Lowering The Medicare Age: The Pluses And Minuses For Employers

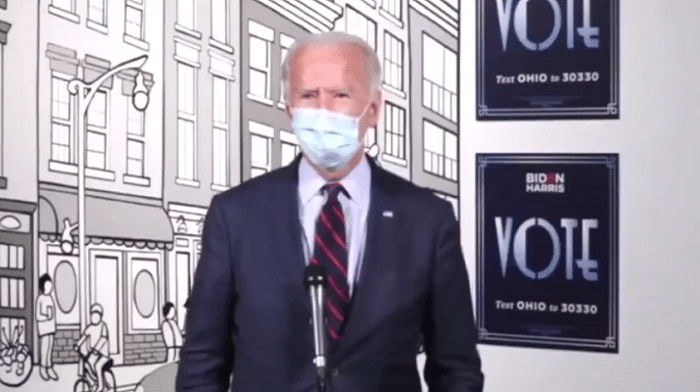

Democratic presidential candidate Joe Biden wants to lower the Medicare eligibility age from age 65 to age 60. This idea has been proposed in several previous bills, so it’s nothing new. But it is getting new attention in this presidential campaign. So what would a lower Medicare eligibility age mean for employers? David Crow, global health and benefits strategy leader at Mercer, examined the pros and the cons in a recent blog post.

Medicare expansion could have some significant implications for employers, Crow said.

The Positives

Lowering the Medicare eligibility age could help employers looking to provide a retiree health option for those employees who want to retire before they turn 65, Crow said. The number of employers offering early retiree medical plans has been in steady declined over the past couple of decades, Crow said. Expanded Medicare would help solve the problem of employees who put off retirement longer than they otherwise would because they are afraid to give up their employer health insurance before they gain access to Medicare.

Expanding Medicare could increase the number of active workers who will consider Medicare as an alternative to their employer-provided group health plan, Crow said. This is especially true in cases where workers compare their employer plan to a Medicare Advantage plan, many of which have $0 premiums. If substantial numbers of active employees choose to leave employer-sponsored plans to enroll in Medicare, employers could see significant cost savings.

The Negatives

If a larger portion of the population enrolls in Medicare plans that reimburse providers at far lower rates than private insurance plans, the result could be even more cost shifting to the private system, Crow said. This means that coverage for workers and their families still enrolled in an employer-sponsored plan is likely to get more expensive -- for both the employer and the employee. In organizations where few active employees migrate to Medicare, the higher cost of coverage might not be offset by lower enrollment.

Health insurance plays an important role in many employers’ overall employee value proposition. So having fewer people who are taking advantage of those benefits could erode that value proposition and make it more difficult for employers to differentiate their benefits, Crow said.

Biden has shared few details of his plan to lower Medicare eligibility. Crow said the implications of that plan on employers “are highly dependent on how such a plan is implemented.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at Susan.Rupe@innfeedback.com. Follow her on Twitter @INNsusan.

© Entire contents copyright 2020 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Don’t Be Too Good At Closing

MDRT Changes Membership Approach, Expands Offerings

Advisor News

- Americans increasingly worried about new tariffs, worsening inflation

- As tariffs roil market, separate ‘signal from the noise’

- Investors worried about outliving assets

- Essential insights a financial advisor needs to grow their practice

- Goldman Sachs survey identifies top threats to insurer investments

More Advisor NewsAnnuity News

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

- Sammons Financial Group “Goes Digital” in Annuity Transfers

- Somerset Reinsurance Announces the Appointment of Danish Iqbal as CEO

- Majesco Announces Participation in LIMRA 2025: Showcasing Cutting-Edge Innovations in Insurance Technology

More Annuity NewsHealth/Employee Benefits News

- Mental health remains in the forefront 5 years after pandemic

- Proxy Statement (Form DEF 14A)

- Idaho Senate approves Medicaid budget

- John Oliver sued by health care boss

- Pharmacy bill passes House committee

More Health/Employee Benefits NewsLife Insurance News

- Annual Report 2024

- Revised Proxy Soliciting Materials (Form DEFR14A)

- Proxy Statement (Form DEF 14A)

- Exemption Application under Investment Company Act (Form 40-APP/A)

- AM Best Affirms Credit Ratings of CMB Wing Lung Insurance Company Limited

More Life Insurance News