Moody’s: Commercial properties worth $425.9B in Hurricane Helene’s path

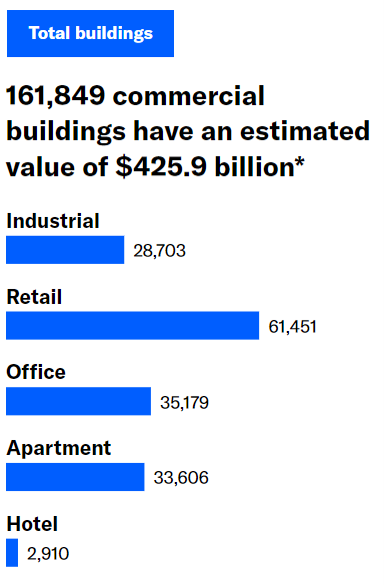

Moody's is estimating 161,849 commercial properties with a total estimated value of $425.9 billion are in the direct path of Hurricane Helene, which has a projected track across Florida’s panhandle and the South.

According to Moody's, nearly 162,000 commercial real estate properties in the state have a greater than 50% probability of being exposed to wind speeds of at least 50 mph — the wind speed at which some damage is likely. The total estimated value of these properties is $425.9 billion.

While the hurricane season has been, to date, less extreme than was previously expected, something that is noteworthy is that Hurricane Helene is expected to hit "a similar area that Hurricane Debbie hit earlier, near the Big Bend area region of Florida," explained Moody’s Associate Director of Research Natalie Ambrosio Preudhomme.

"On the one hand, the portions of the Big Bend area are not particularly populated in terms of commercial real estate properties," Ambrosio Preudhomme said. "So that is one thing to keep in mind when we're thinking about the amount of damage. On the other hand, when we're talking about insurance implications, having two storms hit in very similar areas definitely can exacerbate those implications."

"When we're talking about the industry as a whole, compounding losses can be a challenge," she said. "The Florida market in particular has definitely been in flux over the past several years. There are a lot of smaller, more regional insurers in that market that have more concentrated portfolios. So they are more highly exposed to this risk of hurricanes hitting – especially more than one in the same area, likely affecting their portfolio multiple times.

"We've definitely seen, in the past, multiple insurers going insolvent per season. We did see some improvement last year with some insurers entering the market. So, it's an area that's in flux."

Ambrosio Preudhomme explained how Moody's arrived at the number of commercial real estate properties projected to be in the path of the storm. "We combined Moody's CRE platform – our commercial real estate database – which has millions of commercial real estate properties across property types, so apartments, hotels, free retail offices, industrial. We combined that with a tool called ExposureIQ, which is a tool from RMS, which Moody's acquired... We merged these two Moody's capabilities to look at the properties' exposure to extreme winds during the hurricane."

She said that winds of 50 mph is the "threshold where you would expect some damage from a storm. We pulled that data a little earlier in the storm's trajectory, so I would say it's a conservative estimate and, as the storm has been intensifying, there's a large likelihood that more properties would be exposed to that 50 mph threshold."

“Helene is expected to be larger than other recent hurricanes, bringing with it the ability to cause a larger footprint of damaging wind, storm surge, and rainfall,” according to Jeff Waters, director, North Atlantic Hurricane Models, Moody’s. “Generally, the 2024 season has been at or below the 1991–2020 climatological average in number of named storms, hurricanes, major hurricanes and accumulated cyclone energy – and below the lofty expectations of a hyperactive season. Still, we have seen three landfalling U.S. hurricanes already, with an upcoming fourth in Helene. Additionally, several midseason outlooks are anticipating above average activity for the remainder of the season.”

Property types included in Moody's projection, include:

According to the National Oceanographic and Atmospheric Administration, storm surges are a major potential danger of Helene, with a “catastrophic” storm surge likely along portions of the Florida Big Bend coast, where “inundation could reach as high as 20 feet about ground level, along with destructive waves.” Also, “potentially catastrophic hurricane-force winds are expected within the eyewall of Helene” when it is expected to make landfall Thursday evening.

According to Moody's, insurance coverage cost and availability "has become an increasing pain point for commercial real estate market participants. Property insurance expenses traditionally inflated by roughly two to three percent per year, which is a typical expense budgeting target of underwriters, lenders and asset managers. However, year-over-year insurance cost growth has spiked to over 20% in some markets in recent years. We found that on average nationally, CRE properties have seen about a 9.7% annual growth rate since 2017. The average cost of insurance tends to be much higher for properties exposed to acute climate risks, but the elevated insurance expense growth rate is largely ubiquitous across the country."

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

John Forcucci is InsuranceNewsNet editor-in-chief. He has had a long career in daily and weekly journalism. Contact him at johnf@innemail.

Regulators issue draft guidance to test compliance with annuity rules

MetLife vindicated in class-action lawsuit over LTC rate hikes

Advisor News

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

- Take advantage of the exploding $800B IRA rollover market

- Study finds more households move investable assets across firms

More Advisor NewsAnnuity News

- Court fines Cutter Financial $100,000, requires client notice of guilty verdict

- KBRA Releases Research – Private Credit: From Acquisitions to Partnerships—Asset Managers’ Growing Role With Life/Annuity Insurers

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

More Annuity NewsHealth/Employee Benefits News

- CVS Pharmacy, Inc. Trademark Application for “CVS FLEX BENEFITS” Filed: CVS Pharmacy Inc.

- Medicaid in Mississippi

- Policy Expert Offers Suggestions for Curbing US Health Care Costs

- Donahue & Horrow LLP Prevails in Federal ERISA Disability Case Published by the Court, Strengthening Protections for Long-Haul COVID Claimants

- Only 1/3 of US workers feel resilient

More Health/Employee Benefits NewsLife Insurance News