As Social Security anxiety rises, Americans grab annuities for guarantees

Americans are turning to annuities for a guaranteed income to supplement Social Security at a time when anxiety about the entitlement program is climbing in surveys.

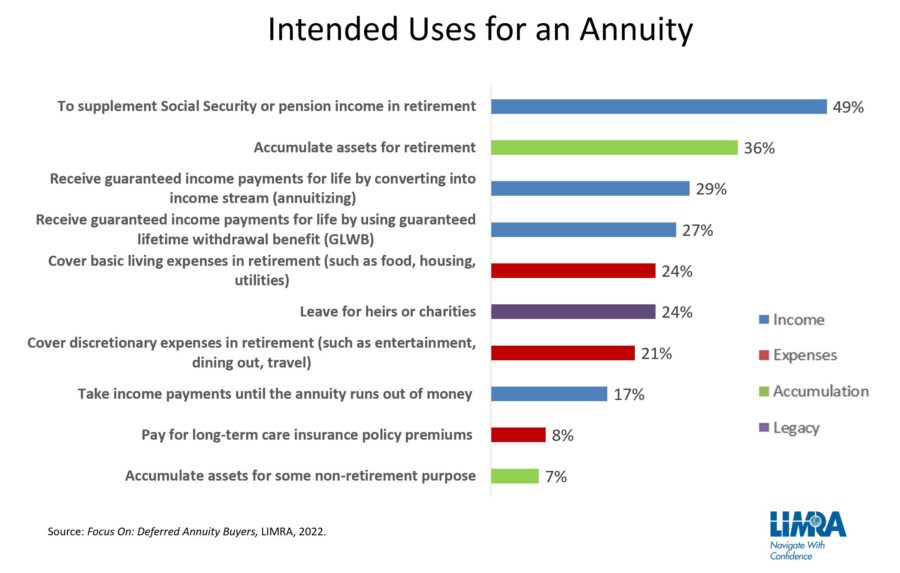

A recently released LIMRA study found that people who bought annuities bought them primarily to supplement Social Security, with “accumulate assets for retirement” a distant second.

Of the four reasons people bought an annuity -- income, expenses, accumulation and legacy – income was by far the leading use, taking three of the top four reasons, according to the LIMRA report.

The uses for annuities depended on the age of the purchaser.

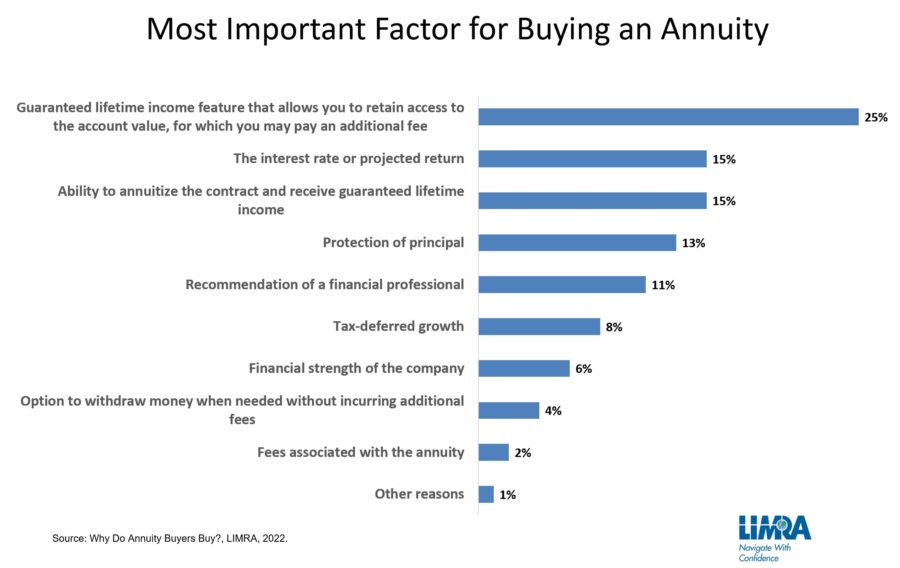

‘What is important to annuity buyers varies significantly based on their age and life stage,” according to the report. “Older buyers, who often have more conservative investment allocations, are more likely to cite protection of principal. Younger buyers, who are less likely to have a pension and may have more unanticipated expenses, were more inclined to cite the guaranteed income features and access to their account balances.”

The survey of more than 900 investors between May and July spanned the ages of 45 to 80.

Social Security anxiety

Most Americans are worried that Social Security will run out of money, according to a recent Nationwide Retirement Institute survey conducted by Harris.

The poll found that 70% of respondents worried that the program will run out of funding, and 33% of people not yet on Social Security said they don’t think they ever will get that money.

Economic anxiety increased over the past year, with 66% of respondents worried about their retirement income, a 10-point increase over the previous year’s result. Part of that anxiety is due to a misunderstanding about Social Security, as two-thirds of respondents did not know the entitlement was indexed for cost-of-living increases.

“There is an immediate opportunity for financial professionals to clear up clients’ misconceptions about Social Security to alleviate their fears and help them stay on track toward their long-term retirement goals,” according to the Nationwide report.

The survey found significant gaps in knowledge, such as:

- Only 7% correctly identified all the factors that determine maximum Social Security benefits.

- Almost half (49%) don’t know or aren’t sure what percent of their income would be replaced in retirement by Social Security. More than two in five (44%) of those not receiving Social Security aren’t sure how much their monthly payments will be.

- Only 13% of adults correctly guessed their full retirement age based on their year of birth.

- Nearly half (49%) believed if they file early their benefit will automatically go up once they reach their full retirement age.

This survey was conducted between April 25 and May 23, 2022, among 1,853 U.S. adults age 26+ (national sample), including 674 Millennials, 576 Gen Xers, 603 Boomers+.

Why they buy

In the LIMRA survey, the most important factor in buying an annuity was having the guaranteed income but also having access to the account value, an additional benefit they paid for. The next top factors, the interest rate or projected return and the ability to annuitize, was a distant second and third.

Most annuity buyers are happy enough with their purchase to recommend it to others, particularly younger people. Of those 45-54, 84% would be very likely to recommend an annuity.

Given the anxieties around Social Security and the economy in general, the emphasis on a lifetime income appears to be growing more important.

“As income-generating features are the most important attributes in the buying decision of deferred annuities, financial professionals should highlight these in their meetings with clients and prospects,” according to the LIMRA report. “Financial professionals can also leverage existing annuity owners to promote the value of deferred annuities. Testimonials and recommendations can result in greater awareness among the family members, friends, and colleagues of the owner, and may lead to referrals.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Banner sales a theme in year’s top 10 annuity articles

Social Security battle lines lead the way among 2022 top regulation stories

Advisor News

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

- Bill that could expand access to annuities headed to the House

More Advisor NewsAnnuity News

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

- Hildene Capital Management Announces Purchase Agreement to Acquire Annuity Provider SILAC

- Removing barriers to annuity adoption in 2026

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Reliance Standard Life Insurance Company Trademark Application for “RELIANCEMATRIX” Filed: Reliance Standard Life Insurance Company

- Jackson Awards $730,000 in Grants to Nonprofits Across Lansing, Nashville and Chicago

- AM Best Affirms Credit Ratings of Lonpac Insurance Bhd

- Reinsurance Group of America Names Ryan Krueger Senior Vice President, Investor Relations

- iA Financial Group Partners with Empathy to Deliver Comprehensive Bereavement Support to Canadians

More Life Insurance News