Life Insurance Motivation Eases As The Pandemic Fades

If life insurance companies and producers were hoping that the sense of mortality that COVID-19 inspired would stick around and propel consumers to buy coverage, a Deloitte study is likely unwelcome news.

Yes, 2020 was a banner year for life insurance awareness, particularly with younger demographics that have not been interested in previous years.

Deloitte pointed out that 2020 had the largest increase in life application activity with 4% over the year, according to the MIB Life Index, peaking in the summer as COVID-19 anxiety heated up.

The demand was driven largely by those under the age of 44 with a 7.9% increase, followed by a 3.9% bump in the 45-59 group.

Deloitte’s survey tracked the MIB stats with younger respondents appearing to be more interested mid-year in buying coverage because of pandemic concerns, according to the Deloitte report, “Financial Inclusion and the Underserved Life Insurance Market.”

In discussing the motivations of younger consumers, researchers cited the obligations that they face with mortgage debt and child-rearing expenses. Younger people also experienced higher unemployment rates than other age groups and were more likely to have lost employer-sponsored life insurance.

Deloitte’s survey showed that the reasons “I want to increase my coverage to better cover household expenses in case of my death” and “I want to purchase and individual policy due to loss of employment (employer-sponsored policy)” were particularly high for younger age groups, with 58% of 21-30-year-olds and 51% of the 31-40 group citing those two reasons for buying coverage.

Those reasons were cited by only 17% of those over 60. Apparently, quite a few seniors did not get the message or simply did not care that they were the age group most vulnerable to COVID-19, with 92% of non-buyers saying “It has not changed the way I view my life insurance needs.” Even among the buyers, 82% said the pandemic did not change their perception of their life insurance needs.

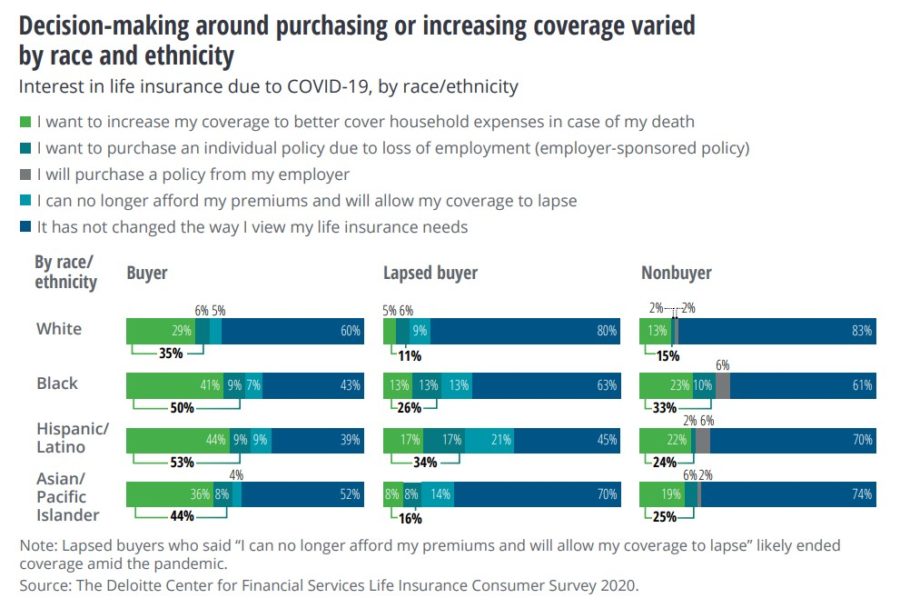

Those primary reasons for buying were strongest among non-white buyers, with 53% of Hispanic/Latino buyers citing those reasons, 50% of Black buyers and 44% of Asian/Pacific Islanders. Only 35% of white buyers cited those reasons.

Even nonbuyers cited those reasons for getting insurance, with 33% of Black buyers, 25% of Asian/Pacific Islanders and 24% of Hispanic/Latino nonbuyers vs. 15% of whites citing those reasons.

Deloitte’s survey found that 40% of underinsured buyers interviewed by Deloitte said they were considering increasing their coverage because of the pandemic.

“While some of the coverage increases were substantial, the factors behind them tended to be situational in nature,” according to the report.

The inspiration to get coverage dwindled as the pandemic eased up in the respondents’ community, according to Deloitte’s examination of why consumers bought insurance. More than one-third of those who considered purchasing life insurance due to the pandemic – but ultimately didn’t – said they decided against it because COVID-19 cases in their area started to drop.

“These behaviors make it clear that to achieve sustained growth, insurers cannot rely on global disasters to boost uptake of life insurance,” according to the report, which also pointed out the technological advances that carriers made during the pandemic. “We believe insurers can use this momentum to accelerate innovation and substantially narrow the coverage gap for the long term.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Senators Look At Ways To Make Retirement Saving Easier

Pandemic Accelerates Voluntary Benefit Offerings

Advisor News

- Terri Kallsen begins board chair role at CFP Board

- Advisors underestimate demand for steady, guaranteed income, survey shows

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

- OBBBA and New Year’s resolutions

- Do strong financial habits lead to better health?

More Advisor NewsAnnuity News

- Using annuities as a legacy tool: The ROP feature

- Jackson Financial Inc. and TPG Inc. Announce Long-Term Strategic Partnership

- An Application for the Trademark “EMPOWER PERSONAL WEALTH” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Talcott Financial Group Launches Three New Fixed Annuity Products to Meet Growing Retail Demand for Secure Retirement Income

- Judge denies new trial for Jeffrey Cutter on Advisors Act violation

More Annuity NewsHealth/Employee Benefits News

- Duckworth pushes military IVF coverage as critics warn taxpayers could pay

- House to consider extension for expired ACA subsidies

- Health insurance costs spike after key ACA subsidies end

- Veterans defend nonprofit exec accused of theft

- Allowing Medicare buy-ins would generate competition

More Health/Employee Benefits NewsLife Insurance News