Longer lifespans mean redefining retirement

Americans are living longer and that means the traditional view of retirement must change, said Ken Dychtwald, president of Age Wave.

Dychtwald is a psychologist, gerontologist and the author of 19 books. He discussed how America’s changing demographics are impacting what it means to be older during a session at the Alliance for Lifetime Income Summit.

Humankind has spent centuries trying to find a way to live a healthier and longer life, beginning with the search for the mythical fountain of youth, he said. But it was the public health advances of the 20th century – sanitation, antibiotics and vaccines – that led to climbing life expectancies. Lifestyle interventions, cracking the genetic code and the development of a greater array of prescription drugs further fueled an increase in life expectancy.

But there’s a downside to increased lifespan, Dychtwald said.

“People didn’t worry about running out of money in retirement until recently,” he said. “Life in our public environments is geared toward the young.”

The financial services industry has been largely focused on accumulation. “That’s fine, but that’s not the point,” he said. “Because there is another stage of life beyond accumulation.”

Dychtwald challenged the industry to come up with simple names for retirement income products – names that are easily understood by older Americans.

'A totally new era'

“Your clients are living in a totally new era,” he said. “Two-thirds of all those who lived past 65 in the history of the world are still alive today. But most of them are clueless about what they should be doing with their lives.” He pointed to studies showing that the average retiree watched 47 hours of TV in 2023.

“We are not turning 50 or 60 or 74, the way our grandparents did,” he said. “We have new dreams, new hopes, new arrangements and new role models.”

Dychtwald described the increased life expectancy as “a longevity bonus.”

“If you knew you would live longer than your parents did, where would you put your longevity bonus? Most people think you would do everything early in life and just spend the rest of the time in leisure. What people say is they would like to be young longer, be middle-aged longer, reinvent themselves after retirement. Part of the problem is our employers don’t offer that arrangement. How do we help people rethink and reinvent themselves and is retirement really a good idea?”

Length of retirement has tripled

The average length of retirement has nearly tripled since 1935, Dychtwald said – from 7 years to 20 years. “Is that a good idea and who can afford that?”

With fewer younger workers coming up to take the place of those who are hitting retirement age, the U.S. needs workers over 60, Dychtwald said. “Last year, for the first time in America, we had more workers providing elder care than providing childcare. Yet childcare gets all the attention. The cost to companies to not pay attention to the second half of life is outrageous.”

Retirement no longer means the end of work, he said. Retirement is now about new freedoms – the beginning of a new chapter of life.

“Most people wander into their retirement years relatively clueless about what they’re going to do, how they will spend their time, who are they? We have a billion people over the age of 60 worldwide and nobody has tasked them with anything.”

Dychtwald proposed creating an Elder Corps similar to the Peace Corps, where older people could volunteer, contribute and mentor – “do something good for other people.”

Work/life balance sought

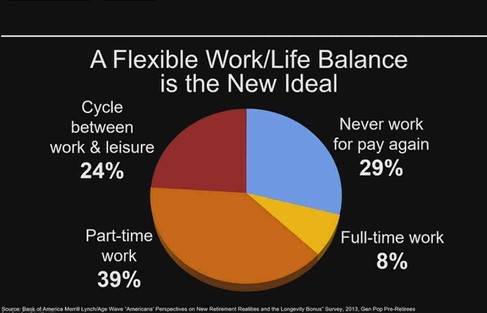

Age Wave research showed that most older Americans seek a work/life balance.

The financial services industry often focuses on helping clients accumulate wealth. But Dychtwald said that Age Wave research showed people want financial peace of mind more than they desire wealth.

“I think you’re in the business of saving lives,” Dychtwald said. “By helping people have the financial resources to last a lifetime, you are saving lives. There may not be a more honorable profession to be in right now.”

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Seeking answers for insurance crisis left in Milton, Helene’s wake

‘Dawn of a new era’: Insurance chatbot industry to hit $4.5B by 2032

Advisor News

- Guardian releases The 2024 Guardian Annual and record-breaking financial results

- Worker retirement confidence unchanged, retirees more optimistic

- TIAA, MIT Age Lab ask if investors are happy with financial advice

- Youth sports cause parents financial strain

- Americans fear running out of money more than death

More Advisor NewsHealth/Employee Benefits News

- Clearing Up Confusion Around Social Security Payments

- Immigration cooperation, IEDC limits and more nab concurrence votes, head to governor

- Ending Medicaid expansion would devastate Ohio’s economy

- Alfa health plan bill 1 vote from final passage

- Business Briefs 0424

More Health/Employee Benefits NewsLife Insurance News

- Guardian releases The 2024 Guardian Annual and record-breaking financial results

- 9 in 10 Americans Have Put Off Health Checkups and Screenings That Could Help Save Their Lives

- Annual Report for Fiscal Year Ending December 31, 2024 (Form 20-F)

- Ameriprise Financial Reports First Quarter 2025 Results

- IUL: Offering stability amid trade tariff uncertainty

More Life Insurance NewsProperty and Casualty News

- MSI Launches Commercial General Liability Insurance for Habitational Property Owners to Protect Against Emerging Risks in a Challenging Market

- Landry's approach to lower insurance rates could cast his political fate

- Kemp inks tort reform bills

- Study: Connecticut homeowners face $80 insurance hike due to tariffs

- Idaho insurance dept. issues wildfire data call

More Property and Casualty News