Life insurance activity flat in November, up for the year, MIB reports

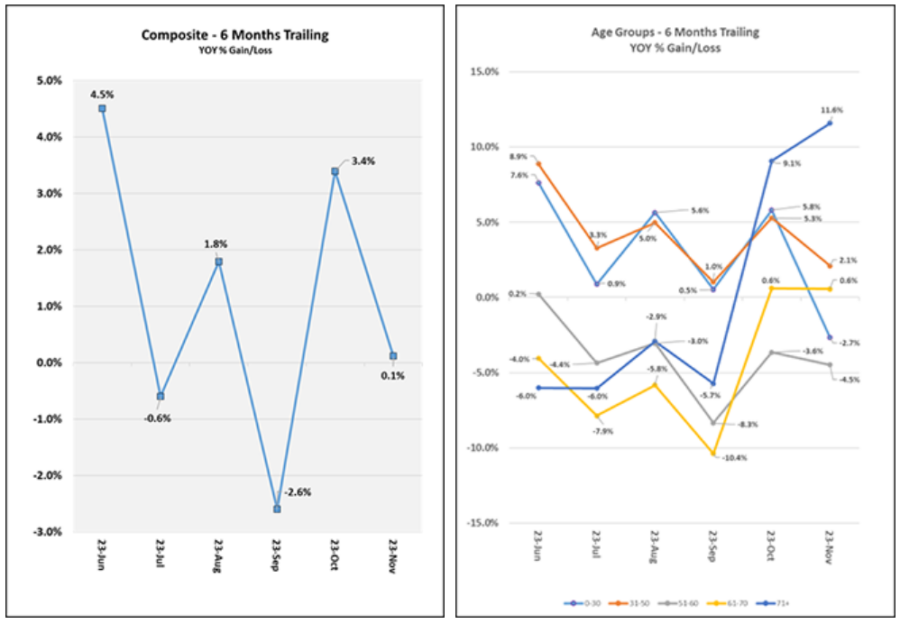

Life insurance application activity was flat in November on a year-over-year comparison. But activity remained up 2.6% year to date, according to the MIB Life Index.

Comparing November to the same month in prior years reveals steady growth. Life insurance activity was flat at -0.1% compared to November 2021, up 2.8% compared to 2020, and up 4.1% compared to 2019, MIB reported.

When taking a historical lookback on a year-to-date basis, activity through November 2023 was down -3.2% compared to 2021, up 0.9% compared to 2020, and up 4.4% compared to 2019. On a month-over-month basis, November was up +5.4% compared with October.

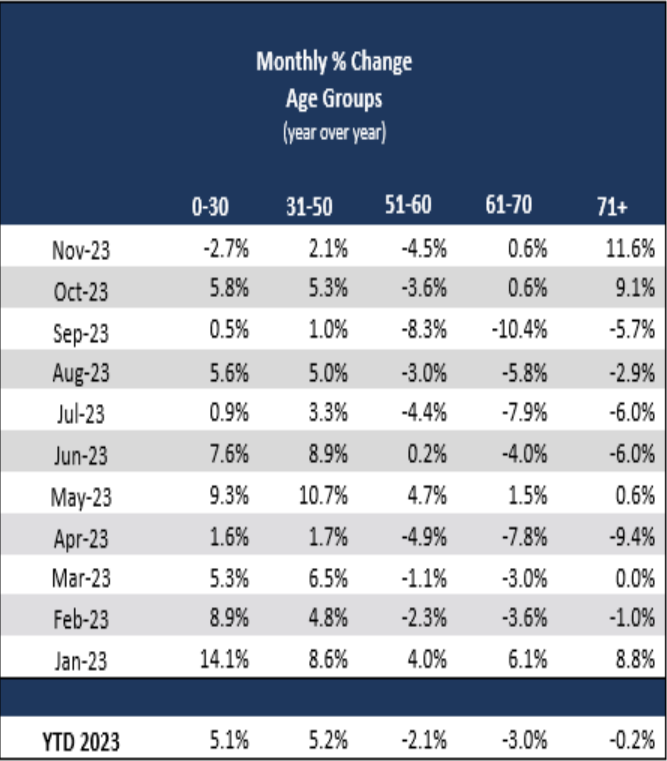

When looking at age bands, November saw a continuation of a pattern that began in October with ages 71+ leading in year-over-year growth, MIB said. However, patterns for all other age bands fluctuated, with activity for ages 0-30 down 2.7%, ages 31-50 up 2.1%, ages 51-60 down 4.5%, ages 61-70 up 0.6%, and ages 71+ up 11.6%.

However, on a year-to-date basis activity for ages 0-50 was at growth, ages 51-70 declined and ages 71+ is flat. Activity year to date for ages 0-30 was up 5.1%, ages 31-50 up 5.2%, ages 51-60 down 2.1%, ages 61-70 down 3% and ages 71+ down 0.2%.

When examining year-over-year activity by face amount, November 2023 saw flat activity for amounts up to and including $250,000 and growth for higher amounts. Growth hit double digits for amounts over $500,000. When including age bands, ages 0-30 saw flat activity for amounts up to and including $250,000 and growth for all other face amounts, in the double-digits for amounts over $1 million.

Ages 31-50 saw flat activity for amounts up to and including $250,000, and growth for all other face amounts, in the double digits for amounts over $500,000. Ages 51-60 saw declining activity for amounts up to and including $250,000, and growth for all other face amounts, in the double digits for amounts over $1 million.

Ages 61-70 saw growth for all face amounts, in the double digits for amounts over $250,000. Ages 71+ saw growth for amounts up to and including $5 million, in the double digits for amounts up to and including $500,000 as well as amounts over $1 million up to and including $2.5 million, and saw double-digit declines for amounts over $5 million.

Life insurance product report

November 2023 saw year-over-year relatively flat activity for term life and growth for universal life and whole life. Specifically, term life was up 1%, universal life up 2.5%, and whole life up 6.6%, representing the second month that whole life led in year-over-year growth, MIB reported.

When examining activity by product type and age band, term life saw growth for ages 0-50, flat activity for ages 51-60, and declines for ages 61+, in the double-digits for ages 71+. Universal life saw flat activity for ages 0-30, growth for ages 31-50, declines for ages 51-70, and double-digit growth for ages 71+. Whole life saw flat activity for ages 0-30 and growth for all other age bands, in the double digits for ages 61+.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Supreme Court takes up meaning of ‘income’; decision could impact taxes

Trade groups oppose NASAA’s proposed changes to annuities regulation

Advisor News

- Trump announces health care plan outline

- House passes bill restricting ESG investments in retirement accounts

- How pre-retirees are approaching AI and tech

- Todd Buchanan named president of AmeriLife Wealth

- CFP Board reports record growth in professionals and exam candidates

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER READY SELECT” Filed: Great-West Life & Annuity Insurance Company

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

More Annuity NewsHealth/Employee Benefits News

- Trump announces health care plan outline

- Wipro Announces Results for the Quarter Ended December 31, 2025

- Arizona ACA health insurance enrollment plummets as premiums soar without enhanced subsidies

- Counties worry about paying for uninsured

- People needing health care coverage have until Thursday to sign up for Obamacare

More Health/Employee Benefits NewsLife Insurance News