Prudential Pivots Away From Annuities, CEO Lowery Says

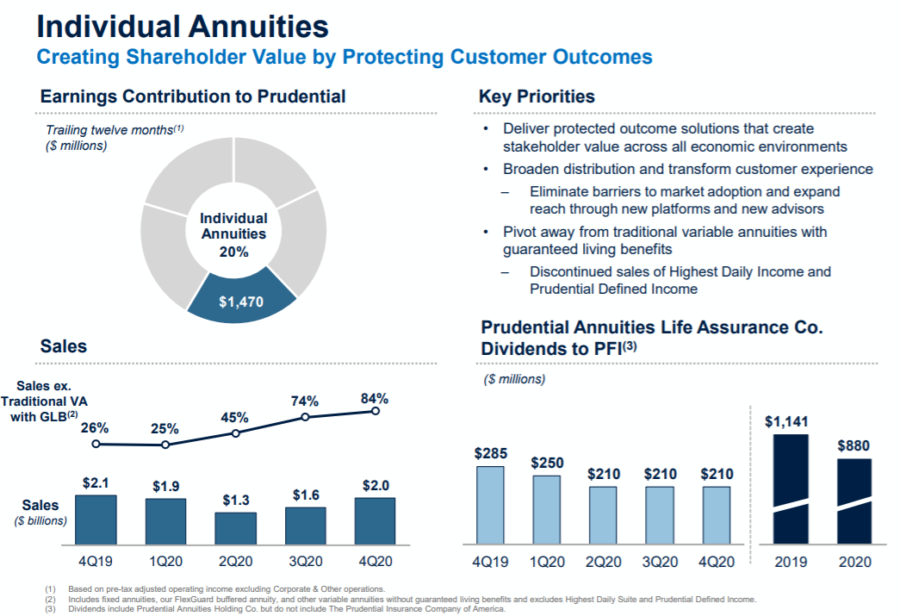

Prudential plans to halve the share annuities contribute to its earnings, a downsizing the insurer aims to accomplish through sales, reinsurance deals and expiring policies.

Charles Lowrey, chairman and CEO, said the company strategy is centered on Prudential's $750 million cost savings plan.

"Over the next three years we plan to reallocate between $5 billion and $10 billion of capital with the intention of doubling the earnings contribution of our higher growth businesses and halving individual annuities," he said.

The Prudential plan is to reduce annuities to 10% or less of company earnings, Lowrey said.

Prudential announced plans to discontinue all sales of variable annuities with guaranteed living benefits during the insurer's third-quarter earnings call. Together with repricing strategies and introducing its FlexGuard annuity in late May helped Prudential's annuity business remain competitive.

FlexGuard is registered index-linked annuity, designed to provide customers with downside protection and the opportunity to grow and accelerate the performance of their retirement assets into the future. More importantly for Prudential, it is less interest-rate sensitive, Lowrey noted.

FlexGuard sales doubled in the fourth quarter to $1.2 billion, up from $600 million in the third quarter, said Rob Falzon, vice chairman.

"The pandemic has increased awareness of the value of our broad set of life insurance and financial solutions as we continue to enhance our capabilities to reach people when, where and how they want," Falzon added.

Prudential's annuity segment reported adjusted operating income of $440 million in the current quarter, compared to $450 million in the year-ago quarter. The decrease reflects lower fee income, net of distribution expenses and other associated costs, partially offset by higher net investment spread results.

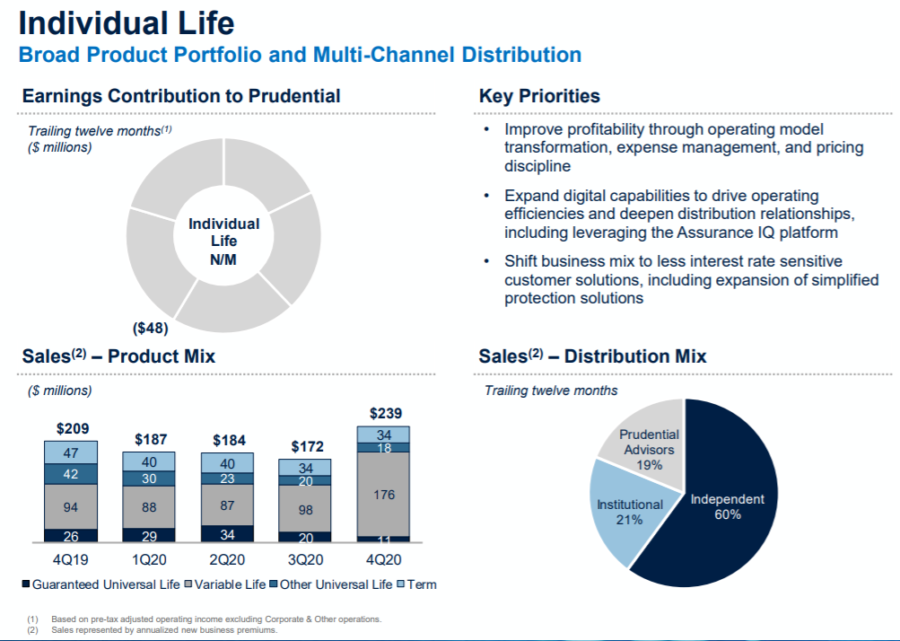

The life insurance segment reported a loss, on an adjusted operating income basis, of $65 million in the current quarter, compared to adjusted operating income of $58 million in the year-ago quarter. The decrease reflects less favorable underwriting results, driven by COVID-19 mortality experience, and a change in business practice, which resulted in a refinement to reserves and related balances, partially offset by higher net investment spread results and lower expenses.

Sales of $239 million in the current quarter were up 14% from the year-ago quarter, as higher Variable sales were partially offset by lower universal life and term sales, reflecting product repricing and pivot strategy.

Prudential is seeing a lot of interest in term life products, Falzon said.

"Although sales have been lower than expected, we continue to modify our underwriting processes to allow for more instant decisions," he explained. "As we streamline this process and improve the customer experience. We expect our life revenues to grow."

Other highlights from the fourth quarter include:

- Fourth quarter 2020 net income attributable to Prudential Financial, Inc. of $819 million or $2.03 per Common share versus $1.128 billion or $2.76 per share for the year-ago quarter.

- Fourth quarter 2020 after-tax adjusted operating income of $1.183 billion or $2.93 per Common share versus $915 million or $2.24 per share for the year-ago quarter.

- Net loss attributable to Prudential Financial, Inc. of $374 million or $1.00 per Common share for 2020 versus net income of $4.186 billion or $10.11 per share for 2019.

- After-tax adjusted operating income of $4.111 billion or $10.21 per Common share for 2020 versus $4.656 billion or $11.24 per share for 2019.

- Book value per Common share of $167.81 versus $155.88 per share for the year-ago; adjusted book value per Common share of $94.79 versus $101.04 per share for the year-ago.

- Parent company highly liquid assets of $5.6 billion versus $4.1 billion for the year-ago.

Assets under management amounted to $1.721 trillion versus $1.551 trillion for the year-ago. - The Company’s Board of Directors has authorized the repurchase of up to $1.5 billion of its outstanding Common Stock during the period from January 1, 2021 through December 31, 2021. In addition, the Company declared a quarterly dividend of $1.15 per share of Common stock, payable on March 11, 2021, to shareholders of record as of February 16, 2021, representing an increase of 4.5% over the prior year dividend level and a 4.9% annualized yield on adjusted book value.

Prudential updated each of its business segments and individual operations:

PGIM

PGIM, the company’s global investment management business, reported record high adjusted operating income of $404 million for the fourth quarter of 2020, compared to $288 million in the year-ago quarter.

The increase reflects higher asset management fees, driven by an increase in average account values, and higher Other Related Revenue, driven by record high agency revenue and the impact of investment performance on incentive fees and co- and seed investment earnings, partially offset by higher expenses, primarily driven by business growth.

PGIM assets under management of $1.499 trillion, a record high, were up 13% from the year-ago quarter, reflecting market appreciation and public fixed income inflows. Third-party net inflows of $6.3 billion in the current quarter reflect retail inflows of $3.8 billion and institutional inflows of $2.5 billion.

U.S. Businesses

U.S. Businesses reported adjusted operating income of $807 million for the fourth quarter of 2020, compared to $841 million in the year-ago quarter.

The decrease reflects less favorable underwriting results, driven by COVID-19 related net mortality experience, and a change in business practice in our Individual Life business, and lower fee income, net of distribution expenses and other associated costs, in our Individual Annuities business, partially offset by higher net investment spread results, driven by higher variable investment income, and lower expenses.

U.S. Workplace Solutions, consisting of Retirement and Group Insurance, reported adjusted operating income of $451 million for the fourth quarter of 2020, compared to $342 million in the year-ago quarter.

Retirement

Reported record high adjusted operating income of $538 million in the current quarter, compared to $281 million in the year-ago quarter. The increase reflects higher net investment spread results, driven by higher variable investment income, higher reserve gains, including favorable impacts due to COVID-19, and lower expenses.

Account values of $559 billion, a record high, were up 12% from the year-ago quarter, driven by market appreciation and net inflows. Net inflows in the current quarter totaled $5.5 billion with $3.2 billion from Institutional Investment Products, primarily from pension risk transfer transactions, and $2.3 billion from Full Service.

Group Insurance

Reported a loss, on an adjusted operating income basis, of $87 million in the current quarter, compared to adjusted operating income of $61 million in the year-ago quarter. The decrease primarily reflects less favorable underwriting results in our group life and group disability businesses due to COVID-19 and related impacts.

Reported earned premiums, policy charges, and fees of $1.3 billion in the current quarter were consistent with the year-ago quarter.

U.S. Individual Solutions, consisting of Individual Annuities and Individual Life, reported adjusted operating income of $375 million for the fourth quarter of 2020, compared to $508 million in the year-ago quarter.

Individual Annuities

Account values of $176 billion, a record high, were up 4% from the year-ago quarter, reflecting equity market appreciation, partially offset by net outflows. Gross sales of $2.0 billion in the current quarter reflect our continued product repricing and pivot strategy.

Assurance IQ

Assurance IQ reported a loss, on an adjusted operating income basis, of $19 million in the current quarter, compared to a loss of $9 million in the year-ago quarter. This reflects a 94% increase in sales, driven by higher Medicare sales during the annual enrollment period, that were more than offset by increased expenses to support business growth, including higher marketing, distribution, and infrastructure costs.

International Businesses

International Businesses, consisting of Life Planner and Gibraltar Life & Other, reported adjusted operating income of $790 million for the fourth quarter of 2020, compared to $748 million in the year-ago quarter. The increase reflects lower expenses, business growth, and more favorable underwriting results, partially offset by lower net investment spread results.

Life Planner

Reported adjusted operating income of $426 million in the current quarter, compared to $345 million in the year-ago quarter. The increase reflects lower expenses, business growth, higher net investment spread results, and more favorable underwriting results.

Constant dollar basis sales of $216 million in the current quarter decreased 19% from the year-ago quarter, primarily reflecting lower sales in Japan following product repricing in August of 2020.

Gibraltar Life & Other

Reported adjusted operating income of $364 million in the current quarter, compared to $403 million in the year-ago quarter. The decrease primarily reflects lower net investment spread results.

Constant dollar basis sales of $238 million in the current quarter decreased 16% from the year-ago quarter, reflecting lower sales in Japan following product repricing in August of 2020.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2021 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Biden Pushes $1.9T Package, Saying ‘Economy Is Still In Trouble’

Northwestern Mutual To Pay Vermont $287K For Policy Underpayments

Advisor News

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

More Advisor NewsAnnuity News

- Hildene Capital Management Announces Purchase Agreement to Acquire Annuity Provider SILAC

- Removing barriers to annuity adoption in 2026

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News