Long-term care insurance: Public v. Private – What’s working?

Washington state became the first state in the nation to enact a publicly funded long-term care program, when the WA Cares Act – a bill aimed at helping residents pay for long-term care – took effect July 1.

Will Washington’s program be successful? Will other states follow suit? And what will publicly funded LTC programs do to private long-term care insurance? A panel of LTCi experts tackled that topic during the recent National Association of Benefits and Insurance Professionals Capitol Conference.

WA Cares requires employers to withhold a 0.58% premium tax on employee wages to pay into the first-of-its-kind state-mandated trust called the WA Cares Fund. The fund is designed to provide Washington residents up to $36,500 adjusted for inflation per lifetime to pay for long-term care, beginning in July 2026. Residents must pay into the fund for at least 10 years to be eligible for the benefit. Those who have private LTCi can opt out from WA Cares.

WA Cares “is working as planned,” said Steve Cain, director and national sales leader with LTCi Partners. “The state has collected about $350 million worth of taxes since July 2023. This is the way they wanted it to work.”

But WA Cares could be put in jeopardy by a ballot initiative that goes before Washington state voters in the November election. Voters will be asked to decide whether WA Cares will become voluntary instead of mandatory.

“If voters decide to make it voluntary, it will, in all likelihood, make WA Cares unsustainable if enough people lapse their policies or go out of WA Cares,” Cain said.

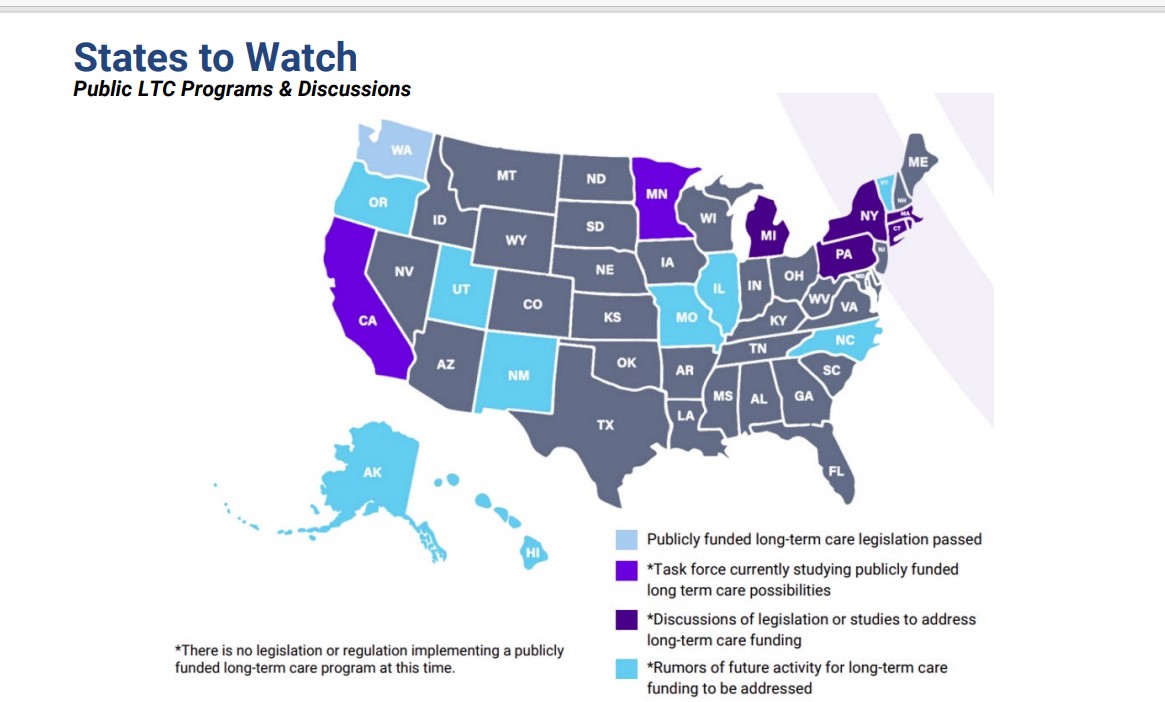

At least eight other states are discussing or studying the possibility of a publicly funded long-term care program. All eyes are on Washington to see whether such a program can be sustainable.

“WA Cares isn’t a comprehensive long term care plan, but Washington state said, ‘Let’s at least do something,’” Cain said. “Long-term care could end up bankrupting states because of the large numbers of baby boomers needing care and the demands on Medicaid to pay for that care. This is something they need to fill a gap on – put a Band-Aid on these potential expenditures.”

“If WA Cares is made voluntary, it will kill the program,” said Jamala Arland, executive vice president, life insurance, with Genworth Financial. “And that would send a message to other states that this doesn’t work; the taxpayers don’t want to pay a tax for a limited long-term care benefit.”

All states are seeing pressure on their Medicaid budgets to care for an increasing number of elderly residents with long-term care needs. But will taxpayers be happy with having part of their wages withheld to pay for long-term care?

“All these states have significant senior populations that will require care at some point,” Cain said. “States are looking at how they can help people finance long-term care. States are looking at how they can reduce their Medicare expenditures. A compulsory publicly funded program can help do that. But sometimes you have to listen to the will of the people.”

Attracting younger consumers

One challenge in getting the voters to accept a program such as WA Cares is convincing young workers of the need to set aside funds to pay for their future care, Cain said.

“In something like WA Cares, you’re taxing 20-year-olds, 30-year-olds, 40-year-olds – long-term care is not even on their radar screen. If you ask them, ‘Do you want to be part of this?’ what do you think they will say?”

Although Cain said he believes taxing younger workers to pay for long-term care can be a tough sell, he is seeing more interest in buying long-term care protection from younger consumers.

“We’re seeing millennials beginning to look at this. They understand the issue and maybe are more open to planning than we’ve seen with earlier generations,” he said. “I do think that some of the discussions around state programs have created an interest at the employer level to offer this coverage to workers. And we’ve seen once that happens, younger employees buy. Our average purchase age at LTCi Partners in the individual or traditional retail market is 57 or 58. But the average age in the worksite market is 47.”

LTCi: ‘This stuff works’

Despite the questions around the sustainability of a publicly funded LTCi program and the challenges of selling LTCi in the private market, Cain said there is one aspect of LTCi that is not talked about enough – the carriers’ record of paying claims.

“The long-term care insurance industry is doing a great job of paying claims. What we must do as advisors is constantly reinforce to legislators, to clients and to advisors who refer to us – this stuff works. That’s the promise – we will pay out the benefit at the time of need.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected]. Follow her on X @INNsusan.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Insurance industry to be impacted by 3 trends in 2024, says expert

Commentary: Another view of Biden’s prescription drug cost initiative

Advisor News

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

- Helping clients up the impact of their charitable giving with a DAF

- 3 tax planning strategies under One Big Beautiful Bill

More Advisor NewsAnnuity News

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

- Venerable Announces Head of Flow Reinsurance

- 3 tax planning strategies under One Big Beautiful Bill

More Annuity NewsLife Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance NewsProperty and Casualty News

- Oklahoma Watch: Attorney general intervenes in State Farm lawsuit

- Alexander County issues Request for Proposals for insurance broker/agent

- Despite rate hikes, study finds California home insurance costs are middle of the pack nationwide

- Using AI to predict and prevent weather catastrophe home insurance claims

- Pennsylvania State University (Penn State) Researchers Have Provided New Study Findings on Environment (Flood risk perceptions, insurance, and policy: a review of the Pennsylvania flood task force initiative): Environment

More Property and Casualty News