Student loan debt may bite future Social Security checks, as forgiveness hangs in balance

While the promise of student loan debt relief seems to slip further out of reach, the prospects of the debt coming back to bite people in their retirement grows.

That is because student loan debt delinquencies can be deducted from Social Security benefits to the tune of thousands of dollars per year. The number of debtors is rising, along with delinquencies, according to a recent study by Boston College’s Center for Retirement Research. In fact, student loan delinquency rates have surpassed all other types of consumer debt delinquencies between 2012 and early 2020.

That trend is accelerating, meaning more Americans will see their Social Security benefits shrink. The withholding amount is the lessor of 15% of the Social Security monthly benefit or the amount by which the benefit exceeds $750 per month. The deduction is an average of $2,500 annually, a 4% to 6% decrease in benefits, according to the study.

“While these amounts are relatively small, for households that are just making ends meet, even a small decline in income can have significant consequences,” according to the study. “Putting these numbers into context, the amount of withheld benefits could roughly pay off the average per capita credit card balance. Since delinquency rates are higher among younger borrowers, student loans may pose a bigger risk for this group’s future retirement security.”

The Biden administration’s plan to forgive up to $10,000 for those with less than $125,000 in annual income is before the Supreme Court, with a decision expected in June. Under that program, Pell Grant recipients can also have another $10,000 forgiven.

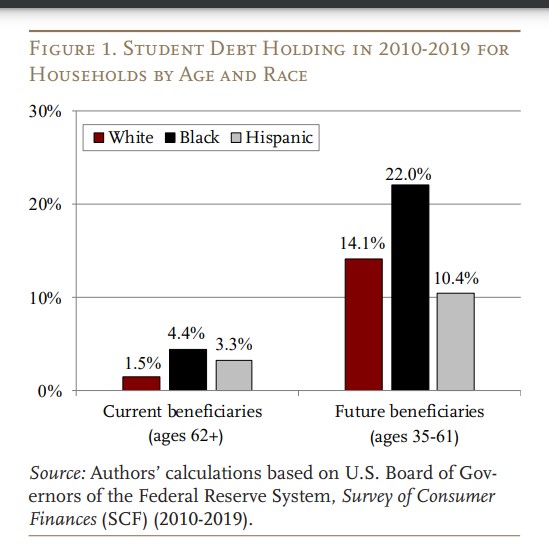

Black and Hispanic students are more likely to receive Pell Grants and are also more likely to carry debt into older age.

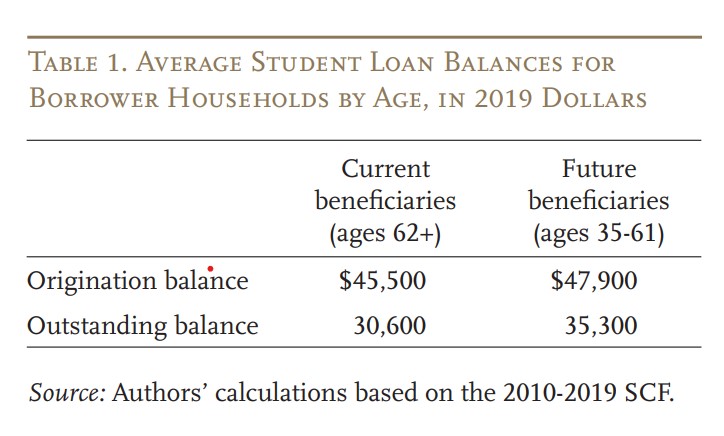

The debt itself is growing, with an average of more than $30,000, even for today’s seniors.

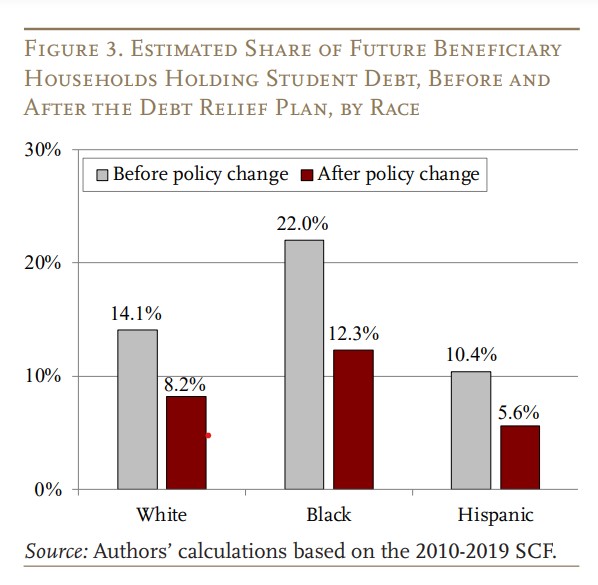

The Biden plan would have a significant impact on the average debt, cutting it in half, which would have the biggest impact on Black borrowers.

Although seniors have student loan debt, it is not yet a large problem, according to the report. But delinquencies among younger borrowers are growing – and they will be carried into the borrowers’ senior years.

“Moreover, the concentration of delinquency among borrowers in racial minority groups suggests that student loan debt may become a source of racial inequality among beneficiaries,” according to the report. “Our preliminary analysis suggests that Black and Hispanic borrowers would likely benefit most from the debt relief plan, receiving the highest amount of debt forgiveness and experiencing the largest drop in loan holding.”

During a speech on Monday marking Martin Luther King Jr. Day, President Joe Biden told a Black audience “I have your back” on student debt relief, according to Politico. He also criticized Republicans for opposing his efforts for relief, during his speech before a National Action Network event.

“The only thing blocking my plan is them suing us,” Biden said of the GOP. “My administration is making the case to the Supreme Court, and I'm confident — I'm confident — in the legal authority to carry out our plan.”

As the Boston College report noted, Biden said that the extra relief for Pell grant recipients would help Black borrowers in particular.

Republicans have opposed the forgiveness programs because they say the plans are unfair to people who have paid off their loans and that it constitutes an abuse of presidential power.

Rep. Virginia Foxx (N.C.), the top Republican on the House Education and Labor Committee, told The Hill that she expected the Supreme Court will throw out the forgiveness program.

“The Biden administration’s $400 billion wealth transfer is grossly unfair and Republicans will do everything we can to stop this abusive power grab, fix our broken student loan program, and lower the cost of college for students, families, and taxpayers,” Foxx said.

Student loan payments to resume

Meanwhile, payments are expected to resume on student loans for 44 million Americans this summer after a three-year pause.

The Federal Student Aid office’s 1,400 workers are getting ready to handle the restart even though the office has not had a budget increase to deal with the payments and other debt relief plans that the Biden administration has imposed, along with the $1.6 trillion student loan portfolio it manages.

Congress denied the administration’s request for an $800 million addition for the department’s $2 billion budget, according to a CNN report. Republican congressional members are also expected to push for cuts in the Education Department.

If the Supreme Court allows the forgiveness program, it will be extra work for the office. That would be in addition to the $112 billion in grant, work-study and loan funds it manages each year.

Supremes to chime in

The Supreme Court is expected to hear arguments on two cases in late February. One is Biden v. Nebraska, which was brought by a coalition of six states that say the forgiveness program would harm the states because of tax revenue loss and “other profits from working relationships state entities have with some loan servicers,” according to The Hill. The program is on hold until the case is resolved.

The other is Department of Education v. Brown, which was brought by two people backed by the Jobs Creators Network Foundation. A Texas district judge ruled that Biden abused his power by developing the program.

Arguments are scheduled for Feb. 28, with a decision expected late in session, probably in June. If the Supreme Court allows the program, it can go into effect immediately.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2023 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Health insurers must prioritize tech to improve customer experience

Critics say SECURE 2.0 did little to help the economically insecure

Advisor News

- FINRA, FBI warn about generative AI and finances

- Prudential study: Babies born today will likely need nearly $2M to retire

- Economy performing better than expected, Morningstar says

- Advisors have more optimism post-election

- How to get people to share personal information

More Advisor NewsAnnuity News

- Pension Rights Center: PRT deals could lead to ‘nationwide catastrophe’ regulated

- Allianz Life Retirement Solutions Now Available Through Morgan Stanley

- Midland Advisory Focused on Growing Registered Investment Advisor Channel Presence

- Delaware Life Announces Suite of Innovative Fixed Index Annuities

- Allianz Life moves to strengthen annuity operations with own reinsurer

More Annuity NewsHealth/Employee Benefits News

- MNsure sets record as more than 167,000 Minnesotans sign up for health insurance

- Indiana Black Legislative Caucus Unveils 2025 Legislative Agenda

- Health insurers take heat over high prices, but are hospitals the real villains?

- Texas Has 19 of the 20 U.S. Counties With the Most Uninsured | Insurify

- Record number of Americans enroll in ACA

More Health/Employee Benefits NewsLife Insurance News

- PHL Variable policyholders: moratorium on policy benefits ‘inequitable’

- How to identify ideal prospects for long-term-care insurance

- New York Life Announces Planned Leadership Transitions in Foundational Business

- Jackson Study Reveals Vast Underestimation of Healthcare and Long-Term Care Costs in Retirement Planning

- Axcelus Financial Names Keith Stock Chief Executive for Bermuda Companies

More Life Insurance News