Student Loan Debt Stymies Multiple Generations

Critics have said President Joe Biden’s hints that he would consider canceling student debt amount to a “bribe” to young voters, but a survey showed that even boomers are struggling with student debt.

A majority of Americans (59%) of Americans say that they delayed financial decisions because of student loan debt in a Bankrate poll taken early this month.

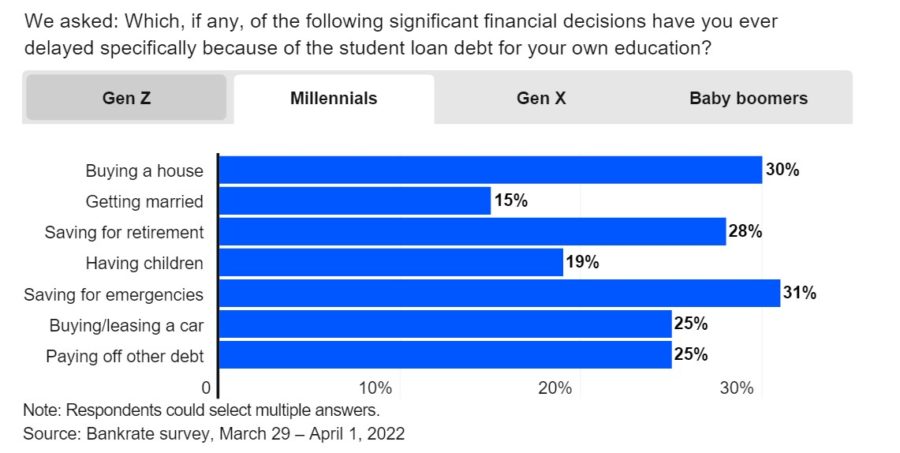

Gen Z and millennial borrowers are struggling the most across the board, with nearly a third of millennials not saving for emergencies (31%) or buying a house (30%) because of student debt.

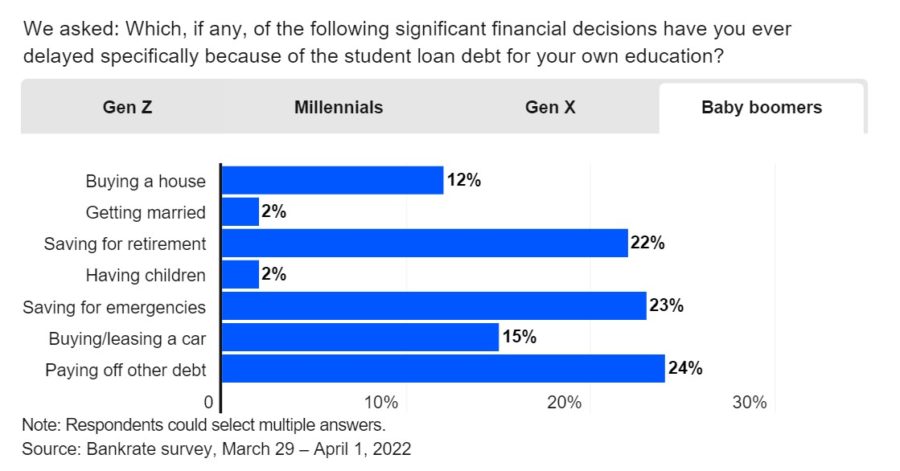

But Gen X and boomer borrowers are also delaying financial decisions because of student debt. More than a quarter (28%) of Gen Xers are not saving for emergencies or saving for retirement (26%). Nearly a quarter of boomers are not paying off other debt (24%), saving for emergencies (23%) and saving for retirement (22%).

Progressive legislators petitioned the Biden administration last year to erase up to $50,000 in student loan debt, arguing that the debt has reduced the rate of home ownership and retirement savings. They also asked that the cancellation not be counted as taxable income.

Biden promised during his campaign to cancel up to $10,000, which he has yet to do. But the administration recently extended the pandemic pause on paying on student loans until Aug. 31. For the more than 45 million people who owe a total of $1.6 trillion, that would mean they would start getting bills for the loans just before the November elections.

Members of the Congressional Hispanic Caucus this week said Biden discussed loan forgiveness during a meeting. Activists have been pressuring Biden to make good on his $10,000 campaign pledge.

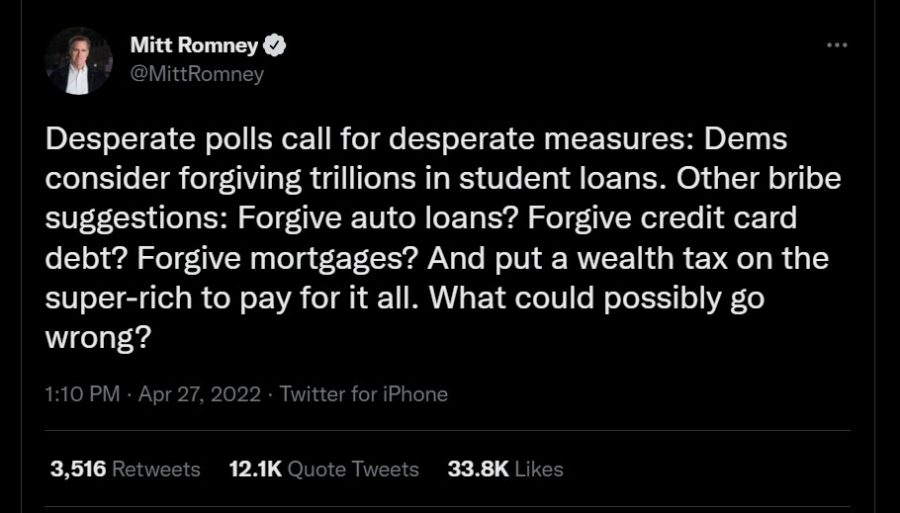

Republican legislators have blasted the idea, with Sen. Mitt Romney of Utah calling it a bribe, saying “Desperate polls call for desperate measures.”

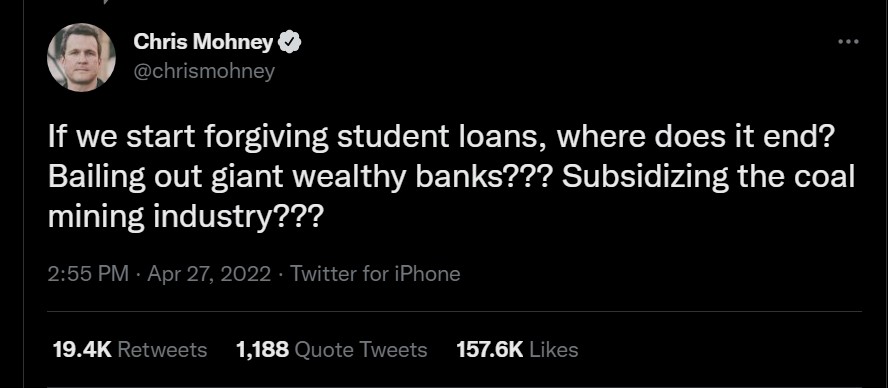

Romney said the forgiveness would be a slippery slope to forgiving other debts. Although Romney’s tweet joined a chorus criticizing the idea, others ridiculed the Republicans’ recent concerns about bail-outs. One tweet reminding readers about the bank bailout after the 2008 crash received more than 150,000 likes.

Although the argument against loan forgiveness has mostly accused Biden of pandering to younger voters, the Bankrate poll shows student loan debt affects a broad range of demographics.

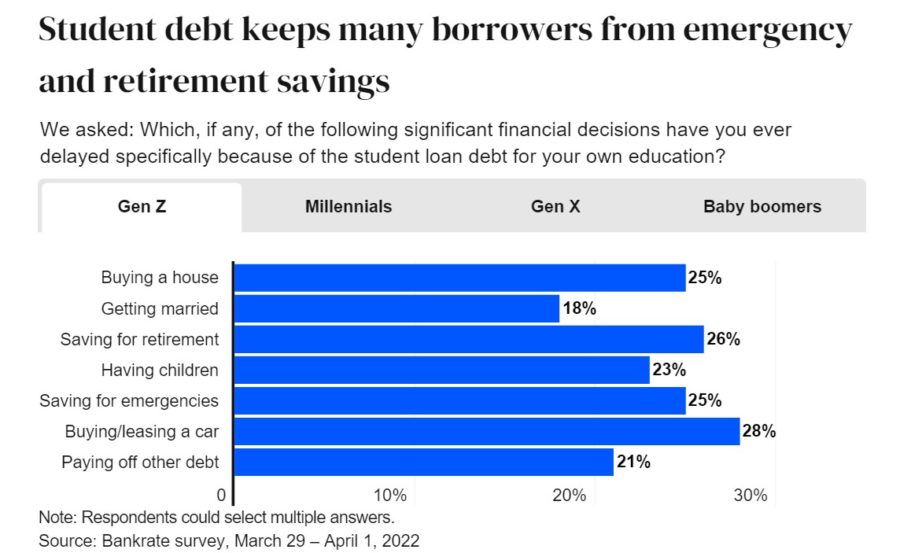

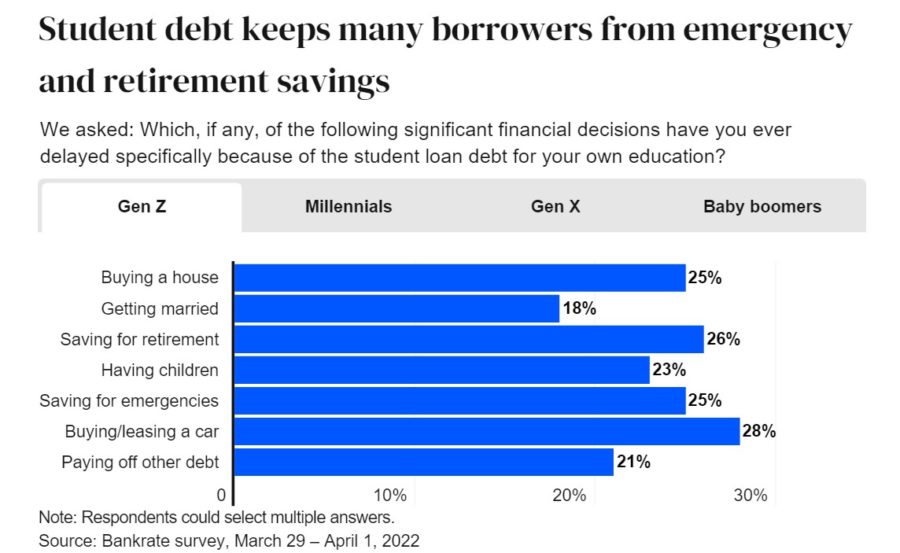

The percentage of people delaying financial decisions drops across the generations, but they are still present. Nearly three-quarters (74%) of Gen Z borrowers and 68% of millennial borrowers have delayed financial decisions, compared to 54% of Gen Xers and 42% of boomers. Gen Z said they are most likely to delay buying or leasing a car, while millennials are most likely to put off saving for emergencies and buying a house.

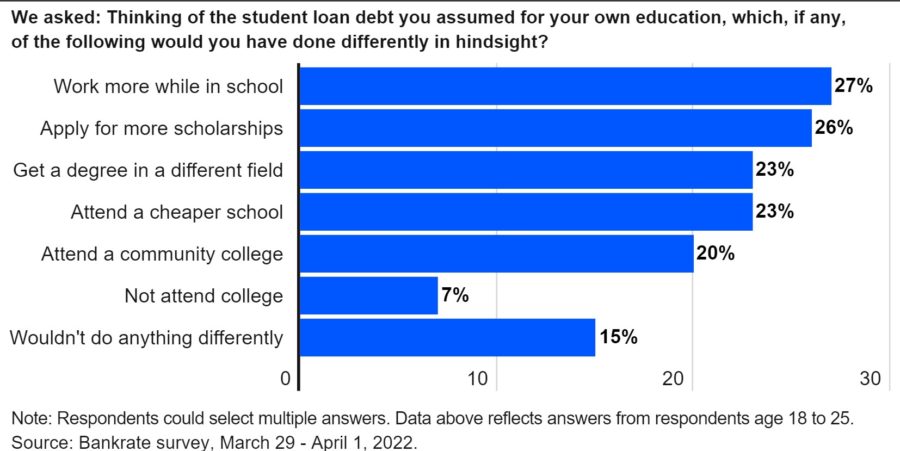

A majority of respondents (59%) said that getting a degree helped with their career and earning potential, but the youngest cohorts had the most regret. Nearly a quarter of Gen Zers said the wished they worked more while they were in school, applied for more scholarships, got a different degree or went to a cheaper school. Only 15% said they would do anything differently.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at stevenamorelli@gmail.com.

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Market Risks, World Tensions Fuel Americans’ Economic Pessimism

3 Podcasts Every DEI Ally Should Follow

Advisor News

- Athene Enhances Flagship Annuity Products, Expands Innovative Preset Allocation Feature

- Advisor gives students a lesson in financial reality

- NC Senate budget would set future tax cuts, cut state positions, raise teacher pay

- Americans believe they will need $1.26M to retire comfortably

- Digitize your estate plan for peace of mind

More Advisor NewsAnnuity News

- Athene Enhances Flagship Annuity Products, Expands Innovative Preset Allocation Feature

- GBU Life introduces Defined Benefit Annuity

- EXL named a Leader and a Star Performer in Everest Group's 2025 Life and Annuities Insurance BPS and TPA PEAK Matrix® Assessment

- Michal Wilson "Mike" Perrine

- Emerging digital annuity sales process cutting cycle times by 94%, IRI says

More Annuity NewsHealth/Employee Benefits News

- Editorial | Why Medicaid funding crisis matters here

- Recent Findings in Liver Cancer Described by Researchers from Kaohsiung Chang Gung Memorial Hospital (Comparing Health Insurance-reimbursed Lenvatinib and Self-paid Atezolizumab Plus Bevacizumab In Patients With Unresectable Hepatocellular …): Oncology – Liver Cancer

- Missouri Farm Bureau wants to offer health insurance alternatives for members

- Don’t let Texas move Fort Worth-area kids off health plans their families prefer | Opinion

- CT health system’s contract with insurer has expired. What patients need to know about their coverage.

More Health/Employee Benefits NewsLife Insurance News

- AFBA and 5Star Life Insurance Company Name Erica L. Jenkins Senior Vice President, General Counsel, and Corporate Secretary

- Athene Enhances Flagship Annuity Products, Expands Innovative Preset Allocation Feature

- Empathy Collaboration with Voya Financial Brings Industry-First Legacy Planning to Millions

- Federated celebrates record year despite industry challenges at 121st annual meeting

- Proxy Statement (Form DEF 14A)

More Life Insurance News