Study finds Americans worry about the wrong retirement risks

Even before the latest equity market madness, Americans were fixated on asset volatility as the top risk to their retirement rather than the real risks, according to research.

The latest study brief from the Center for Retirement Research at Boston College is titled “How Well Do Retirees Assess the Risks They Face in Retirement?” and the answer is not very well at all.

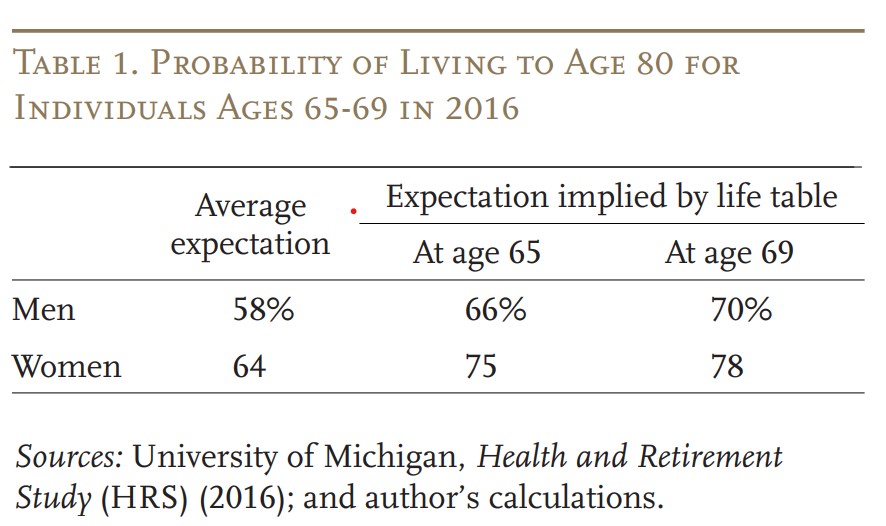

Even as Americans watch relatives live into their 80s and 90s, they themselves don’t expect that longevity for themselves. It is just one of their misplaced pessimisms, according to the report.

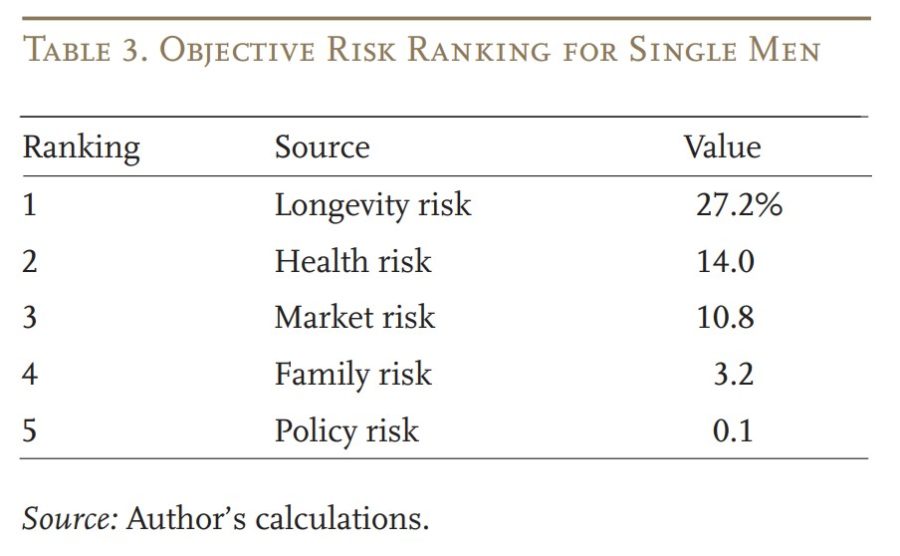

The actual, or objective, risks are:

Longevity: Living longer than expected and exhausting resources.

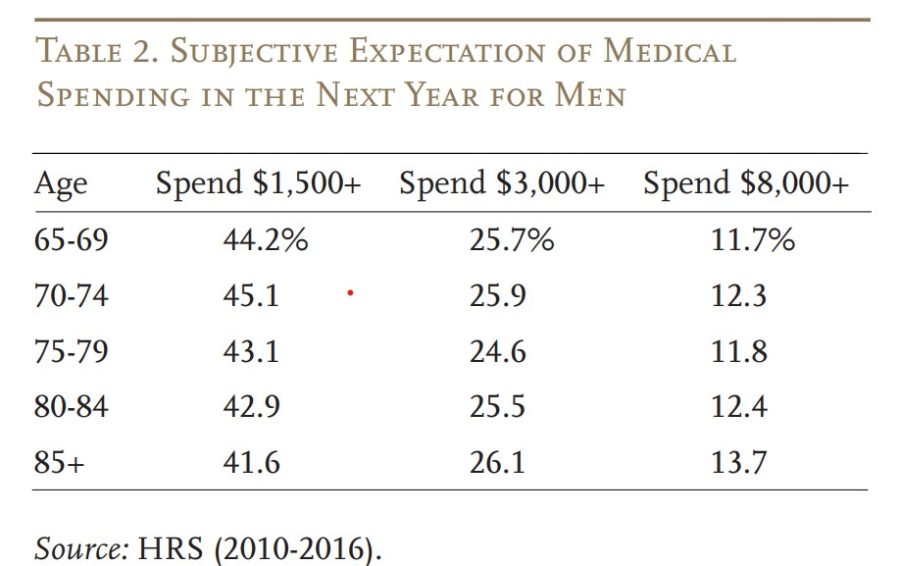

Health: Retirees don’t appear to expect living for decades in retirement, and they definitely are not prepared to pay for unexpected medical expenses and long-term care. Health care costs have increased substantially, a trend likely to continue.

Market Risk: Because most retirement savings are in 401(k) funds, that money is at the mercy of asset market volatility. That also includes real estate, also dependent on market conditions.

Family: No, this doesn’t mean unexpected visits from relatives, but includes divorce, death of a spouse and dependent adult children because of illness or unemployment. This is a wild card risk that could last decades.

Public policy: Social Security, the primary source of income for most retirees, is perpetually fretted over with dire announcements of running out of money. “One big reason the policy risk is small is that Social Security reform is unlikely to have a significant impact on people who have already retired.”

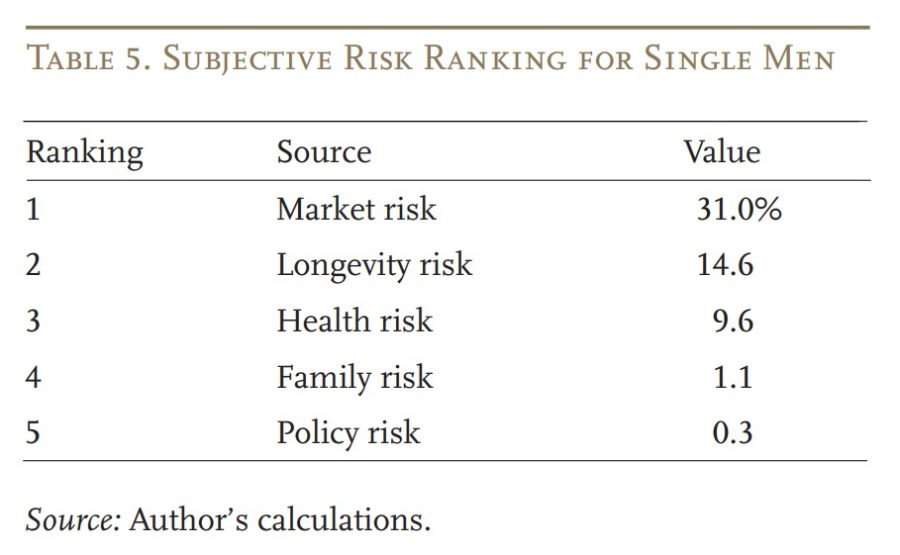

Those are the risks according to previous retirement research. The respondents’ perceived, or subjective, risks downplay the real danger to the retirement security.

“The biggest risk in the objective ranking is longevity risk, followed by health and market risks,” according to the report. “In contrast, the subjective rankings show that market risk tops the list, which reflects retirees’ exaggerated assessments of market volatility. Perceived longevity risk and health risk rank lower, because retirees are pessimistic about their survival probabilities and often underestimate their health costs in late life.”

The results in the subjective assessment are the percentages of initial wealth the respondents would give up to eliminate the risk.

“Given the large volatility of subjective expectations, it is not surprising that market risk is now at the top of the list. The health risk is not as large as in the objective ranking, because retirees significantly underestimate their medical expenses in old ages.”

In a report from last year, retirement center researchers documented how unprepared Americans are to handle long-term care expenses.

“About a quarter of retirees can cover severe care needs for at least five years using income, financial assets, and informal caregivers,” according to the report. “At the other extreme, about one-quarter of individuals cannot afford even minimal care needs. The remaining 47 percent of individuals lie somewhere in between.”

But the researchers cautioned that this assessment might overestimate available resources –basically, caregivers might not be willing to give all their health and wealth to care for family members and others.

“Providing care, especially high intensity care over long periods, can have negative effects on the physical and emotional health of caregivers,” according to the report. “Individuals may not be willing to deplete their entire financial reserves, leaving no buffer for emergencies.”

A recalibration with that in mind showed that only 21% could cover severe long-term care and 36% could not cover a year of even minimal care.

What to do about it?

The retirement risk report made three conclusions about the mismatched risk assessments.

Educate: Americans do not have an accurate understanding of their real retirement risks, and they need to understand what to protect against.

Insure income: With the combination of longevity and market risk, Americans need a lifetime income from Social Security or annuities.

Plan for LTC: “Long-term care is also a significant risk faced by retirees, but one they often underestimate. Better designed public programs and private products, possibly integrated with life annuities, could be encouraged to protect retirees with limited financial resources from this potentially catastrophic risk.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

--

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

As consumer sentiment sinks, Republicans even more pessimistic, survey shows

Policyholders wait as Greg Lindberg insurers remain stuck in receivership

Advisor News

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

More Advisor NewsAnnuity News

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

- Assured Guaranty Enters Annuity Reinsurance Market

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

- Guaranty Income Life Marks 100th Anniversary

- Delaware Life Insurance Company Launches Industry’s First Fixed Indexed Annuity with Bitcoin Exposure

More Annuity NewsHealth/Employee Benefits News

- Guest Column: I lost my mom to cancer. Better advocacy is needed.

- Unable to reach a new agreement, LVHN's contracts with UnitedHealthcare begin expiring Monday

- HEALTH INSURERS SHOW NO REMORSE FOR THE HELL THEY PUT PATIENTS THROUGH

- GOP HEALTH CARE CRISIS: FEWER MICHIGANDERS ARE ENROLLING IN AFFORDABLE CARE ACT HEALTH INSURANCE PLANS THIS YEAR

- NEW REPORT: UP TO 120,000 OHIOANS LOSE COVERAGE UNDER JON HUSTED'S HEALTH CARE CRISIS

More Health/Employee Benefits NewsLife Insurance News