Policyholders still waiting as regulators unwind Greg Lindberg insurers

For many policyholders who purchased life insurance or annuities through Bankers Life, or another insurer formerly owned by Greg Lindberg, the wait to access their frozen funds is difficult to accept.

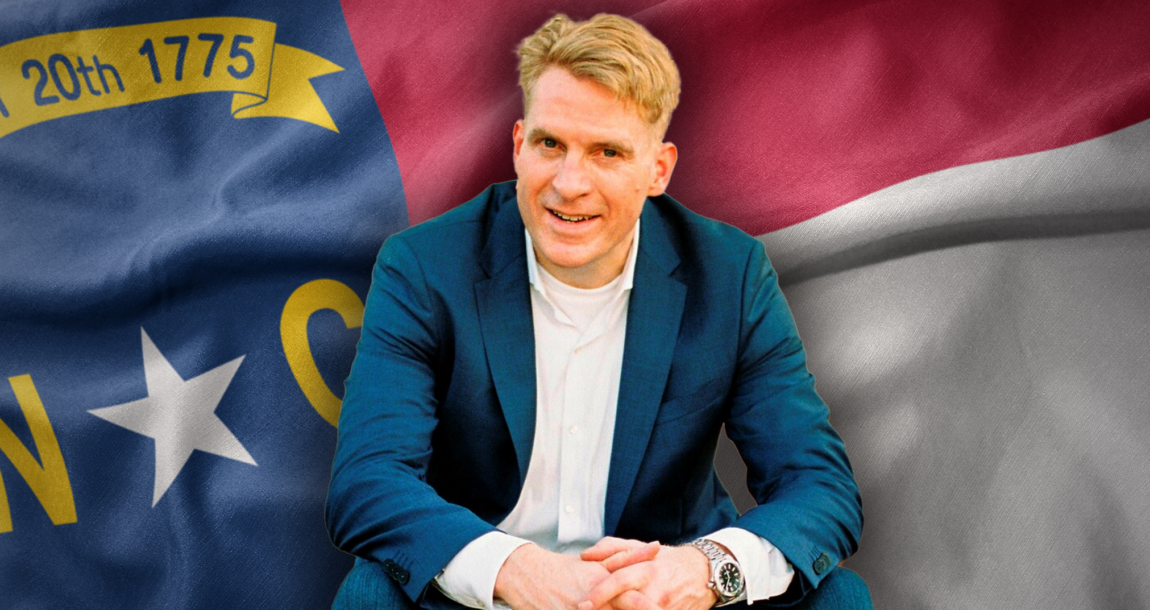

Todd Davis, a Dillon, S.C.-based insurance agent, placed several policies with Lindberg-owned insurers. That was before Lindberg was charged with bribery, fraud and a host of other fraud-related charges, and his insurers were placed into receivership by the North Carolina Department of Insurance.

"The problem is nobody is talking to them. Nobody's talking to the agent," Davis said. "They have this [toll-free] number you can call and I called it the other day and I hung on and hung on for 30 minutes and nobody even comes to the phone. So that's the problem, the communication with the people who have no idea what's going on with their money."

On June 27, 2019, Southland National Insurance Corp., Colorado Bankers Life Insurance Co., Bankers Life Insurance Co. and Southland National Reinsurance Corp. – all owned by Lindberg – were placed in rehabilitation by order of the Superior Court of Wake County, North Carolina.

Since then, regulators have worked to unwind the complex financial web of companies and accounts controlled by Lindberg. InsuranceNewsNet wrote about the mysterious receivership process in July 2022. The year since produced little news to encourage long-suffering policyholders that the end is close.

A spokesman for the insurance department pointed out that Insurance Commissioner Mike Causey petitioned the Rehabilitation Court to place the insurers into liquidation in November. The court granted that petition on Dec. 30, 2022, by issuing an order of liquidation with a declaration of insolvency that would trigger the state guaranty associations within 90 days of the order becoming final.

Lindberg appealed that order of liquidation. Until the Order of Liquidation becomes effective, the insurers remain in rehabilitation.

Standard guaranty association coverages protect policyholders up to $300,000. Court documents indicate that nearly all of the policies in the receivership process are less than $300,000.

Losing income

Davis sold "about 7 to 10" policies impacted by the receivership, he said, with his typical client a retired senior citizen living off the interest income. He mentioned one recent client, a woman with a Colorado Bankers Life policy who is losing out.

"Her five-year surrender period ended," Davis explained. "She was getting around 3.8% interest and now it's going to the minimum guaranteed amount of 1%. She utilizes that interest income so now she's going to lose the supplemental income she was getting."

Lindberg, founder of the private equity firm Eli Global, eventually acquired several insurers and grouped them together as the Global Bankers Insurance Group. Insurance profits soared and ultimately enabled Lindberg to funnel $2 billion to Eli Global, according to a Wall Street Journal report. That attracted regulators and initiated Lindberg's downfall.

Lindberg made a special agreement with former Insurance Commissioner Wayne Goodwin allowing him to invest up to 40% of his insurance companies' assets into affiliated business entities. In November 2016, Goodwin lost his seat to Mike Causey, who reduced the cap on affiliated investments from 40% to 10%.

Lindberg had been sentenced to more than seven years after being convicted of attempting to bribe Causey to secure preferential regulatory treatment. He won an appeal and was released last summer after serving two years in prison. The 4th Circuit panel declared that Judge Max Cogburn had erred by giving jurors in Lindberg’s trial misleading instructions before they began deliberations.

In March, Cogburn agreed to move Lindberg's retrial to November. Lindberg also faces a lengthy list of fraud charges in separate cases brought by the federal government and the Securities and Exchange Commission.

Special distributions set up

In the meantime, the rehabilitator has instituted various policyholder distribution programs, including:

1. The rehabilitator petitioned the Rehabilitation Court for approval to pay contractual interest-only payments on annuities of the insurers as of Nov. 1, 2022, and going forward, until the Order of Liquidation becomes effective. The court granted the petition on Feb. 6, 2023. Policyholders have the option to activate interest-only payments if allowed under their annuity contracts. The Withdrawal of Accumulated Interest Portal at www.NCRehabInterestElection.com is available to make the election to receive interest-only payments for interest accruing on or after Nov. 1, 2022.

2. The rehabilitator filed on May 3, 2023, a motion in the Rehabilitation Court to modify the court-ordered moratorium to allow the rehabilitator to cash out certain small annuities of the insurers, at a value of $1,334.00 and under that amount. The rehabilitator had determined that the small annuities are operating at a loss due to the high amount of non-performing affiliated assets and the cost to administer the policies. It is therefore in the interest of all policyholders that the small annuities be cashed out. The court held a hearing on the motion on June 19, 2023, and has granted the motion. Eligible policyholders will receive letters notifying them of the cash out, how much they would receive, and any elections they may have. The rehabilitator estimates the small annuity cash out letters will go out by the end of the summer of 2023. Policyholders should not contact customer service about the cash out of small annuities until after receiving a letter. They will not be able to answer any questions until that time.

3. The rehabilitator filed on April 28, 2023, a motion in the Rehabilitation Court to modify the court-ordered moratorium to allow the rehabilitator to make a one-time partial withdrawal in the amount of 25%, less any applicable tax withholding, fees and surrender charges, to annuity holders of Colorado Bankers Life. The court held a hearing on the motion on June 19, 2023, and has granted the motion. The rehabilitator estimates the CBL partial withdrawal letters will go out by the end of the summer of 2023. Eligible policyholders will receive letters notifying them of the partial withdrawal, how much they would receive, and any options they may have. Policyholders should not contact customer service about the partial withdrawal until after receiving a letter. They will not be able to answer any questions until that time.

4. The rehabilitator filed on July 6, 2023, a motion in the Rehabilitation Court to modify the court-ordered moratorium to allow the rehabilitator to make a one-time partial withdrawal in the amount of 25%, less any applicable tax withholding, fees and surrender charges, to annuity holders of Bankers Life. A hearing has not been scheduled yet. If the motion is approved, eligible policyholders will receive letters notifying them of the partial withdrawal, how much they would receive, and any options they may have. The rehabilitator estimates the Bankers Life partial withdrawal letters would go out by the end of the summer of 2023. Eligible policyholders would receive letters notifying them of the partial withdrawal, how much they would receive, and any options they may have. Policyholders should not contact customer service about the partial withdrawal until after receiving a letter. They will not be able to answer any questions until that time.

Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at john.hilton@innfeedback.com. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Ibexis: A vision and product strategy for success

NAFA CEO talks about 2023 state of the fixed annuity industry

Advisor News

- TIAA, MIT Age Lab ask if investors are happy with financial advice

- Youth sports cause parents financial strain

- Americans fear running out of money more than death

- Caregiving affects ‘sandwich generation’s’ retirement plans

- Why financial consciousness is the key to long-term clarity

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Bill aimed at holding health insurance companies accountable stalls at Capitol

- Health Insurance Subsidies Set to Expire, Threatening Coverage for Millions

- Expiring health insurance tax credits loom large in Pennsylvania

- Confusion muddies the debate over possible Medicaid cuts

- Trump protesters in Longview aim to protect Medicaid, democracy, due process

More Health/Employee Benefits NewsLife Insurance News

- IUL: Offering stability amid trade tariff uncertainty

- ‘Really huge’ opportunity for life insurance sales if riddle can be solved

- Americans fear running out of money more than death

- NAIFA eyes tax reform, retirement issues in 2025

- Legislation would change tax treatment of life insurers’ debt investments

More Life Insurance News