Investors ‘doomscrolling’ on the brink, surveys find

Americans are anxious about their investments but not pulling out, although some would like to. They’re spending cash on necessities rather than buying assets in a down market. They have one eye on their lives and the other on their sinking investments as they doomscroll on the brink.

Those are some of the findings from a couple of recent surveys, although one of them found some glimmers of optimism about next year.

A Wells Fargo survey found that two-thirds (66%) of investors are anxious about their money and three-quarters (77%) are spooked by market volatility. Two out of five (42%) would like to cash out of their investments, with 29% saying they wish they could cash out their retirement funds without tax penalty.

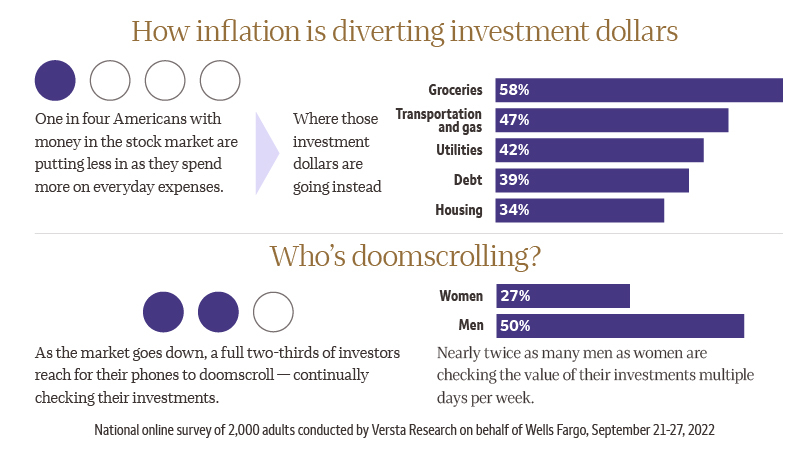

Inflation is a key driver pushing Americans to shift their priorities. Even with a down market offering bargains for assets, 25% are investing less as they spend more on basics such as groceries, gas and housing.

The old mantra might have been “set it and forget it,” but investors are having a hard time with the “forget it” part, with 66% saying they are continually checking their investments. It’s grown to an obsession for half of men, with 50% checking their investments several times a week while 27% of women do.

“Uncertainty on so many levels can cause people to focus in on their present self, or immediate needs and circumstances – and to lose focus on their future self, or more strategic priorities like retirement readiness,” said Michael Liersch, head of Advice and Planning in Wells Fargo’s Wealth & Investment Management business. “The irony is that this is the moment when we need to keep balance between our present and future selves, and potentially even dedicate more, not less, to our future selves.”

That may be, but the survey found their present selves are worried about getting food on the table.

Inflation is not only eating into living expenses, but it is also taking a bite out of investor confidence, with 65% saying they would feel more confident about investing if inflation would drop. They would also like to see interest rates to go back down (44%), as well as gas prices (41%) to feel better about investments.

Hazy with some clearing ahead

Another survey, a poll commissioned by Janus Henderson Investors, found that 86% of investors are concerned about inflation, with 54% very concerned.

Nearly eight in 10 investors (79%) were concerned about the stock market, with 40% very concerned.

A report on the survey said that investors who were still working were more anxious about the stock market and inflation compared to retirees, especially if they have less than $1 million in assets.

Even health was a factor, with those in “good” or “very good” health more anxious about the market and inflation than those who said they were in “excellent” health.

Economic conditions have some of the survey respondents more nervous about their retirement, with 45% less confident that they will have enough money to live comfortably throughout retirement and 54% were unchanged in their perception. Only 1% felt more confident.

Women had more of a drop in confidence than men, and younger people tended to be more anxious. The less healthy group with less than $1 million were also more concerned. White investors were more likely than non-whites to report a drop in retirement confidence.

The anxiety over markets and inflation have influenced spending, with 41% having reduced spending and 39% planning to reduce spending. Consistent with the other questions, women and those with less wealth and health were more concerned.

“A pattern is emerging in which many of the investors who reported being most concerned about the stock market and inflation, and who reported a drop in retirement confidence, have taken the common-sense action of having already reduced their spending in 2022,” according to the report.

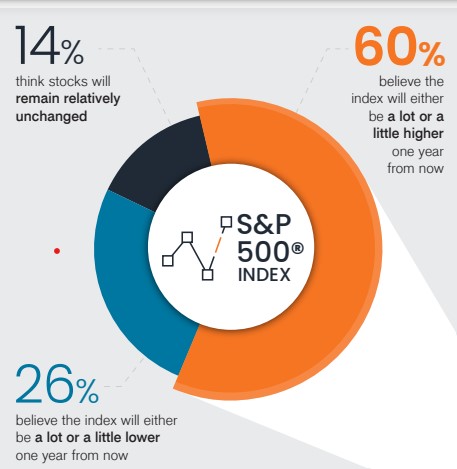

A bright spot in the survey was an overarching optimism about the stock market in the next year, with 60% saying they believe the S&P 500 index will be up a year from now, with 26% expecting it to be lower and 14% saying it will be unchanged.

As with the other categories, the youngest cohort (50-59) were more likely to say the market would be down as compared to the oldest (80 and older). They also tended to have less than $2 million in investments and were in good or fair/poor health.

Researchers said that although most investors believe that brighter days are ahead, advisors should be concerned about the 26% who expect the market to drop, because that group is more likely to pull money from investments.

“When discussing the importance of remaining in the market with skittish clients, advisors may wish to incorporate known approaches in behavioral finance,” according to the report. “For example, refocusing the client’s attention from all-time market highs to considering whether they are still on track to meet their goals can be a powerful motivating factor. Another approach is to ask clients if they would have feelings of regret three, five, or 10 years from now if they were to sell and the markets eventually rebounded. This hypothetical situation can be empirically supported by pointing to how the stock market often provided generous returns immediately following previous bear markets.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at stevenamorelli@gmail.com.

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

What does the Great Unwinding mean for employer-based health plans?

OMB moves DOL ESG rule, as backlash builds

Advisor News

- Americans fear running out of money more than death

- Caregiving affects ‘sandwich generation’s’ retirement plans

- Why financial consciousness is the key to long-term clarity

- Selling long-term-care insurance in a group setting

- How to overcome the fear of calling prospects

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Low-income diabetes patients more likely to be uninsured

- UnitedHealth execs bemoan ‘unusual and unacceptable’ Q1 financials

- LTCi proves its value beyond peace of mind

- Governor signs ban on drug middlemen owning pharmacies

- The lighter side of The News: Political theater; A bone to pick with a Yankee; Health insurers have mascots?

More Health/Employee Benefits NewsLife Insurance News

- ‘Really huge’ opportunity for life insurance sales if riddle can be solved

- Americans fear running out of money more than death

- NAIFA eyes tax reform, retirement issues in 2025

- Legislation would change tax treatment of life insurers’ debt investments

- Closing the life insurance coverage gap by investing in education

More Life Insurance News