Is investing in the art market a sound strategy?

Investing is crazier than ever. The stock market is as volatile as a toddler surging and crashing on sugar, the bond market is good for new issues and bad for old ones and commodities are chaotic. How about art?

Who hasn’t been stricken slack-jawed when someone on Antiques Roadshow has brought in an unassuming painting from a garage sale that turned out to be worth a life-changing several hundred thousand dollars?

Could it be that easy? Of course, that is more luck than strategy, more lottery than investing.

Yet the headlines blare the latest auction record, such as the collection of Paul Allen’s, one of the founders of Microsoft, which sold for $1.5 billion in November. Several items sold for more than $100 million each. That sale shattered the all-time record set just a half year earlier, the $922 million sale of the collection belonging to divorcing billionaires Harry and Linda Macklowe.

Although those are some attention-grabbing highlights, the art market overall is doing well, even in these fraught times, according to the latest annual UBS/Basel Art report. In fact, the art market is doing better than others.

“After a significant decline in sales during the pandemic, the U.S. art market has seen one of the most robust recoveries of all the major markets,” according to the report. “From a pandemic-induced low in 2020, sales bounced back in 2021, increasing by just over one third in value to $28.0 billion. Growth continued in 2022 with a further increase of 8% year-on-year to $30.2 billion, its highest level to date. This was driven by a major uplift at the high end of the auction sector, along with more moderate but positive growth in dealer sales.”

Recession ready

The art market is in a sense a niche investment market, it is large with a global value of $1.7 trillion, putting it on par with other major private markets.

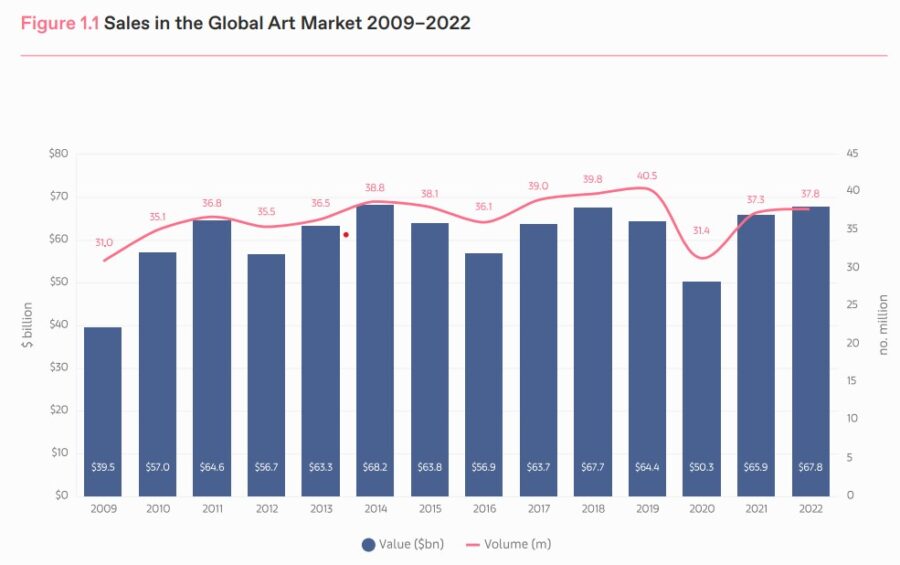

The U.S. is a huge chunk of the global market. Last year when the U.S. had $30.2 billion in sales, the global total was $37.8 billion, according to the UBS/Basel Art report.

Before 2020, the previous art market dip was in the last recession of 2009-2010. The art market sprang out of that hole with a 63% gain in sales value over the next two years. The new Chinese money that helped fuel the previous rebound receded as China’s overall growth slowed in 2012.

The art market had a similar jump after the 2020 plummet. In some ways the 2020 dip helped wipe out some of the pressure suppressing the art market from global geopolitical tensions and uncertainty leading up to the pandemic. Consequently, the 2020 slump was not as severe as the one in 2009, and the recovery was not as robust, notching a nevertheless respectable 35% increase in global art sales value from 2020 to 2022.

“In both cases, the market’s rebound has exceeded its decline,” according to the report. “Sales in 2022 were greater than before the pandemic and the second-highest point achieved in the market to date, with values just below the peak of 2014. A significant factor helping the market contract less (and recover faster) has been ample demand at the higher end of the market from wealthy collectors.”

The U.S. has the highest concentration of ultra- and high-net-worth individuals.

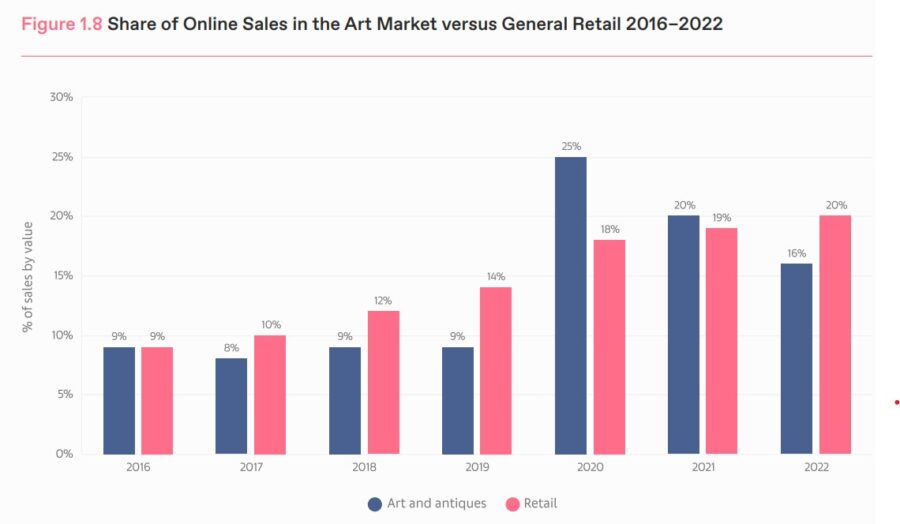

As might be expected, online sales stepped up as auction rooms closed down. That was true of all retail, but the art market was particularly strong in online sales.

Although individual dealers weren’t as successful in online sales, auction houses were the big winners.

“In the auction sector, more online bidding is taking place than ever before, with Sotheby’s reporting that 91% of the bids placed at their auctions in 2022 were online (from just 44% in 2017 and only 18% in 2012),” according to the report. “Similarly, at Christie’s, 75% of bids in 2022 were online, compared to just 45% in 2018.”

A respectable but volatile return

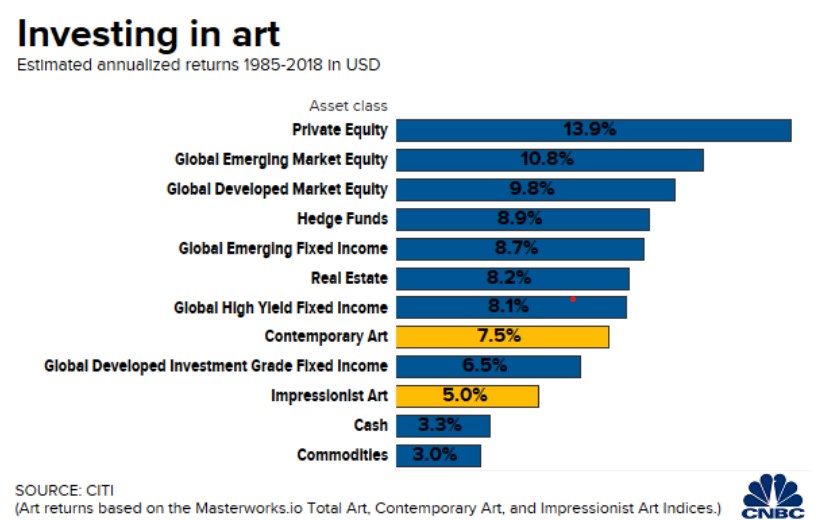

So, is art a good investment for the average person with the money to spend? Art does perform surprisingly well over time, at least compared with fixed income investments.

The art market overall has returned 5.3% annually between 1985 and 2018, according to a CNBC report citing a Citi study. Contemporary art has been the strongest performer with an average of 7.5% annually while impressionistic art returned 5%.

https://www.cnbc.com/2019/12/07/art-has-shown-long-term-returns-that-rival-bonds.html

Although the numbers seem to compare well with other asset classes, a chart shows how low it is on the list of investment returns.

But is this the right time to jump into art investing? Typically no. The art market has an inverse relationship with interest rates. When rates are low, art sales grow. That’s because investors want the higher return from safer sources.

“Periods of falling and/or low real rates have coincided with rising art prices,” according to the report.

Paying for it and living with it

The Citi report confirmed the notion that art investing takes time, not just in learning about it but also in the price appreciation. The rule of thumb is a collector would have to hold the asset for at least 10 years to see an appreciable appreciation.

Patience is important for the volatility also. Although 5.2% sounds like a nice annual return, that is an average taking in a lot of variation. The standard deviation from the average across all art categories and 25.8% for contemporary art. The deviation for investment-grade fixed income was 5.2%.

On top of all that is the hassle and expense of buying and selling art. Generally, you get what you pay for.

With equities, an investor can keep an eye on a solid stock and wait for a price drop due to an extenuating circumstance such as a product recall. It’s similar in art. The more the buyer knows, the more likely they can find a good buy. In essence, they need to know more than the seller.

They can spot the anomaly just as the equities expert can.

But it is unusual for a busy, high-net-worth person to have the time and attention to learn the intricacies of particular art and the market itself.

Investors have to rely on the expertise of the dealer and auction house to know the material and stand behind their opinion. That costs the buyer and seller.

The typical “buyer’s premium” at an auction ranges up and down from 25%. For higher-end sales, that percentage will scale down. Then there is tax and shipping.

Then to sell, the consignor pays in the range of 15%. For many sales, consignors will also pay a marketing, cataloging, shipping and storage fees.

Any return on the asset would have to take into account those expenses.

Selling directly to a collector will be more cost effective, but the lack of guarantees from an expert will drive down the price. Also, finding the collector is its own challenge, although do-it-yourself auction websites help.

If you don’t have the history of the item, or provenance, that will also drive down the price. The pieces that fetch breathtaking prices tend to have a provenance that traces the chain of custody all the way back to the artist.

So there are not really any bargains to be had or easy ways to make a buck with art. Sure, we have seen the Antiques Roadshow spectacular finds, but those folks just hit the lottery. They picked what they liked and it happened to be worth a fortune.

And that is what almost expert will say – buy what you like. Only a tiny percent of art is resold for a profit. Most of it goes from the wall to the attic to the sidewalk. Art is for the heart and not so much for the wallet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at stevenamorelli@gmail.com.

© Entire contents copyright 2023 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

North Dakota the 47th jurisdiction to join the interstate insurance compact

$1.5 trillion debt signals trouble for commercial real estate market

Advisor News

- Americans increasingly worried about new tariffs, worsening inflation

- As tariffs roil market, separate ‘signal from the noise’

- Investors worried about outliving assets

- Essential insights a financial advisor needs to grow their practice

- Goldman Sachs survey identifies top threats to insurer investments

More Advisor NewsAnnuity News

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

- Sammons Financial Group “Goes Digital” in Annuity Transfers

- Somerset Reinsurance Announces the Appointment of Danish Iqbal as CEO

- Majesco Announces Participation in LIMRA 2025: Showcasing Cutting-Edge Innovations in Insurance Technology

More Annuity NewsHealth/Employee Benefits News

- Idaho Senate approves Medicaid budget

- John Oliver sued by health care boss

- Pharmacy bill passes House committee

- Lowering the cost of insurance in Colorado – a new analysis of the Peak Health Alliance

- University of Toronto Reports Findings in Alopecia [The Dermatologist Is Out? Assessment of Dermatologists In Ontario Accepting Ontario Health Insurance Plan (Ohip) Referrals for Hair Loss Evaluation]: Skin Diseases and Conditions – Alopecia

More Health/Employee Benefits NewsLife Insurance News

- Revised Proxy Soliciting Materials (Form DEFR14A)

- Proxy Statement (Form DEF 14A)

- Exemption Application under Investment Company Act (Form 40-APP/A)

- AM Best Affirms Credit Ratings of CMB Wing Lung Insurance Company Limited

- Council agrees to settlement for animal welfare division

More Life Insurance News