Prudential Continues Strong ‘Product Pivot Strategy’ In Healthy 1Q

Strong sales of its buffered annuity, FlexGuard, helped Prudential continue its first-quarter shift away from interest rate-sensitive products and underpinned its strong financial showing.

Total first-quarter revenues of $14.2 billion were up 11% over 1Q 2020 due to higher premiums, policy charges and fee income, net investment income, asset management fees, commissions as well as other income.

Charles Lowrey, chairman and CEO, said Prudential made significant progress on the company's $750 million cost savings plan.

"We’re on track to deliver $750 million in cost savings by the end of 2023, $400 million of which were targeted for 2021," he said during a call with analysts. "Cost savings for the first quarter were $110 million. The initiatives generating these cost savings are also producing better customer and employee experiences."

Flexing Annuity Muscle

FlexGuard is a registered index-linked annuity, designed to provide customers with downside protection and the opportunity to grow and accelerate the performance of their retirement assets into the future. More importantly for Prudential, it is less interest-rate sensitive, said Rob Falzon, vice chairman.

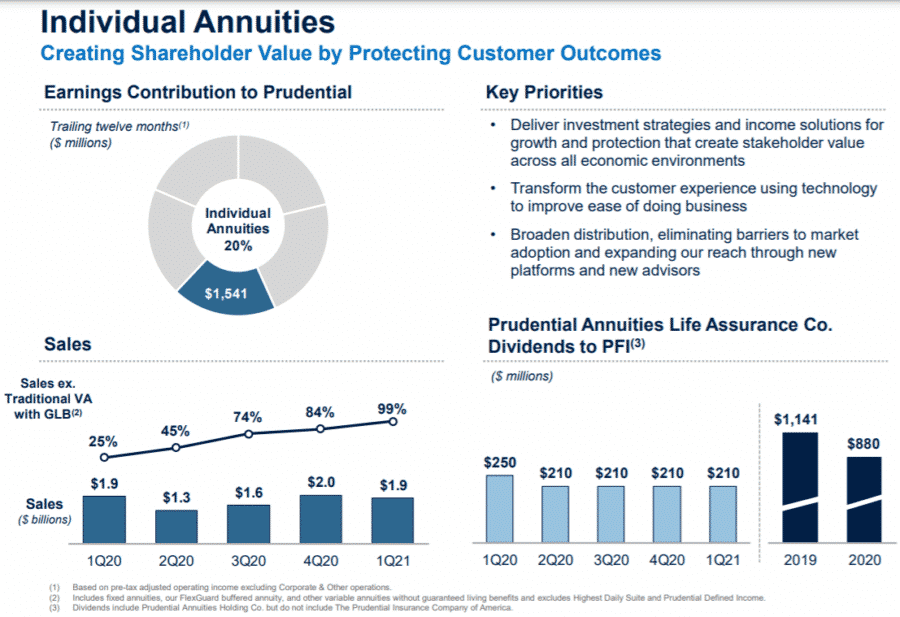

FlexGuard sales totaled $1.6 billion in the first quarter, representing 84% of total annuity sales, up from $1.2 billion in the fourth quarter of 2020, he said.

"We benefit from having a strong and trusted brand, as well as a highly effective distribution team that has significant reach with Prudential advisors and third-party advisors," Falzon said. "We are engaging with a broad range of advisors with FlexGuard. We also leverage our broad multi-dimensional relationships with our strategic partners that both distribute our products and manage the assets of our clients."

Prudential previously announced plans to reduce annuities to 10% or less of company earnings.

In the third quarter, the company said it would discontinue all sales of variable annuities with guaranteed living benefits. Together with repricing strategies and introducing FlexGuard in late May 2020, Prudential completely retooled its annuity business to remain competitive.

Just 1% of first-quarter annuity sales came from traditional variable annuities with guaranteed living benefits, said Andrew Sullivan, executive vice president and head of U.S. businesses.

"As we pivot into FlexGuard, we're putting into the market a very different type of product that better balances consumer value with shareholder value," he said. And we could not be more pleased with the success of that product. We had a 14.5% market share back in 4Q. And as you saw, our sales have continued to expand, where we had $1.6 billion in sales this quarter.

"That is really coming off the strength of our brand and the strength of our distribution, and we're very happy with the returns and the risk profile of that new business that we're putting on the book."

Prudential reported strong overall first-quarter annuity sales figures:

- Reported adjusted operating income of $444 million in the current quarter, compared to $373 million in the year-ago quarter. The increase reflects higher net investment spread results and higher fee income, net of distribution expenses and other associated costs.

- Account values of $176 billion, a record high, were up 23% from the year-ago quarter, reflecting equity market appreciation, partially offset by net outflows. Gross sales of $1.9 billion in the current quarter reflect our product pivot strategy.

Life Insurance

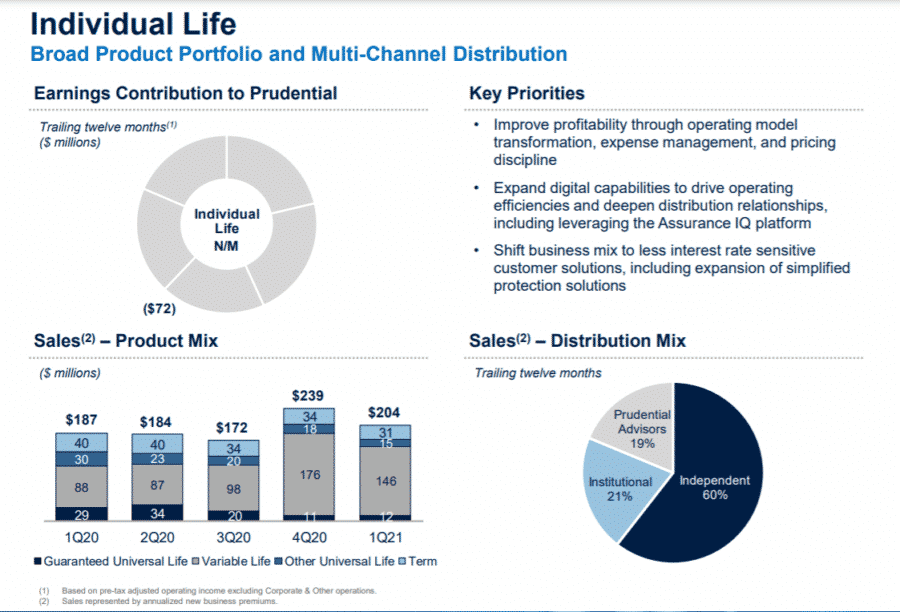

Individual life insurance results amounted to good news, bad news for Prudential:

- Reported a loss, on an adjusted operating income basis, of $44 million in the current quarter, compared to a loss of $20 million in the year-ago quarter. The decrease reflects less favorable underwriting results, driven by COVID-19 mortality experience, partially offset by higher net investment spread results and lower expenses.

- Sales of $204 million in the current quarter were up 9% from the year-ago quarter, as higher Variable sales were partially offset by lower Universal Life and Term sales, reflecting a product repricing and pivot strategy.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2021 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Health Insurers Accused Of Overestimating Costs To Reduce Rebates

US Economy On The Brink Of Dramatic Growth, CNBC Host Says

Advisor News

- DOL proposes new independent contractor rule; industry is ‘encouraged’

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

More Advisor NewsAnnuity News

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

More Annuity NewsHealth/Employee Benefits News

- Medicare Advantage Insurers Record Slowing Growth in Member Enrollment

- Jefferson Health Plans Urges CMS for Clarity on Medicare Advantage Changes

- Insurance groups say proposed flat Medicare Advantage rates fail to meet the moment

- As enhanced federal subsidies expire, Covered California ends open enrollment with state subsidies keeping renewals steady — for now — and new signups down

- Supervisors tackle $3.1M budget deficit as school needs loom

More Health/Employee Benefits NewsLife Insurance News