Pandemic Adds To Women’s $1M Retirement Gap, Harris Poll Finds

Headlines blare the good news of a rebounding economy, but women have a far deeper valley to bounce out of.

The COVID-19 pandemic set back retirement plans for Americans across socioeconomic groups, but women suffered a deeper disadvantage that will set them even further back for the rest of their lives.

That was one of the findings from "The Four Pillars of the New Retirement: What a Difference a Year Makes," conducted by Edward Jones and Age Wave with The Harris Poll. The polling in December and March updated polling taken in May 2020.

One in three Americans expects to delay their retirement because of the pandemic as of March, according to the study. In a hopeful sign, although 22 million Americans stopped making monthly retirement contributions by December, that dropped to 14 million as of March.

Among households ages 45-54, 42% do not have any retirement savings, and the median retirement balance is $100,000.

“While retirement was already transforming before COVID-19, the pandemic has accelerated key retirement trends, disrupting retirement as we know it,” according to the report’s authors. That impact is not borne equally among Americans.

“The financial fallout from the pandemic has been unequally distributed,” the report’s authors wrote. “Many Americans have benefited from a financial boom, while millions of those earning the least have suffered financially and emotionally from job and income loss.”

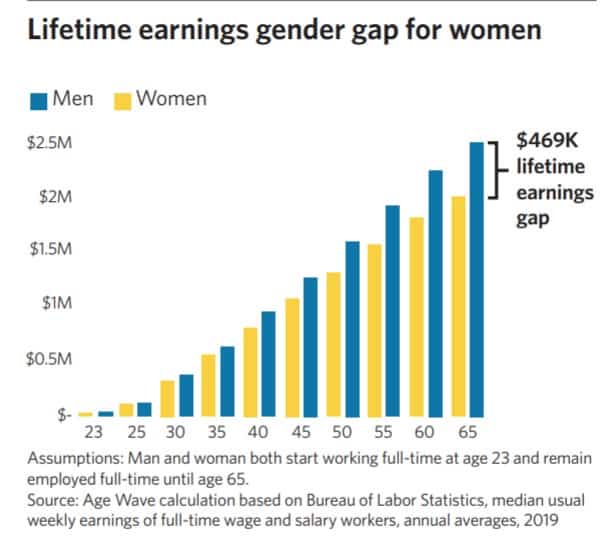

Women already faced a $469,000 gap in lifetime earnings on average.

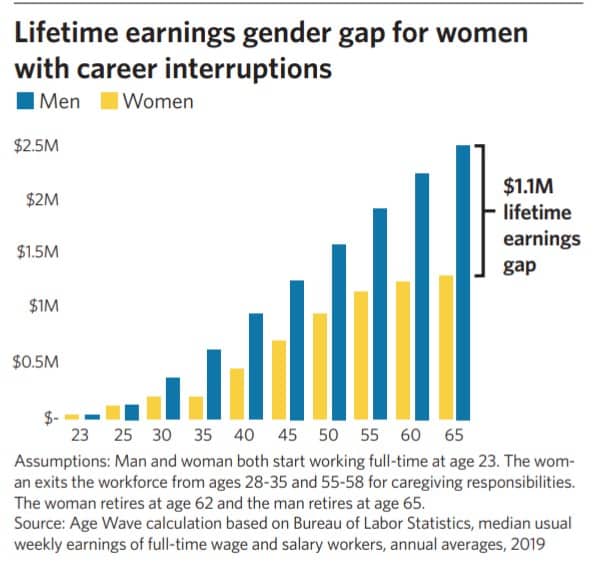

That gulf doubles to more than $1 million when their career is disrupted.

Boomer women have spent an average of eight years out of the workforce from ages 18-52, according to the report. Women also retire an average of two years earlier than men.

The researchers illustrated how the career disruption can add up to $1 million, with an example of a woman who stopped working between the ages of 28 to 35 as she cared for children until they entered kindergarten. She continues her mid-career until 55, when she cares for an elderly relative until she jumps back to full time work at 58.

Not only did she lose income and promotion opportunities, she also has less in pension and Social Security – for a grand total of $1.1 million.

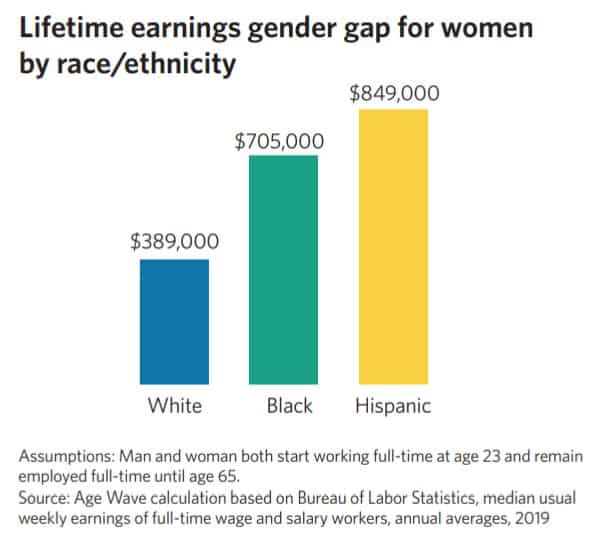

The earnings gap is even wider for Blacks and Latinos.

During the “she-cession,” women left the workforce in greater numbers during the pandemic either through displacement or caring for family members, including homeschooling children and caring for elderly relatives.

Nearly a third (31%) of women active in the labor force said the pandemic hurt their job security, compared to only 23% of men, according to the report. The gap was more glaring for pre-retirees, with 39% women losing some job security compared to 20% of men.

All those disadvantages lead to fewer dollars to put aside, with only 41% of women saving each month for retirement, compared to 58% of men.

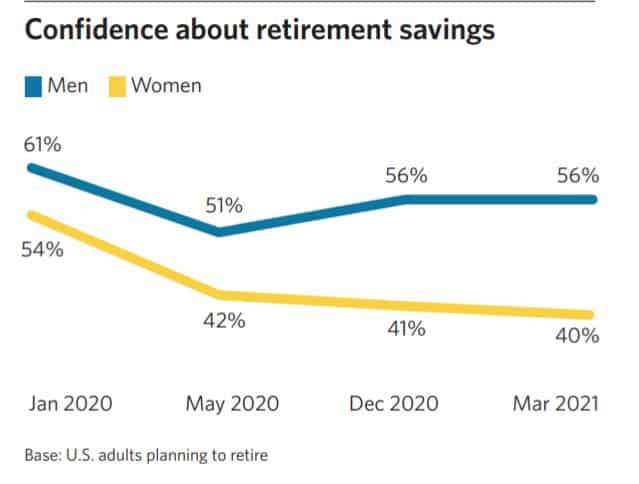

While men have regained a dash of confidence in retirement since May 2020, women have been losing confidence.

“In stark contrast, women’s retirement savings confidence dropped and has not rebounded, remaining alarmingly low,” according to the report. “Among pre-retirees, the confidence gender gap is even wider (35% for women vs. 56% for men).”

Retirement accounts for women are 67% than that of men. Those fewer dollars will have to stretch a longer way as women typically live five years longer and retire earlier.

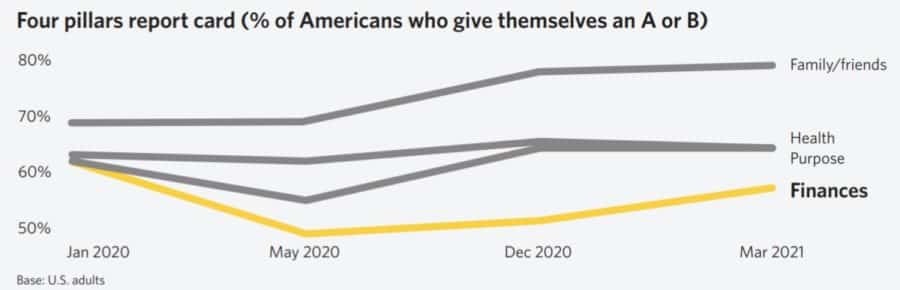

Although financial security was the most wobbly pillar of retirement during the pandemic, Americans came to value family and friends even more during the pandemic. In fact, it was the only one to have increased over pre-pandemic levels.

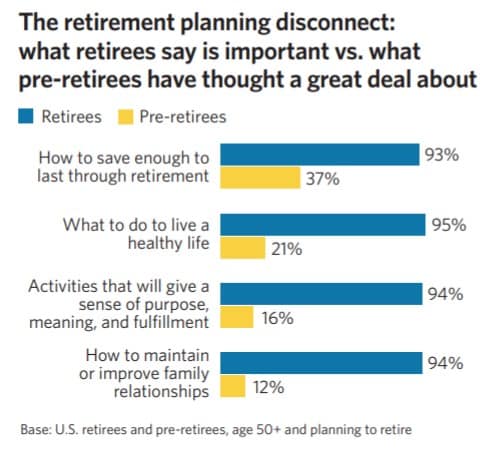

That emphasis on family and friends would be well-placed, according to retirees, with 94% of them saying “how to maintain or improve family relationships” is important. That is in stark contrast with the mere 12% of pre-retirees saying they think about it.

“Another encouraging sign is that the majority of Americans now say there is a silver lining to the pandemic: 76% credit it with causing them to ‘refocus on what’s most important in life,’” the researchers wrote. “This sentiment held true across age, gender, race/ethnicity, income and region of the country.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

UnitedHealthcare Delays New ER Visit Policy Based On Feedback

Nebraska Man Headed To Prison After Failed Insurance Scam

Advisor News

- Geopolitical instability and risk raise fears of Black Swan scenarios

- Structured Note Investors Recover $1.28M FINRA Award Against Fidelity

- Market reports turn economic trends into a strategic edge for advisors

- SEC in ‘active and detailed’ settlement talks with accused scammer Tai Lopez

- Sketching out the golden years: new book tries to make retirement planning fun

More Advisor NewsAnnuity News

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

- Advising clients wanting to retire early: how annuities can bridge the gap

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

More Annuity NewsHealth/Employee Benefits News

- PID finds violations by Aetna Insurance

- Iowa insurance firms warn bill would make health costs rise

- ELLMAN BILL PROTECTS ACCESS TO HEALTH COVERAGE, PREVENTS DENIALS OVER PAST-DUE PREMIUMS

- Blue Cross Blue Shield of Wyoming CEO Gore announces retirement; Urbanek to take lead

- Wellpoint taps Rachel Chinetti as president

More Health/Employee Benefits NewsLife Insurance News

- Jackson Earns Award for Highest Customer Service in Financial Industry for 14th Consecutive Year

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- LIMRA: Individual life insurance new premium sets 2025 sales record

- How AI can drive and bridge the insurance skills gap

- Symetra Partners With Empathy to Offer Bereavement Support to Group Life Insurance Beneficiaries

More Life Insurance News