Life Sales’ Strong Spring May Be A Harbinger For A Record Year

The life insurance sales boom in the first quarter may not be a pandemic-induced outlier – in fact, it might even be a spring harbinger for a record year in sales, according to LIMRA’s CEO.

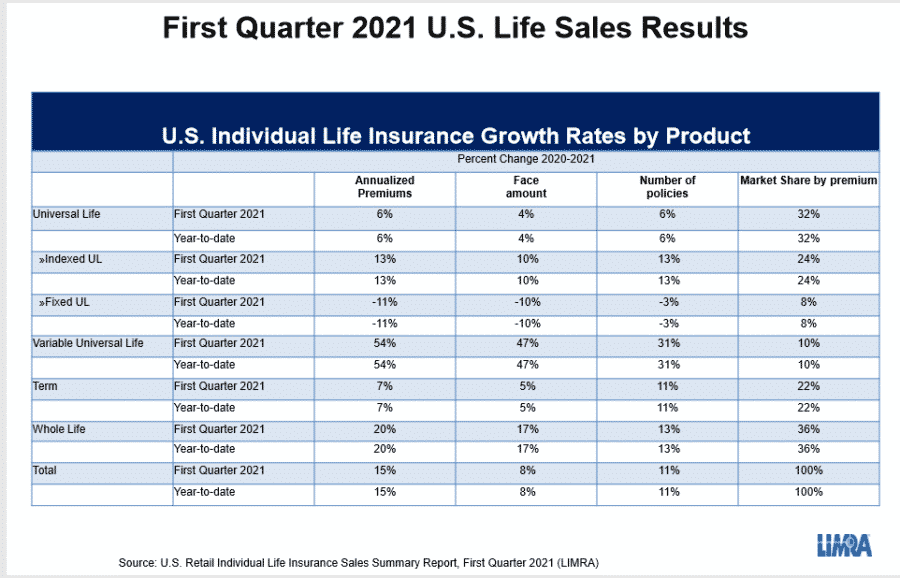

The first quarter was unusually strong for life sales with 11% increase in policy count and a 15% boost in annualized premium compared to the first quarter of 2020, amounting to the best showing since 1983, according to LIMRA’s Individual Life Insurance Sales Survey.

Products did well across the board in the first quarter, except non-indexed fixed universal life.

The increases ranged from term life with an 11% boost in policy count and 7% bump in premium, up to variable UL with a 31% jump in policy count and 54% leap in premium. Non-indexed fixed UL was the only negative, dropping 3% in policy count and decreasing 11% in premium.

VUL has been bounding in sales for the past few years as carriers shift to products that do not require as much capital to support guarantees and do not depend as much on performance based on interest rates. The strong equity market rebound in 2020 also sparked greater interest in the products from consumers who want some stock market exposure.

Even with their strong performance, VULs still account for only 1% of overall policy count, although they make up 10% of the overall premium.

The first quarter was the last one in which lockdowns were still tight in most of the United States. Will that sales momentum continue as Americans break out of their homes and rush back to some sense of normal?

Consumers might be shaking off some of the pandemic blahs, but that does not mean they are forgetting about life insurance, said David Levenson, president and CEO of LIMRA, LOMA and LL Global. He expects sales to continue at a record pace for the rest of the year. And he backs up his confidence with three indicators.

MIB Data: MIB had a record number of life insurance application activity with a 19% increase in March. April saw a 10% increase in the first month of the second quarter.

Barometer: LIMRA’s Insurance Barometer Study found 31% of consumers said they were likely to buy life insurance in the next 12 months because of COVID-19. The study also revealed that 42% of Americans said they would run into financial difficulty within six months following the death of the main breadwinner and 25% said they would run aground in one month.

“If we look at this as another way to measure demand,” Levenson said, “we recorded the highest level of consumers seeing that they needed life insurance since we started doing the barometer study in 2011.”

Second quarter sales: The first quarter’s sales momentum rolled into April with a 12% increase across the board, Levenson said.

Carriers, Sellers Meet Demand

Term life sales had their strongest policy count growth since 2000, and whole life had its best quarter in 30 years. The two make up 88% of the policy count across the industry, but 58% of market share by premium.

The term and whole life sales boost owes much to the industry learning how to sell in a lockdown. Levenson said these “straight-forward, easy-to-understand products” appealed to locked-down consumers looking to get or increase their coverage.

Carriers improved application processing speed and digital access, along with improving direct-to-consumer systems. Producers became adept at selling remotely, with sales up for independent and captive agents. Sales increased across distribution channels except for banks and worksite sales.

Ninety percent of term policies are sold through an agent or advisor, although some of those sales are “internet-assisted” through online brokerage firms.

Nearly four in 10 whole life policies are sold through direct channels. Direct whole life policies tend to be small, with less than $15,000 of face amount, and are often designed to cover final expenses.

The average policy size in the first quarter across all products was $280,000, 4% lower than first quarter of 2020. The average size of direct-to-consumer sales dropped by 19% in the first quarter.

Levenson attributed the drop in average face amount to the industry’s focus to serve more middle Americans.

Carriers and sellers will be able to parlay the new tools and skills they picked up during the pandemic to bring in even more sales as Americans get back into their usual routines because 102 million Americans still need coverage, Levenson said.

“We have 330,000 life-licensed financial professionals in this country,” he said. “And I think there's tremendous demand to probably keep many more than 330,000 people, busy full time.”

Even as the lockdowns loosen, Levenson expects that Americans will not soon forget the national lesson in mortality.

“You know, we're hopefully nearing the final stages,” Levenson said of the pandemic, “but I do think the memory of this will be with us for a while.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at stevenamorelli@gmail.com.

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Four Career Growth Resources For NexGen Advisors

Equitable Closes Legacy VA Reinsurance Transaction With Venerable

Advisor News

- TIAA, MIT Age Lab ask if investors are happy with financial advice

- Youth sports cause parents financial strain

- Americans fear running out of money more than death

- Caregiving affects ‘sandwich generation’s’ retirement plans

- Why financial consciousness is the key to long-term clarity

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Expiring health insurance tax credits loom large in Pennsylvania

- Confusion muddies the debate over possible Medicaid cuts

- Trump protesters in Longview aim to protect Medicaid, democracy, due process

- Grant Cardone, Gary Brecka, settle dueling state lawsuits

- 9 in 10 put off health screenings and checkups

More Health/Employee Benefits NewsLife Insurance News

- ‘Really huge’ opportunity for life insurance sales if riddle can be solved

- Americans fear running out of money more than death

- NAIFA eyes tax reform, retirement issues in 2025

- Legislation would change tax treatment of life insurers’ debt investments

- Closing the life insurance coverage gap by investing in education

More Life Insurance News