IUL: It’s about the caps (long term)

Indexed universal life has always been a bit of a lightning rod for controversy. Advocates suggest IUL has high upside potential with downside protection, while naysayers suggest the product is complicated and that poor market returns in the future will be a major challenge for policyholders.

It is true that future market returns are relevant to how these policies perform, but the bigger issue is the caps on the upside, which are typically set by the insurance carrier. How the carrier manages cap rates in the long term is often far more impactful to a policyholder’s overall experience than what type of market cycle they experience. To that end, advisors and agencies should be focused on recommending carriers with historically stable cap rates who have a strong emphasis on providing consistent value in the future.

How is the IUL cap so impactful?

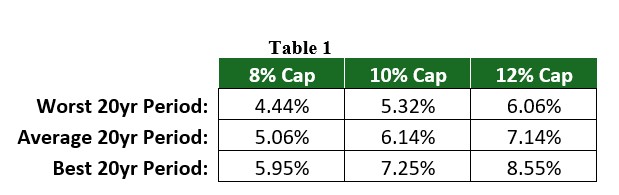

Assume a policy started with a 0% floor and 12% cap tracking the S&P 500 point-to-point index. Over time, the cap on this policy slowly eroded to 8%. To quantify the impact of the reduction in cap, take the average return of all 20-year periods in the index from 1950-2024, see reference chart and table. The best 20-year period of returns for a 0% floor and 8% cap is less credited interest than the worst 20-year period for the same index with a 12% cap. For this policyholder, assuming all else is equal, the next 10-20 years of the policy’s life cycle will be driven far more by the reduction in their cap than the performance of the index.

Using the same data set but looking at it differently, the difference between the worst return and the average return on a product with a 10% cap is 0.82%. The difference between the average return with a 10% cap versus an 8% cap is 1.08%. The conclusion to draw here is that a bad market may cost the policy holder with a 10% cap 0.82% in interest earned, but a reduction in cap from 10% down to 8% cost the policy holder 1.08% in the average scenario. Granted, there is a sensitivity here to varying degrees of cap reductions (and good versus poor markets), but the main issue here is that the cap rate is a vitally important variable with most any IUL and one that, unlike market returns, is controlled by the insurance company.

Why does this phenomenon exist?

It’s pretty simple. Historically, with a 0% floor and 10% cap during the time period in this analysis, the S&P 500 would have hit the floor or the cap 61 out of the 75 years. The cap would have been hit 41 times, or more than 50% of the years. In other words, an IUL will hit the floor or cap more than 80% of the time. Since floors are typically guaranteed, cap rates are the critical determinant.

Where to go from here?

The point of this exercise is not to minimize actual market outcomes (yes, that is important), nor is it to suggest that advisors should simply chase the highest caps. Additionally, there is a lot to be said here for sequence of returns and the impact to policy expenses, which is a subject for another article. Rather, all those involved in the value chain of insurance (carriers, agencies, and advisors) should put a premium on stability and fairness in how policy holders are treated in the long term, not just at policy issue.

The life insurance industry continues to provide immense value to families, businesses, and charities. In total, estimated benefits and claims for the life insurance industry was estimated to be more than $965 billion in 2024. Life insurance will continue to be a valuable planning tool for Americans and it’s important that the industry provides this exceptional value in terms of benefits paid while focusing on stewardship of policyholders.

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Sam Rocke, CFP, is executive vice president of protection sales with Ash Brokerage. Contact him at [email protected].

5 ways insurers will prioritize AI and customer experience in 2026

3 tax planning strategies under One Big Beautiful Bill

Advisor News

- Metlife study finds less than half of US workforce holistically healthy

- Invigorating client relationships with AI coaching

- SEC: Get-rich-quick influencer Tai Lopez was running a Ponzi scam

- Companies take greater interest in employee financial wellness

- Tax refund won’t do what fed says it will

More Advisor NewsAnnuity News

- The structural rise of structured products

- How next-gen pricing tech can help insurers offer better annuity products

- Continental General Acquires Block of Life Insurance, Annuity and Health Policies from State Guaranty Associations

- Lincoln reports strong life/annuity sales, executes with ‘discipline and focus’

- LIMRA launches the Lifetime Income Initiative

More Annuity NewsHealth/Employee Benefits News

- PLAINFIELD, VERMONT MAN SENTENCED TO 2 YEARS OF PROBATION FOR SOCIAL SECURITY DISABILITY FRAUD

- Broward schools cut coverage of weight-loss drugs to save $12 million

- WA small businesses struggle to keep up with health insurance hikes

- OID announces state-based health insurance exchange

- Cigna plans to lay off 2,000 employees worldwide

More Health/Employee Benefits NewsProperty and Casualty News

- Homeowners insurance rates could reemerge in Illinois legislative session

- Are MS Coast homeowner insurance rate hikes easing? What experts, records say

- Bill would limit homeowners insurance rate hikes

- MAYOR BASS APPLAUDS NEW LEGISLATION TO EXTEND MORTGAGE FORBEARANCE FOR L.A. WILDFIRE SURVIVORS AFTER LEADING A DELEGATION OF PALISADIANS TO SACRAMENTO

- Bill to regulate homeowners' insurance rates could reemerge this session

More Property and Casualty News