retirement is different for each person, people universally want a peace of mind in retirement. “Pre-retirees and retirees also express a strong interest in having flexibility and control over their lives. Building on these desires can lead to more effective messaging and interventions.”

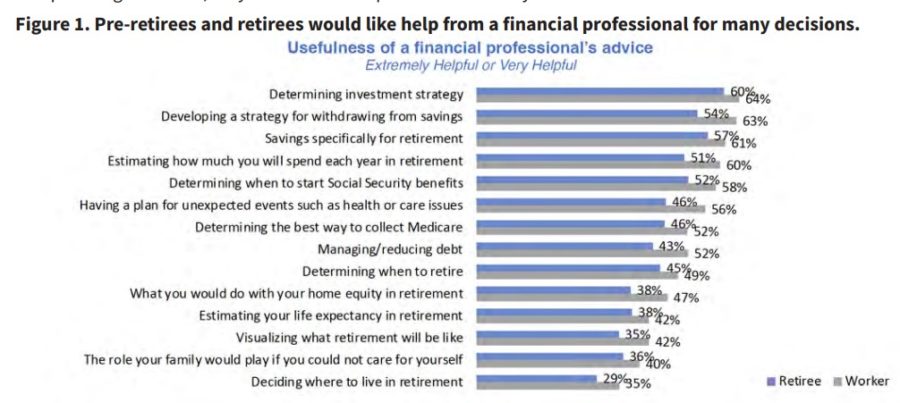

- People are anxious about going it alone. “Most pre-retirees and retirees need and want help with the critical retirement decisions they face, but they’re not always certain where to find it nor seek it out if they do.”

Most clients don’t have the skills to make the necessary complex decisions, and that scares them, according to the survey. They have a hard time navigating their competing personal and financial goals, so they often don’t try.

How to help

“With a large number of workers in that ‘near or entering into retirement’ demographic,” the authors wrote, “the financial industry, financial advisors, employers, and retirement plan administrators have an opportunity to provide more resources to aid with that transition, resources that can help pre-retirees and retirees better address the critical and complex decisions they face as they transition into retirement.”

The researchers’ review of other research revealed three phases for advisors to approach to work with clients on retirement planning:

Engaging and educating

Start by emphasizing the importance of the decision and motivate the client to engage in the process. It is easy to skip over this step to move onto planning, but if people are just going through the motions, they are less likely to follow through.

“While this is often a very difficult first step, it’s a critical one: Engaging and motivating pre-retirees to understand and spend the necessary time to address the various decisions they face will help them define their specific needs and desires in retirement,” the researchers wrote.

Guiding

Give clients simple steps to make the many decisions in retirement planning. “Given the perceived complexity of the retirement planning process, three-quarters of survey respondents reported that providing educational resources that contain useful information and a step-by-step guide to making important decisions would help encourage them to do more retirement planning,” according to the report.

Because daily life gets in the way of long-term planning, it is essential to break through the noise with reminders and encouragement. Reminding clients of decisions is a good first step, but congratulating them can go a long way to keeping them on track. “More than half of survey respondents also reported they’d be encouraged to do more retirement planning by hearing stories of similar people (reported by 55% of survey respondents) and by being asked thought-provoking questions (64% of respondents).”

Enabling

Help clients understand the barriers they face and help remove or surmount them, rather than just leaving it up to them.

“Many techniques have been tested and proven successful in helping people visualize and connect with their ‘future selves,’” according to the report. “Relatively simple techniques like writing a letter to their ‘future self,’ envisioning and describing a typical day in retirement, answering thought-provoking questions about how they envision their future, and seeing and reacting to an age-progressed photo have all been shown to elicit a positive reaction to planning for the future.”

As advisors help clients along the path, they can use certain words and phrases that will help people take on their challenges. The survey showed which ones resonated most.

Who is financially comfortable?

So, what does financial comfort look like? They had at least $100,000 in financial assets – 82% of those considered financially fragile had less than that, and 61% of the “able to get by” group had less, while only 21% of financially comfortable group had less than $100,000.

It helps to have a traditional pension – 58% of the financially comfortable group had a pension, while 47% of the able to get by people did and 34% of the financially fragile group did.

Owning a home was key, with 87% of the financially comfortable reporting they owned one, while 68% of the able to get by group did and 42% of the financially fragile.

“Our survey showed that the first two groups need the same type of retirement planning help and are receptive to the same interventions and messages as people who report that they’re financially comfortable,” according to the report. “However, it’s only natural that the two more vulnerable groups need more attention, more encouragement, and more straightforward, step-by-step guidance than they’re currently receiving.”

The survey, conducted by Greenwald & Associates, found that more than half of workers and retirees wanted help from advisors on key decisions, such as determining strategies for investing and withdrawing assets.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at stevenamorelli@gmail.com.

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Initial insured loss estimates for Hurricane Ian range up to $75 billion, a Fla. record

Making the most of Financial Planning Month

Advisor News

- TIAA, MIT Age Lab ask if investors are happy with financial advice

- Youth sports cause parents financial strain

- Americans fear running out of money more than death

- Caregiving affects ‘sandwich generation’s’ retirement plans

- Why financial consciousness is the key to long-term clarity

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Immigration cooperation, IEDC limits and more nab concurrence votes, head to governor

- Ending Medicaid expansion would devastate Ohio’s economy

- Alfa health plan bill 1 vote from final passage

- Business Briefs 0424

- Bill aimed at holding health insurance companies accountable stalls at Capitol

More Health/Employee Benefits NewsLife Insurance News

- Annual Report for Fiscal Year Ending December 31, 2024 (Form 20-F)

- Ameriprise Financial Reports First Quarter 2025 Results

- IUL: Offering stability amid trade tariff uncertainty

- ‘Really huge’ opportunity for life insurance sales if riddle can be solved

- Americans fear running out of money more than death

More Life Insurance News