New IUL Illustration Rules Will Not Apply To In-Force: Regulators

A state regulator task force took another step Thursday toward agreement on rule changes designed to rein in index universal life insurance illustrations.

In another "straw poll" vote, Life Actuarial Task Force members buried the in-force issue by voting 13-3 to affirm that any changes will only apply to new policies. Illinois, New York and California regulators voted against.

The task force is considering language proposed by the American Council of Life Insurers to shore up Actuarial Guideline 49 and bring IUL illustrations more in line with actual returns. Members are racing the clock to present a proposal for adoption by its parent A Committee during the committee's July 10 call.

The vote followed a spirited debate during which Birny Birnbaum, executive director of the Center for Economic Justice, repeatedly pressed regulators on the logic of illustration changes that exclude existing policies.

"We don’t understand why you would go to the trouble of saying 'We want to fix the problems of AG 49,' but to the consumers who have already purchased the product, they shouldn't get the benefits," Birnbaum said.

Industry representatives claim it would confuse consumers to receive new illustrations that might be drastically different.

The background: AG 49 was adopted by the NAIC in 2015 to rein in IUL illustrations that were showing consumers unrealistic returns. Critics say insurers almost immediately got around the new rules by offering IUL bonuses and multipliers.

The mandate: The IUL Illustration subgroup working on tightening AG 49 was thrown a curveball in October when the Life Actuarial Task Force sent this mandate to members: designs with multipliers or other enhancements should not illustrate better than non-multiplier designs.

The context: IUL sales are a source of strength for insurers. Overall total universal life new premiums increased 31% in the fourth quarter 2019, primarily driven by IUL products.

'It's Nonsense'

Applying illustration changes to old policies would create a lot of potential confusion, on replacement policies, for example, said Brian Bayerle, senior actuary for ACLI. Consumers could end up seeing something completely different from an illustration that was appropriate when the initial policy was purchased, he explained.

"I don’t necessarily think we ended up with [AG 49 changes] that industry loves," Bayerle said. "I think we have a policy that industry can live with. We do think the best path forward is to apply this to policies on a going-forward basis."

In addition, the costs associated with applying new illustration guidelines to in-force policies might be very costly to insurers and consumers, noted Teresa Winer, actuary with the Georgia Office of Insurance.

But Birnbaum remained incredulous.

"It’s nonsense," he said. "How can somebody claim with a straight face that a consumer is going to be confused by getting better information than they got previously?"

Loan Interest Crediting

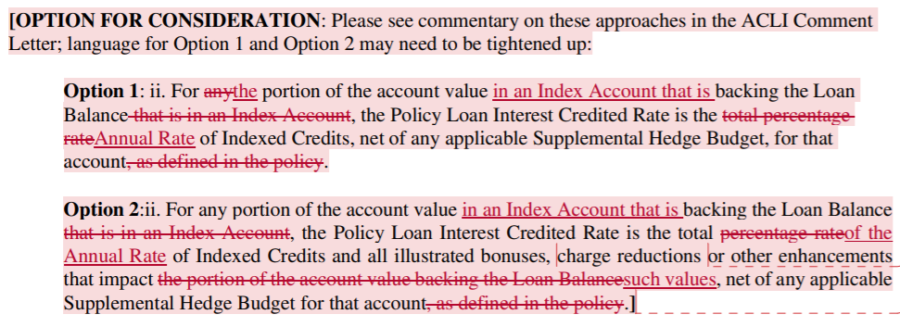

The biggest remaining issue for the task force is to decide between two options for establishing a policy loan interest credited rate. ACLI presented two options:

Members also produced a third option that combines option one language with a reduction of the permissible loan arbitrage from 100 to 50 basis points.

The task force is accepting comments on the three options by email to Reggie Mazyck at [email protected] by June 12.

"We just have to start making decisions," said Fred Anderson, deputy commissioner of insurance for Minnesota.

Anderson chairs the IUL Illustration Subgroup, which has discussed amending AG 49 for close to 18 months.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2020 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

SEC Settles With P&C Insurer Who Allegedly Failed To Disclose CEO Compensation

American College CEO Opens Up About Black Life In A White World

Advisor News

- DOL proposes new independent contractor rule; industry is ‘encouraged’

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

More Advisor NewsAnnuity News

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

More Annuity NewsHealth/Employee Benefits News

- GOVERNOR HOCHUL LAUNCHES PUBLIC AWARENESS CAMPAIGN TO EDUCATE NEW YORKERS ON ACCESS TO BEHAVIORAL HEALTH TREATMENT

- Researchers from Pennsylvania State University (Penn State) College of Medicine and Milton S. Hershey Medical Center Detail Findings in Aortic Dissection [Health Insurance Payor Type as a Predictor of Clinical Presentation and Mortality in …]: Cardiovascular Diseases and Conditions – Aortic Dissection

- Medicare Advantage Insurers Record Slowing Growth in Member Enrollment

- Jefferson Health Plans Urges CMS for Clarity on Medicare Advantage Changes

- Insurance groups say proposed flat Medicare Advantage rates fail to meet the moment

More Health/Employee Benefits NewsLife Insurance News