Indexed Universal Life Continues Its Hot Streak

New premium for indexed universal life (IUL) insurance sales rose 9 percent in the fourth quarter compared with the year-ago period, and IUL new premium rose 8 percent in 2017 compared with 2016, LIMRA reported.

Fourth-quarter IUL sales represented 24 percent of all individual life insurance premium compared to 21 percent in the year-ago period.

IUL is “clearly where the action was,” said Robert A. Kerzner, CEO of LIMRA, in a quarterly briefing to members.

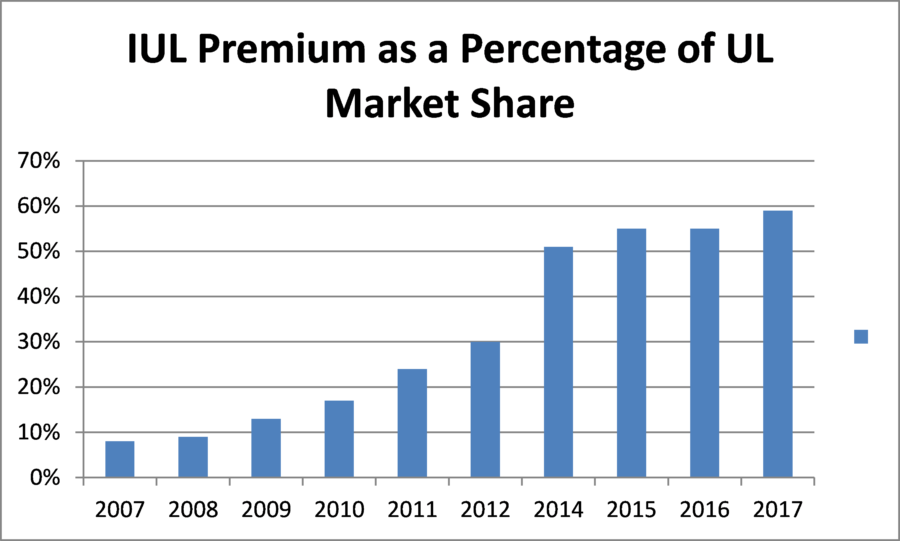

In the fourth quarter, IUL accounted for 64 percent of all universal life premium, Kerzner said.

Coming off similar growth numbers for the third quarter, IUL sales provide one of the few growth lines in a struggling individual life market, according to LIMRA’s latest data.

Overall sales growth of individual life in the fourth quarter fell 1 percent compared with the year-ago period. Meanwhile, life insurance policy count fell 2 percent compared with fourth-quarter 2016, LIMRA reported.

Year-end new premium rose 1 percent compared with 2016, but policy count dropped 3 percent last year over 2016.

"With rising interest rates, growth continued to be a challenge," Kerzner said.

LIMRA does not release sales numbers.

Wink’s Sales & Market Report, which also tracks indexed life sales, is set to release fourth-quarter data in the coming days.

The Standard & Poor’s 500 stock market, meanwhile, was up 1.50 percent year to date after market close Wednesday.

Headlines about rising equity markets help agents prospecting for new business and give IUL contracts a sheen lacking on other kinds of life insurance products, life insurance experts said.

With IUL sales on a tear, it’s no surprise that insurers have launched new IUL contracts and upgraded old ones in the past few weeks.

Allianz Life Targets Traditional Life Agents

Allianz Life announced the launch of Allianz Life Pro+ Elite, an IUL policy for traditional life insurance agents and financial professionals.

The policy is being marketed as an enhanced version of the company's Allianz Life Pro+ product, but with more proprietary index allocation options including bonused allocation options.

Index options are designed to boost the cash value within the policy based on an external index. When stock markets rise, corresponding cash values also rise.

Allianz Life Pro+ Elite comes with five index options, five crediting methods and a 12-year surrender charge, the company said.

Chronic illness and terminal illness riders, as well as several different term riders are available with the contract.

The maximum death benefit on the insured is $65 million, the company said.

Allianz Targets B/Ds, Financial Advisors

Another IUL marketed as Allianz Asset Pro+ is a new IUL contract designed to be sold by broker/dealers and financial professionals.

Allianz Asset Pro+ offers four indexing options and two crediting methods, and will only be issued to people 80 years old or younger.

The policy offers accelerated benefit riders for chronic illness and terminal illness, although riders are not available in all states, the company said.

Maximum death benefit on the insured is $65 million and the contract comes with a 10-year decreasing surrender charge.

Allianz Asset Pro+ is a streamlined version of Life Pro+ Elite with fewer index allocation options, the company also said.

The contract offers a simpler solution for financial professionals who are beginning to offer life insurance options within a holistic financial planning model, the company said.

“With more financial professionals looking to expand their offerings, Allianz Life Pro+ Elite and Allianz Asset Pro+ can help strengthen a financial strategy with protection for a lifetime and potential benefits for the future,” Jason Wellmann, senior vice president of Life Insurance Sales for Allianz Life, said in a news release.

Lincoln Rounds Out IUL Portfolio

Lincoln Financial has introduced the Lincoln WealthPreserve IUL policy.

The policy offers a one-year point-to-point capped indexed account tied to the S&P 500 Index, the company said.

It provides a 1 percent guaranteed minimum interest rate so that even in a declining market, the policy owner will see a gain.

In the first 10 years of the policy, the growth cap is guaranteed to be no less than 8.75 percent, the company said.

With IUL policies, consumers capture market gains but are protected from market losses, said Stafford Thompson, Jr., senior vice president of Life Product Management, Lincoln Financial Group.

The IUL policy is available to consumers ages 20 to 80 and comes with accelerated benefits riders at policy issue.

AXA Equitable Tweaks Lineup for Higher Rates

An extra interest credit feature that rises as interest rates rise has been added to its IUL Protect policy, AXA Equitable has announced.

The extra interest credit accrues on top of the policy’s potential index returns and can boost the cash value in the policy.

Policyholders receive an additional credit to the index-linked option equal to the interest generated by the fixed or guaranteed interest account rate minus 3.5 percent.

Pacific Life Launches Protection-Focused IUL

Pacific Life announced the launch of Pacific Discovery Protector IUL, a new IUL policy designed for long-term life insurance protection.

Premiums are "competitively priced," and contracts offers no-lapse guarantees, the company said in a news release.

Discovery Protector is a protection-based product, said Stephan Mitchell, assistant vice president of product marketing for the Life Insurance Division at Pacific Life.

It was launched after the company's success last year with Pacific Discovery Xelerator IUL, an accumulation-based IUL sibling.

InsuranceNewsNet Senior Writer Cyril Tuohy has covered the financial services industry for more than 15 years. Cyril may be reached at [email protected].

© Entire contents copyright 2018 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Cyril Tuohy is a writer based in Pennsylvania. He has covered the financial services industry for more than 15 years. He can be reached at [email protected].

M&A 2018 Outlook: Why Advisors Should Care

Pay No Heed To February Stock Market Swoon, Analysts Say

Advisor News

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

More Advisor NewsAnnuity News

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

- FIAs are growing as the primary retirement planning tool

More Annuity NewsHealth/Employee Benefits News

- Researchers from Boston University Report Findings in Managed Care (Unexplained Pauses In Centers for Disease Control and Prevention Surveillance: Erosion of the Public Evidence Base for Health Policy): Managed Care

- New Managed Care Study Results Reported from University of Houston (Impact of Adjuvant GLP-1RA Treatment on the Adherence of Second-Generation Antipsychotics in Nondiabetic Adults): Managed Care

- New Findings on Managed Care Reported by Lane Moore et al (State Disparities in Medicaid Versus Medicare Reimbursement for Hand Surgery): Managed Care

- New Kentucky House GOP budget fixes insurance issue, ups education spending

- Missouri and Kansas families pay nearly 10% of their income on employer-provided health insurance

More Health/Employee Benefits NewsLife Insurance News