Make Your Business Plan A Living Document

By Todd Colbeck

Traditional business plans are more like a list of desires. Little emphasis is placed on what you can actually control. These plans are filled out in the fourth quarter of the year and possibly submitted to your manager before they go in a drawer and largely are forgotten.

Business Power Planning focuses on the client first, what you can control second, and the rewards you will receive third. It is a living document which evolves with your business from quarter to quarter, month to month, or even week to week.

How many times have you filled out a business planning template that is required by your manager only to park it in your desk until the end of the year?

The traditional templates are simply a list of desires. How many new clients will you get? How many policies will you sell? How much in new business will you bring in? These desires are fine but they are only a list of wants. You may want new clients but can you really control whether or not a prospect decides to engage you? Can you really control whether clients decide to follow your product recommendation? Power Planning is different because you focus on things that are easily measured and nearly 100 percent under your control.

For example, can you control whether someone decides to give you a referral? No. But can you control whether or not you ask? One hundred percent yes. Now the real question becomes, what referral systems will you test and how will you set appointments with the referrals that you receive?

So if you simply made a plan to use a referral system at every opportunity, can you control that? Once you find a system that works, will you keep using it? Both of these are issues within your control.

The Four Parts of a Business Power Plan

- How will I try to increase client loyalty?

- How will I try to increase my staff's engagement?

- How will I try to improve service and operations?

- How will I measure and track results?

If you grow client loyalty, engage your staff and improve service and operations, your financial goals will take care of themselves. However, it is critical that you measure and track your results throughout the year. If you try something that doesn't work, try something else and track it to see whether it improves. If something is working, keep doing it until you find something else that works better. Pretty simple, right?

Business Power Planning thrives on simplicity, while traditional business planning is often much too complicated. Let's review the first part of your Business Power Plan, how you will attempt to increase client loyalty.

How Will I Try to Increase Client Loyalty?

- “Interaction, the leading driver of customer satisfaction with an insurer, has an overall score of 832. However, 27 percent of customers in 2014 have to wait to speak with an agent when they call, up from 22 percent in 2013; and 13 percent of customers are transferred to another agency representative, an increase from 10 percent in 2013.”

Source: J.D. Power 2014 US Household Insurance Study

The first part of your Business Power Plan focuses on improving client loyalty. Loyal clients don't leave, they do business exclusively with you, and they rave about your services to their associates. As a successful professional, you already are doing this or else you couldn't stay in business. Every year, product-focused companies release new products to increase their competitive advantage, even if they are No. 1 in their category.

According to J.D. Power, you can increase client loyalty by providing better products, better service or both. How can you combine different products together to help your clients? Would someone be happier working with the same agent for both homeowners insurance and life insurance? Can you cross-sell products in different categories? Does it surprise you to learn that clients who have purchased at least three different products from you are more loyal, less likely to leave and will provide many more referrals? You can see that service is the key to client loyalty with an insurance agent as client interaction is the key driver of loyalty. Your business plan must include ways that you can improve client interaction. Take a look at my recent article on setting up a turnkey service model if you need help improving client interaction. Having a plan to measure and improve client loyalty is key, because without clients you are out of business.

How Will I Try to Increase Employee Engagement?

How Will I Try to Improve Service and Operations?

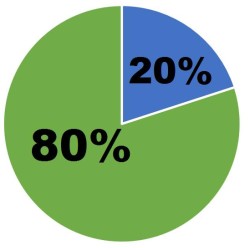

The Pareto Principle applies to operations as well. Twenty percent of your tasks contribute to 80 percent of your results. The 20-percent tasks for an insurance agent are prospecting, meeting with clients and closing sales. Improving systems and operations means reducing errors. Every error wastes your time and time is money. Improving operations also reduces waste - wasted time, wasted phone calls and wasted meetings. In the ideal system, your meetings are all set at least a month in advance, they are prepped at least a week in advance, and follow-up letters and tasks happen within at least 24 hours after the meeting. What would your life be like if you spent 80 percent of your time prospecting, meeting with clients and closing sales? There is no such thing as perfection in a practice, but you want to improve your systems and operations each year. This is a crucial part of your Business Power Plan.

How Will I Measure and Track Results?

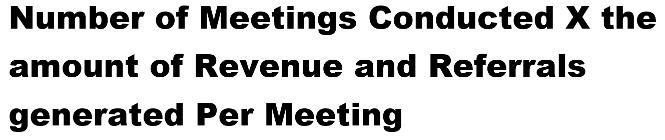

The formula for business growth for an insurance agent is simple:

If you divide the revenue you generated last year by the number of meetings you held, you can determine the average revenue generated per meeting. If all you do is conduct more meetings, you should make more money, barring an event like the financial crisis we had in 2008. If all you do is get more referrals per meeting, you will grow. If all you do is have the same number of meetings but increase the revenue generated per meeting, you will grow. Now what will happen if you do all three? That means you conduct more meetings and generate more referrals per meeting and generate more revenue per meeting! Sounds good but how can you do that? We know that more client interaction leads to client loyalty. A scheduled phone meeting is better than calling out of the blue and interrupting someone. A face-to-face meeting is better than a phone meeting. Insurance agents often believe their clients are so busy that meetings generally annoy them. Well, the exact opposite is true. Clients want and demand more interaction. Every time you meet gives the client a reminder of why they chose to do business with you. You can ask for a referral, suggest additional coverage or introduce new coverage that they need but don’t have. Many types of policies renew every year, giving you the perfect opportunity to schedule those meetings in advance.

The secret is focusing on what you can control rather than on what you can't control. You can't control how your staff feels in the morning. You can control whether you hold a 5-minute meeting to align the day. You can't control whether a client gives you a referral. You can control whether and how you ask. You can't control whether a client misses an appointment. You can control how many appointments you set. This is the power of Business Power Planning rather than the typical "I wish I may, I wish I might" type of business planning where you just list a bunch of desires.

Measuring and Tracking

My sensei (teacher) at The University of Toyota, Dr. Mike Morrison, liked to say that what gets measured gets done. Measure and track the things you can control and make adjustments as needed. All of those financial goals you have for your agency growth will be hit farther, more enjoyably and a lot simpler by having the right systems in place. Then let the system work for you instead of you having to work the system.

Todd Colbeck, MBA, is owner of Colbeck Coaching Group, Miami Beach, Fla. He formerly was brokerage vice president of the northeast U.S. region at American Express Financial Advisors. Contact him at Todd.Colbeck@innfeedback.com.

The Story Of Sherry And Ben

Expert Predicts Big Shakeout Among Roboadvisors

Advisor News

- Americans fear running out of money more than death

- Caregiving affects ‘sandwich generation’s’ retirement plans

- Why financial consciousness is the key to long-term clarity

- Selling long-term-care insurance in a group setting

- How to overcome the fear of calling prospects

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Low-income diabetes patients more likely to be uninsured

- UnitedHealth execs bemoan ‘unusual and unacceptable’ Q1 financials

- LTCi proves its value beyond peace of mind

- Governor signs ban on drug middlemen owning pharmacies

- The lighter side of The News: Political theater; A bone to pick with a Yankee; Health insurers have mascots?

More Health/Employee Benefits NewsLife Insurance News

- Americans fear running out of money more than death

- NAIFA eyes tax reform, retirement issues in 2025

- Legislation would change tax treatment of life insurers’ debt investments

- Closing the life insurance coverage gap by investing in education

- IUL sales: How to overcome ‘it’s too complicated’

More Life Insurance News