Invincible Or Overwhelmed: Reaching The Emerging Millennial Market

Millennial investors are vital for your future success. They are a significant force in our economy — driving change and leading new trends. They’re the most educated generation of Americans thus far — poised to grow more wealth and inherit upward of $30 trillion in what many call the Great Wealth Transfer.

But as a new normal is pounding markets and putting pressure on the economy, what do you need to know to earn millennials’ trust and win their business? The opportunity to reach these emerging investors is huge. Start by understanding their top concerns and closing their knowledge gap. Maintain meaningful relationships by focusing on what matters most to these younger investors and communicating on their terms.

Invincible — Or Overwhelmed?

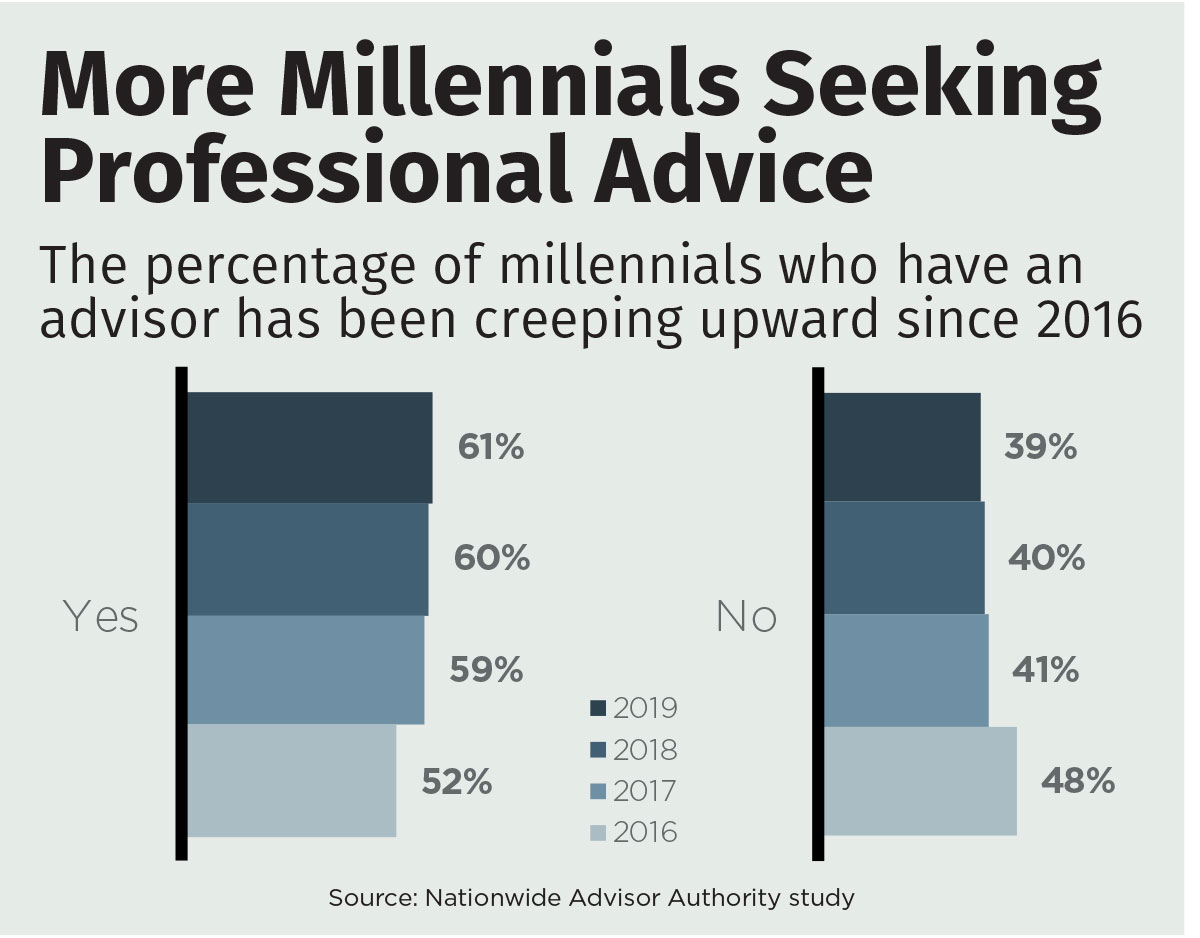

In 2019, before the COVID-19 pandemic, millennials had a more optimistic financial outlook than other generations of investors had. Nationwide’s fifth annual Advisor Authority study of about 1,700 financial advisors and individual investors nationwide revealed that nearly two-thirds of millennials (64%) had an optimistic financial outlook compared with roughly half of Gen Xers (49%) and baby boomers (57%).

Yet, millennials said they were overwhelmed by outsized student loan debt and had strong concerns about volatility, a bear market and a potential recession. Our most recent Advisor Authority special report, “Millennials and Generation X: Targeting the Emerging Market of New Investors,” also showed that they have been thinking about their future — and wrestling with big issues.

Despite their young age and positive mindset, millennials say that saving enough for retirement has been among their top three financial concerns year over year. It remains to be seen whether this changes long term, but assuming we return to a more stable environment, there remains a significant opportunity to help them develop smart habits now to save more for the future with the power of tax deferral. Protecting assets has also been among their top three concerns.

As stocks plunge into bear market territory and the volatility index spikes to new highs, advisors must help millennials stay the course and avoid the urge to move to cash. The cost of health care has also been top of mind for millennials year over year and is likely to become more urgent amid a global pandemic.

Close The Fiduciary Knowledge Gap

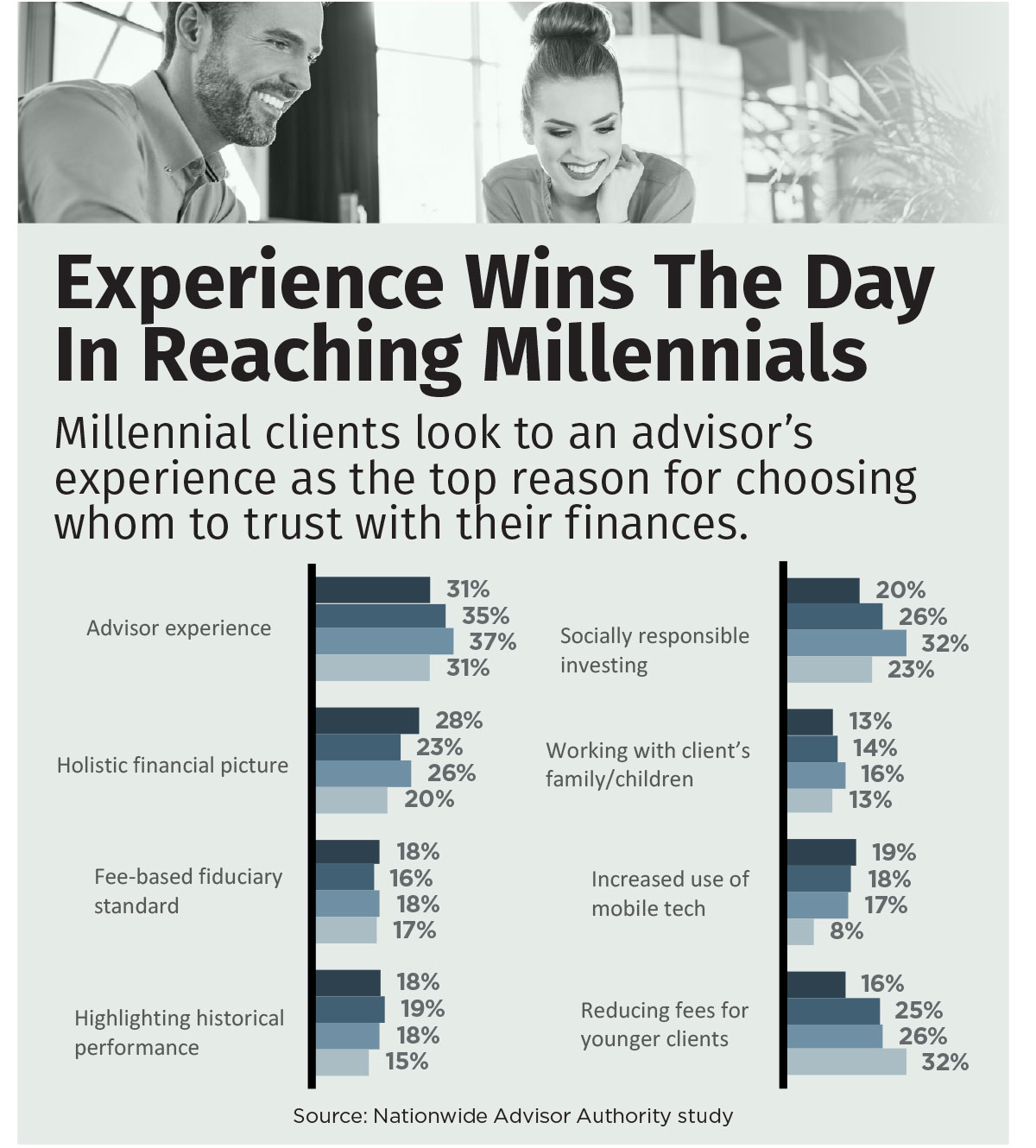

Millennials consider years of experience the No. 1 factor when choosing an advisor, according to the Advisor Authority study. The second most popular factor is offering personalized advice for a holistic financial picture.

In fact, all generations of investors agree on those two points. So what makes millennials different from investors of other generations? Whereas Gen Xers, boomers and mature investors consistently say that a fiduciary standard is among their top three considerations in choosing an advisors, millennials don’t. Maybe millennials don’t know what they don’t know.

Many younger investors simply expect an advisor to do what’s right for their client. As a survey from Edelman Financial Engines revealed, more than half of consumers mistakenly believe that all financial advisors are legally required to put the best interests of their clients first. Only 21% understand the difference between a “fiduciary” and a “financial advisor” who may be a fiduciary or may operate under a different standard of conduct.

Show millennials what you can bring to the table and demonstrate the meaning of serving their best interests. To attract and retain younger clients, start with transparency and greater choice in the solutions and products you recommend and the fee structures you use.

The Importance Of Social Responsibility

Millennials’ reasons for choosing an advisor reflect strong differences in their values and priorities. For example, 20% of millennials cite socially responsible investing among the top three factors influencing their decision to work with an advisor — more than double the percentage of Gen Xers and boomers, and five times more than matures.

This generation proactively seeks investments that advance sustainable development and create a positive impact. According to a recent report from Cerulli, four of the top five sustainable investing themes are related to environmental issues: climate change, fossil fuel divestment, sustainable natural resources and agriculture, and clean water and water scarcity. Take this into consideration as you build portfolios to align more directly with millennials’ values.

You also have an opportunity to help younger clients develop a strategy for charitable giving that fits their annual budget and financial plan. Work with them to identify a cause they’re truly passionate about. Help them choose wisely to invest in an organization that is fiscally healthy, accountable, transparent and results-oriented. There are many useful resources to help with this, including GuideStar, BBB Wise Giving Alliance, Charity Navigator and GiveWell.

Think And Communicate Differently

Build and maintain relationships with millennials through consistent communication that reflects their preferences. These digital natives favor mobile technology, with 19% saying it influences their decision to work with an advisor, compared with just 4% of Gen Xers and 5% of boomers, according to Advisor Authority.

Pick up the phone before you decide whether to schedule a meeting. Our study showed that millennials are beginning to prefer phone calls (34%) over face-to-face communication (33%). And they are tired of email. Only 8% preferred this form of communication with their advisor in 2019, down from 21% in 2016.

Your communication should always center on education. Millennials are likely to do their own research online. And there is plenty of information out there — but is it accurate and from a reliable source? Establish your own online presence — using LinkedIn, blogs, podcasts and videos — to truly communicate on millennials’ terms, earn their trust and win their business.

Be A Diversity Ally

Stop The Drop In Individual Life Insurance Policy Sales

Advisor News

- Athene Enhances Flagship Annuity Products, Expands Innovative Preset Allocation Feature

- Advisor gives students a lesson in financial reality

- NC Senate budget would set future tax cuts, cut state positions, raise teacher pay

- Americans believe they will need $1.26M to retire comfortably

- Digitize your estate plan for peace of mind

More Advisor NewsAnnuity News

- Athene Enhances Flagship Annuity Products, Expands Innovative Preset Allocation Feature

- GBU Life introduces Defined Benefit Annuity

- EXL named a Leader and a Star Performer in Everest Group's 2025 Life and Annuities Insurance BPS and TPA PEAK Matrix® Assessment

- Michal Wilson "Mike" Perrine

- Emerging digital annuity sales process cutting cycle times by 94%, IRI says

More Annuity NewsHealth/Employee Benefits News

- UnitedHealth Group stock drops 22%, erasing $100B in market value

- UnitedHealth Group stock drops 22%, erasing $100B in market value, on lower earnings outlook, higher costs

- UnitedHealth Group stock drops 20% as it chops earnings outlook on higher medical costs

- No Waivers Needed for TRICARE Prime Users Outside Drive-Time Standard

- Health Briefs 0417

More Health/Employee Benefits NewsLife Insurance News

- Citizens Inc. (NYSE: CIA) is a Stock Spotlight on 4/17

- IUL sales: How to overcome ‘it’s too complicated’

- Closing the life insurance coverage gap by investing in education

- MIB Group introduces first e-signature platform specifically for life insurance

- $184.2M financing secured for Seagis East Coast industrial portfolios

More Life Insurance News