Study: Education level should drive decisions on Social Security, annuities

A key factor in deciding when to claim Social Security and whether to buy an annuity in a qualified plan is education level, according to an academic paper.

Three researchers made that observation in a paper, “Fixed and Variable Longevity Annuities in Defined Contribution Plans: Optimal Retirement Portfolios Taking Social Security into Account,” published by the National Bureau of Economic Research.

“For the least educated, delaying claiming Social Security benefits is preferred, whereas the most educated benefit more from using accumulated DC [defined contribution] plan assets to purchase deferred annuities,” according to the paper.

The authors, Olivia S. Mitchell of University of Pennsylvania’s Wharton School and Vanya Horneff and Raimond Maurer, both of Goethe University in Frankfurt, Germany, looked at three economic models to evaluate the balance between delaying Social Security and buying an annuity. In perhaps a counterintuitive conclusion, they said low earners should take on more risky investments.

“Social Security replacement rates are higher for lifetime low earners, and lower for lifetime high earners,” according to the report. “As a result, low lifetime earners receiving a higher replacement rate could decide to devote a greater proportion of their remaining financial wealth to risky equities, through a target date fund or direct equity investment. Conversely, higher lifetime earning retirees receiving a relatively low Social Security replacement rate may wish to purchase larger private annuities in old age from their tax-qualified retirement accounts, to provide a predictable income stream sufficient to cover necessities.”

The paper focused on the impact of longevity income annuities in tax-qualified retirement accounts, in relation to Social Security, taxes and required minimum distributions. They built on prior research by comparing annuities with using retirement account money to defer taking Social Security, according to the authors.

“Our results show that using retirement account assets to purchase at least some fixed deferred income annuities is welfare enhancing for all sex/education groups examined,” according to the paper. “Nevertheless, better educated males and females benefit far more – 7 to 11 times more – compared to the least educated. We also find that a deferral age of 80 is strongly preferred to an immediate annuity, and also to the maximum deferral age of 85 allowed under IRS rules. “

Because better educated people have a relatively lower income replacement from Social Security and can expect longer lifespans, they benefit more from buying deferred income annuities and not delaying Social Security, according to the researchers. The lower educated were better off using retirement funds to delay claiming Social Security rather than buying a DIA because of their higher mortality risk.

Although they focused on qualified longevity annuity contracts (QLACs), which use DIAs, the researchers also saw that variable annuities with equities improved retiree wellbeing in most cases, compared with only having fixed annuities.

“While current regulatory policy stipulates that variable annuities are disallowed as QLACs in US retirement plans, we find that well-designed variable deferred income annuities in retirement plan portfolios can markedly enhance retiree financial wellbeing,” according to the paper.

QLAC lag in sales

QLACs were the focus in the research, but they represent a sliver of annuity sales.

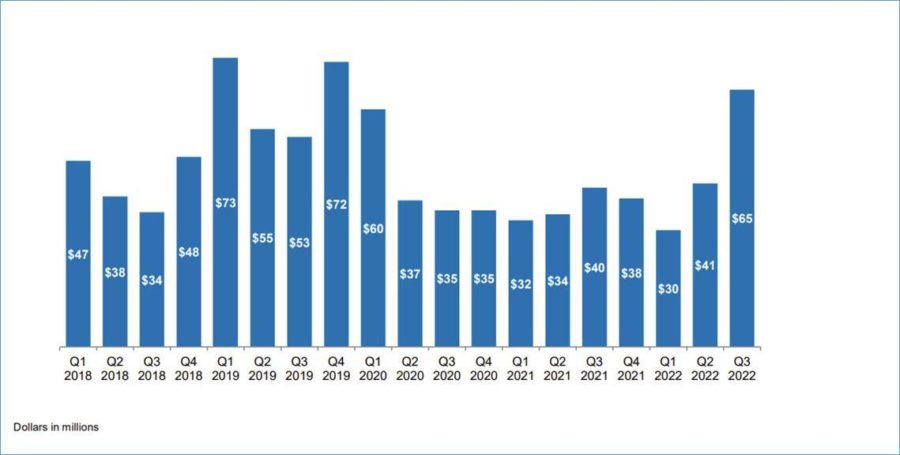

In the third quarter of 2022, the latest available, all annuity sales totaled $80.7 billion, with fixed annuities making $56 billion of that, according to LIMRA. By contrast, QLACs made up $65 million in sales. Although that is tiny in terms of market share, the quarter’s sales were the best since the beginning of the pandemic.

The rise in interest rates propelled sales, along with the sense that the slowing inflation rate might suppress further rate increases, according to LIMRA.

QLAC sales are limited because the products themselves are limited. They are purchased with qualified retirement funds and are designed to start annuitizing in later years (up to age 85) by not counting against RMDs.

SECURE 2.0, passed in December, made significant improvements to QLACs. Currently, retirement plan and IRA holders can use the lesser of 25% of their holdings or $145,000 for QLACs. SECURE 2.0 removed the 25% limit and will allow up to $200,000, indexed for inflation. Although the products cannot include death benefits, they can now have a survivor benefit in case of divorce.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2023 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Economic conditions blamed as insurance agency M&A dips in 2021

Cetera to acquire Securian’s retail wealth business

Advisor News

- DOL proposes new independent contractor rule; industry is ‘encouraged’

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

More Advisor NewsAnnuity News

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

More Annuity NewsHealth/Employee Benefits News

- SENATOR ALVORD PUSHES BACK ON CONSTANT COST INCREASES OF HEALTH INSURANCE WITH FULL BIPARTISAN SUPPORT

- Queensbury details exemptions to lower property tax

- Expanded Affordable Care Act subsidies – now expired – drove major increases in marketplace health insurance enrollment across key groups: Johns Hopkins Bloomberg School of Public Health

- New Insurance Study Findings Have Been Reported from University of South Carolina (Brokering a new path: navigating administrative burdens in the health insurance Marketplaces): Insurance

- Medicaid disenrollment spikes at age 19, study finds: University of Chicago

More Health/Employee Benefits NewsLife Insurance News