Nationwide, Global Atlantic big movers up the LIMRA Q1 annuity sales chart

Athene Life and Annuity remains king of the annuity sellers, but a pair of insurers representing the old guard and the new made impressive moves up the LIMRA first-quarter sales chart.

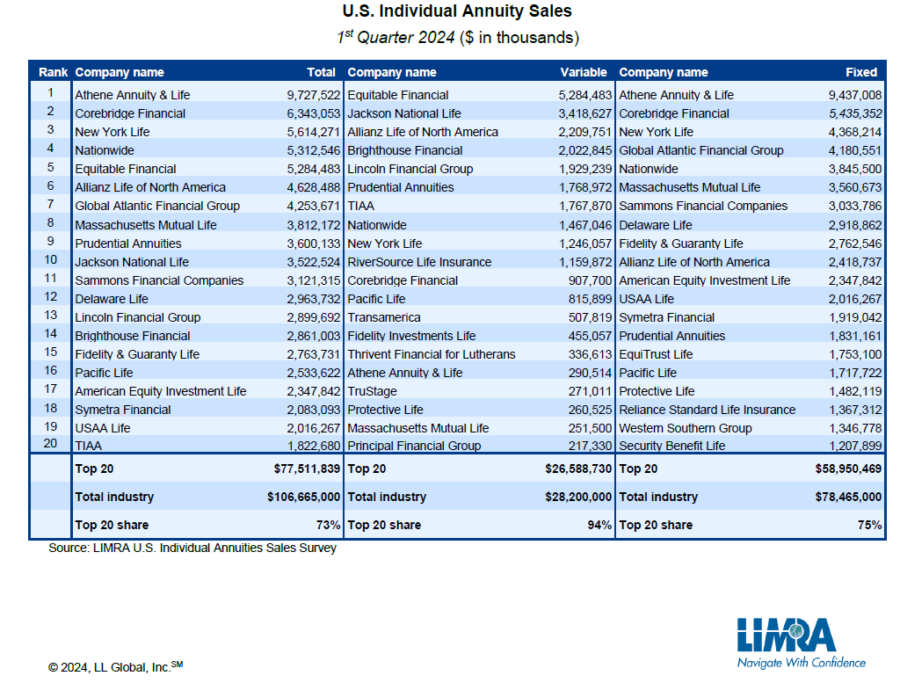

Traditional life insurer Nationwide finished fourth in Q1 sales with $5.3 billion, up from seventh in 2023, according to LIMRA’s U.S. Individual Annuity Sales Survey. They were matched by the private-equity owned Global Atlantic, which climbed from 11th in 2023 to seventh with $4.25 billion in Q1 sales.

Athene retained its comfortable lead with $9.7 billion in sales. Also private-equity owned, Athene sold more than $35.5 billion worth of annuities in 2023.

Total annuity sales settled at $106.7 billion in the first quarter of 2024, 13% above prior year results, LIMRA reported. The figure is down slightly from the preliminary results LIMRA released April 25.

“Demand for investment protection and guaranteed retirement income remains strong. This is the 14th consecutive quarter of year-over-year growth in the U.S. annuity market,” said Bryan Hodgens, head of LIMRA research. “That said, total annuity sales have come down from fourth quarter 2024, largely due to a softening in the fixed-rate deferred annuity market. However, LIMRA expects annuity sales to perform well through 2024.”

It is the highest first-quarter sales results since LIMRA started tracking sales in the 1980s.

At the other end of the sales spectrum, MassMutual tumbled from its second-place perch in 2023 sales to eighth in Q1 with $3.8 billion. That is well off the insurer's sales pace from a year ago, which ended with $24.7 billion in sales.

In March, MassMutual credited "record annuity sales and capital," in part, for its successful 2023 financial results.

LIMRA breakdown

LIMRA's annuity survey represents 92% of the total U.S. annuity market. The association provided a sales breakdown by product type:

Total fixed-rate deferred annuity (FRD) sales were $43 billion in the first quarter, 4% higher than first quarter 2023 sales. This is the ninth consecutive quarter of growth for FRD annuity sales. FRD annuities remain the primary driver of annuity sales growth, representing more than 40% of the total annuity market in the first quarter.

Fixed indexed annuities

Fixed indexed annuity (FIA) sales had a record first quarter. FIA sales totaled $28.6 billion, up 24% from the prior year. FIA sales have experienced 12 consecutive quarters of year-over-year growth.

“Growth was widespread with 61% of FIA carriers and 8 of the top 10 carriers reporting sales growth,” Hodgens said. “Sustained strong interest rates have allowed carriers to improve FIA crediting rates and raise cap rates, which increased the overall product line attractiveness. LIMRA expects FIA sales to continue to grow through 2025.”

Income annuities

Income annuity product sales continue to thrive under the higher interest rates. Single premium immediate annuity (SPIA) sales were $3.6 billion in the first quarter, 6% higher than the prior year’s results. Deferred income annuity (DIA) sales were $1.2 billion in the first quarter, increasing 40% year over year.

Registered index-linked annuities

For the fourth consecutive quarter, registered index-linked annuity (RILA) registered record quarterly sales. RILA sales increased 39% in the first quarter to $14.5 billion.

“For the second consecutive quarter, RILA sales outperformed traditional variable annuities (VAs). RILA sales should continue to outpace traditional VA sales throughout 2024. LIMRA is forecasting RILA sales to surpass $50 billion in 2024,” Hodgens noted.

Traditional variable annuities

Traditional VA sales improved in the first quarter, up 7% year over year to $13.7 billion.

“While traditional variable annuity sales grew in the first quarter, sales remain historically low,” Hodgens said. “Today’s investors have more annuity options to achieve their accumulation goals than they did a decade ago.”

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Content marketing planning: 5 best practices for advisors

FACC injunction request: Freeze DOL fiduciary rule until lawsuit is heard

Advisor News

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

More Advisor NewsAnnuity News

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

- Assured Guaranty Enters Annuity Reinsurance Market

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

- Guaranty Income Life Marks 100th Anniversary

- Delaware Life Insurance Company Launches Industry’s First Fixed Indexed Annuity with Bitcoin Exposure

More Annuity NewsHealth/Employee Benefits News

- Reports Outline Insurance Study Results from RAND Corporation (The Unaffordability of Affordable Care Act Health Insurance Plans): Insurance

- Recent Reports from National Yang Ming Chiao Tung University Highlight Findings in Women’s Health (Health-care utilization after domestic violence: A nationwide study in Taiwan comparing individuals with and without intellectual disability): Women’s Health

- WHAT THEY ARE SAYING: LOWERING PREMIUMS MEANS ADDRESSING THE TRUE DRIVERS OF HIGHER HEALTH CARE COSTS

- Health insurance increase of $1,100 (or around $4,000 for a family of 4) creates big questions

- Researchers at U.S. International University Publish New Data on Health Insurance (The Combined Effects of Digital Health Interventions on Universal Health Coverage Equity in Kenya: An Integrated Approach): Health Insurance

More Health/Employee Benefits NewsLife Insurance News