Student loan borrowers might not be ready to start paying paused debt

In another sign of a post-pandemic normal, the pause on student loan repayment is set to expire in August, which is likely to cause credit damage for millions of borrowers, according to the Federal Reserve.

Most student loan borrowers (60%) have made no payments since March 2020, when collections on defaulted student loans also were suspended, according to New York Fed analysts.

“Once the provision expires, there could be a deterioration of credit risk profiles, which could infringe on this group's general access to credit,” according to the Fed note.

On the plus side, many borrowers used the extra money and time to improve their finances.

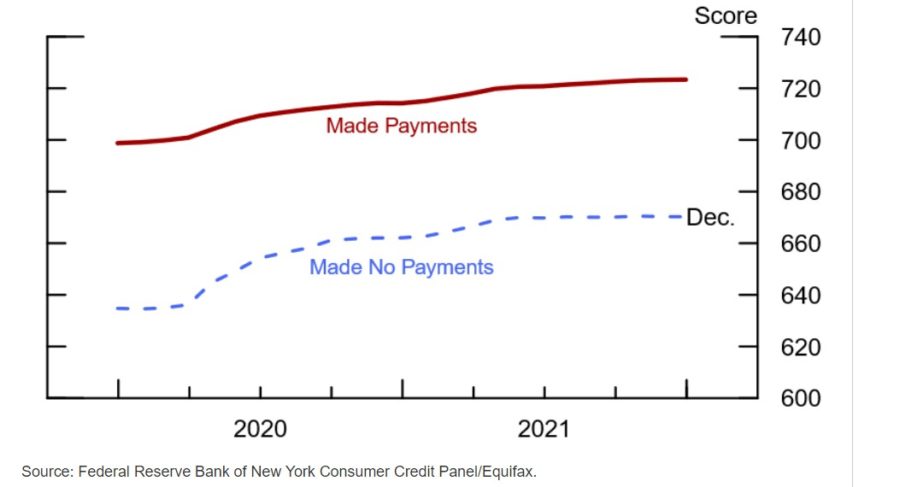

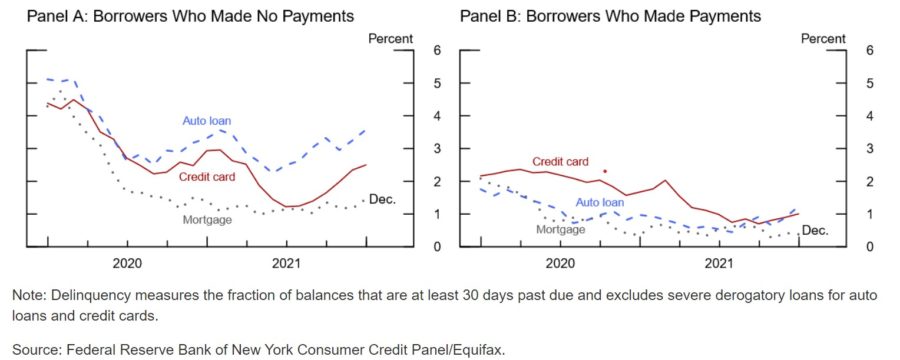

Delinquency rates on credit card, auto and mortgage debts dropped throughout the pandemic. Average risk scores increased by 35 points to 670 through 2021.

The twist is that borrowers who made payments during the period tended to be the ones who cut other debt.

Even those borrowers were starting to struggle at the end of 2021, when other delinquencies started ticking up. But those who made no student loan payments were in worse shape, with credit card debt slightly greater than it was before the pandemic.

Many studies have shown that student loan borrowers often cannot take on much other debt, such as mortgages, so they have fewer of those burdens. Although that is not necessarily a happy circumstance for young people starting their families and careers, it does mean that delinquencies are not likely to bleed into the broader consumer credit market, according to the report.

The original loan forbearance was only supposed to last 60 days, but has been extended, now until Aug. 31, nearly 30 months since it started. In that time, $84 billion was not paid.

“On balance, these borrowers have seen their financial positions improve during the pandemic, but there are some signs of distress,” according to the report. “It is possible that some of these borrowers may not be ready to resume payments once forbearance expires.”

Borrowers who made at least one payment were in better position to resume paying once the pause expires. They were able to cut 15% of their balance, about $52 billion, but they also cut their other debt. For example, they trimmed credit card debt by 10%.

Of those who made payments, 40% paid at least 12 months and 30% made three or fewer.

Who Is Struggling?

The Biden administration has not said if it will allow the latest pause to lapse on Aug. 31.

However, President Joe Biden is apparently poised to forgive up to $10,000 of student loan debt for singles who earn less than $150,000 or couples earning less than $300,000, according to media reports, which also said the program would likely be limited to undergraduate debt. Biden had promised the $10,000 forgiveness during the presidential campaign.

The cancellation would settle the balances of a third of borrowers, while 20% would see their debt cut by at least half, according to the Federal Reserve, with 53% of borrowers owing less than $20,000. But that debt amounts to only 13% of the total, meaning that fewer borrowers are carrying large loans.

But those with the least amount of debt might actually be less likely to pay because they were less likely to have gotten a degree. Those with more debt tend to have advanced degrees and more ability to pay.

“Among those with outstanding debt from their own education, 18 percent were behind on their payments. Those who did not complete a degree were the most likely to be behind,” according to a Fed economic well-being report for May 2021. “Thirty-one percent of adults who had education loans outstanding and who had less than an associate degree reported being behind. This compares to 22 percent of borrowers with an associate degree. The delinquency rate was even lower among borrowers with a bachelor's degree (9 percent) or graduate degree (8 percent).”

First-generation college students were more likely to be behind on their payments than those with a parent who completed college, according to the Fed. First-generation college students were three times more likely to be behind.

Young Black and Hispanic were more likely to be behind on their debt and completely repaying their loans, while young Asians were more likely to keep up payments and satisfy their loans.

“These patterns partly reflect differences in rates of degree completion, institutions attended and wages for a given educational credential,” according to the report.

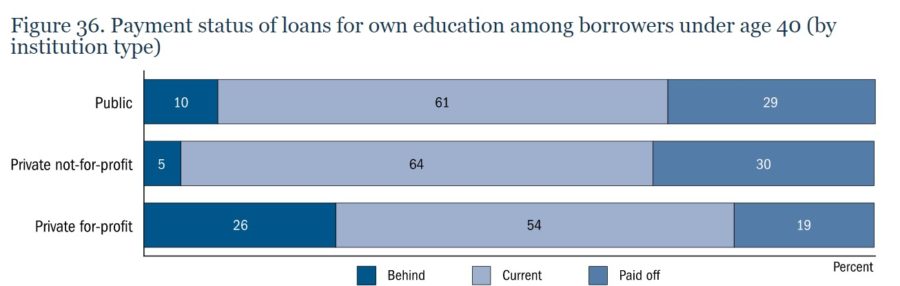

Fed analysts said the difficulty in payments has more to do with the institutions attended, rather than the attendees. Students from private for-profit institutions were far more likely to be in arrears, with 26% late in payments, compared to 5% private, not-for-profit, and 10% public schools.

“Indeed, when accounting for race and ethnicity, first-generation status, and institution selectivity, the relationship between for-profit institution attendance and student loan default persists,” according to the report. “This suggests that the high default rates for attendees of for-profit institutions reflect characteristics of the schools and is not simply due to the characteristics of their students.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Top credit bureaus to relax penalties for medical debt

How agency leaders can pursue a second act

Advisor News

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

More Advisor NewsAnnuity News

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

- FIAs are growing as the primary retirement planning tool

- Edward Wilson Joins SEDA, Bringing Deep Expertise in Risk Management, Derivatives Trading and Institutional Prime Brokerage

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Jackson Financial ramps up reinsurance strategy to grow annuity sales

More Annuity NewsHealth/Employee Benefits News

- Data on Managed Care Reported by Researchers at Dartmouth College Geisel School of Medicine (Impact of the Medicare carotid stenting national coverage determination on procedure utilization and long-term stroke risk after carotid …): Managed Care

- New Managed Care and Specialty Pharmacy Findings Has Been Reported by Howard Weston Schmutz et al (Challenges of the Inflation Reduction Act for long-term care pharmacy: Examining impact and policy solutions): Drugs and Therapies – Managed Care and Specialty Pharmacy

- University of Washington Reports Findings in Managed Care (Too Sick to be True? Evaluating Potentially Problematic Diagnosis Coding Practices in Medicare’s Patient-Driven Payment Model): Managed Care

- Falling off the cliff: Loss of insurance subsidies hits Durango's middle class

- Universite Paris 1 Pantheon-Sorbonne Reports Findings in Science (Misperception, self-reported probabilities and long-term care insurance take-up in the United States): Science

More Health/Employee Benefits NewsLife Insurance News