Pandemic Has Been Healthy For The Upper Incomes

Affluent Americans are not only doing better than their less-wealthy contemporaries but they are also further ahead than their parents were at their age.

Both findings from a recently released Bank of America survey run counter to the experience of many average Americans, particularly those on the lower end of the income scale. Meanwhile, wealthier people have been able to sock away more cash into savings during the pandemic as they focused on improving their financial position.

Four out of five respondents to the BOA survey have taken money normally spent on entertainment, travel and dining and set it aside, with 52% putting it in savings accounts and 25% building up their emergency funds.

The wealthy are leaping far ahead of lower-income groups’ long-term goals. The survey found that the majority of affluent Americans are prioritizing many traditional milestones in life, such as buying a house.

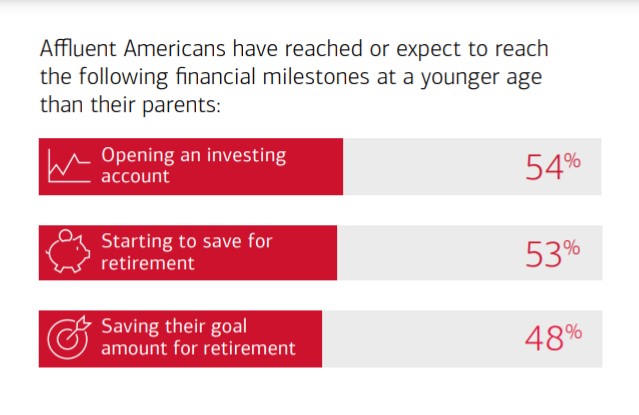

Most (84%) said they plan to achieve or have already achieved one or more financial milestones earlier than their parents. More than half (53%) said they have already achieved or plan to achieve five or more financial milestones earlier than their parents.

The research is based on a survey of adults at least 25 years old with investable assets between $100,000 and $1 million, and 18- to 24-year-olds with investable assets between $50,000 and $1 million.

They tend to be happy with their financial choices in life, with 89% of Generation X, baby boomer and senior respondents satisfied with the financial decisions they have made. They had a few regrets, though, with a third of these respondents (34%) saying they would have done things differently, such as wishing they had saved more (66%) and they had started saving, 59%, and investing earlier (61%).

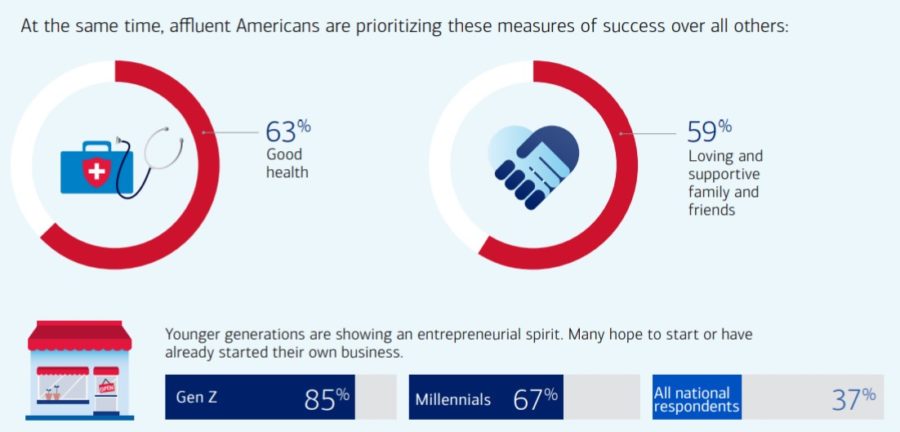

Affluent Americans have been able to pivot their focus on concerns other than money. When asked about the most important measures of personal success today, respondents chose goals such as good health, 63%.

They tended to worry about events affecting their situation, with 62% concerned about economic recession, 55% about market volatility, 50% with the rising cost of healthcare, and 44% with the global health crisis.

“The health crisis has caused many people to take stock of their life priorities and to control what they can during a period of uncertainty,” said Aron Levine, BOA president of Preferred and Consumer Banking & Investments. “In addition to getting their finances in order, people are looking ahead at new possibilities, plotting a course for their future and engaging with educational resources and advice that will help them make informed financial decisions and pursue new and exciting goals for themselves and their families.”

The pandemic has about the same percentage of richer Americans either indulging in riskier financial behavior or reducing their risk tolerance, and nearly half, 48%, are happy with their current investment risk tolerance level. Of the 44% who changed their risk tolerance level, 23% have been more aggressive and 21% have become more cautious.

Down In The Down Market

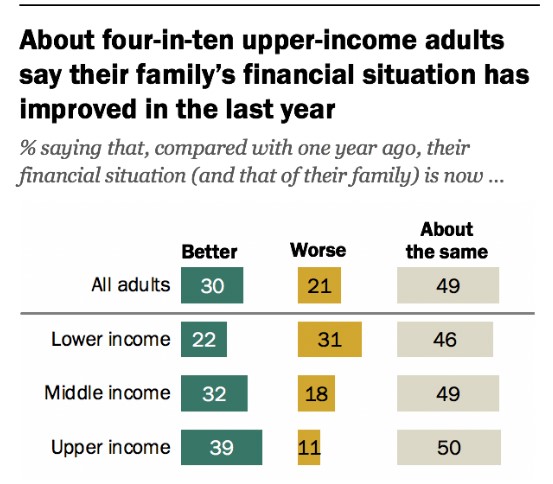

A recent Pew Research Center study confirmed BOA’s finding, with 39% of the upper income groups saying their family’s financial situation has improved compared with a year ago.

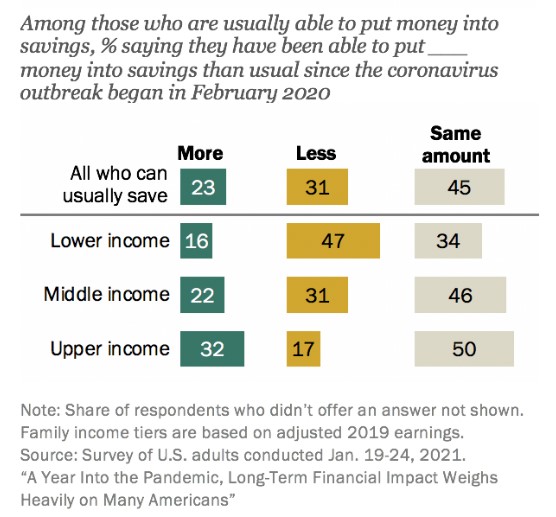

Upper-income adults were also more likely than those with middle or lower incomes to say they have been spending less and saving more money since the coronavirus outbreak began.

In stark contrast with the upper incomes, the Pew study found 32% of those with middle incomes and just 22% of lower-income adults said their financial situation improved.

Income differences were particularly pronounced at the extremes for those who rate their financial situation as good or excellent, with 86% of upper income respondents and 26% of lower-income adults giving their finances a high grade. In the middle income, 58% said their finances are in excellent or good shape.

Overall, about half of non-retired adults said the economic impact of the coronavirus outbreak will make it harder for them to achieve their long-term financial goals. For those who said their financial situation has gotten worse, 44% think it will take them three years or more to get back to where they were a year ago.

Many of the people who lost wages during the pandemic are not doing well. About half (49%) of workers who had a pay cut during the pandemic are still earning less money than before the coronavirus outbreak. This is particularly the case among older workers, with 58% of employed adults at least 50 years old who lost wages during the pandemic saying they’re earning less money than before, compared with 45% of those younger than 50.

In another contrast to higher incomes, lower income people had to spend more and were able to save less during the pandemic, with 26% of lower income respondents saying they have been spending more, compared with 17% of middle-income adults and 11% of upper-income adults. More than half (53%) of upper-income adults were more likely than those with middle (43%) or lower incomes (34%) to say they have been spending less money since the pandemic began.

Another stark divide was along racial lines, with 60% of whites and 58% of Asian adults saying their personal financial situation is in excellent or good shape. That was the inverse of the situation for Black and Hispanic respondents, with 66% of Black and 59% of Hispanic groups saying their finances are in only fair or poor shape.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Complex And Convoluted: Obtaining Coverage For The Cannabis Industry

Summer Plans: How To Make The Most Of Career Opportunities

Advisor News

- Take advantage of the exploding $800B IRA rollover market

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

More Advisor NewsAnnuity News

- KBRA Releases Research – Private Credit: From Acquisitions to Partnerships—Asset Managers’ Growing Role With Life/Annuity Insurers

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

More Annuity NewsHealth/Employee Benefits News

- Health care outlook: Volatility and potential coverage gaps

- Healthcare advocates navigate rising coverage costs after deadline

- Universal health care: The moral cause

- IOWA REPUBLICANS GET WHAT THEY VOTED FOR: HIGHER HEALTH INSURANCE PRICES, FEWER PEOPLE ENROLLED IN THE ACA

- XAVIER RECEIVES $3 MILLION FOR OCHSNER MEDICAL SCHOOL SCHOLARSHIPS

More Health/Employee Benefits NewsLife Insurance News

- John Hancock looks to new AI underwriting tool to slash processing time

- AllianzIM Buffered ETF Suite Expands with Launch of International Fund

- Author Sherida Stevens's New Audiobook, “INDEXED UNIVERSAL LIFE INSURANCE IN ACTION: FROM PROTECTION TO PROSPERITY – YOUR PATH TO FINANCIAL SECURITY,” is Released

- AM Best Affirms Credit Ratings of Etiqa General Insurance Berhad

- Life insurance application activity hits record growth in 2025, MIB reports

More Life Insurance News