Inflation Is A Yay For Yellen – And Annuities

Treasury Secretary Janet Yellen’s assurance that a little inflation and higher interest rates would be good for the economy might have some worried about inflation’s erosion of retirement security, but the higher rates could actually help some retirees.

Yellen was responding to concerns about the inflationary effect triggered by the trillions of taxpayer dollars that have been spent and being proposed to be spent by the Biden administration to support the economy.

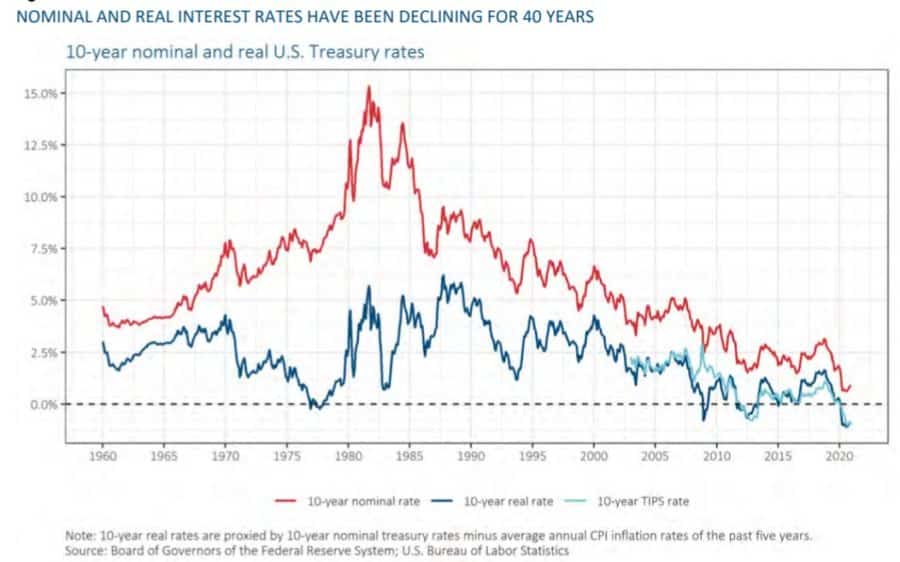

“If we ended up with a slightly higher interest rate environment it would actually be a plus for society’s point of view and the Fed’s point of view,” Yellen said Sunday in an interview with Bloomberg News following the G-7 summit. “We’ve been fighting inflation that’s too low and interest rates that are too low now for a decade.”

A Society of Actuaries report on the effect of low interest rates seems to support Yellen’s position. The SOA project reviewed other studies and found the persistent low rates already have had a negative effect on many aspects of retirement security, particularly annuities.

“When interest rates fall, annuity contracts become more expensive, the same amount will buy lower annuity payouts,” according to the report. “The cost of buying the same amount of annuity income has doubled in the past 30 years because of improved longevity and the decline in interest rates.”

Not only do the low rates put younger consumers at a disadvantage, they also pressure insurance companies to seek riskier investments for higher returns. Carriers have also pulled or reduced many guarantees associated with annuities.

“The incentive for reaching for yield is limited by capital requirements, while evidence exists for reaching for yield within risk-categories of bond investments,” according to the report. “Markets for annuities and life insurance products with guaranteed returns are likely to shrink. The overall profitability will be reduced because of lower interest income.”

The report’s authors expect another dampening effect from a Financial Accounting Standards Board guidance pending effective date.

“A new FASB guidance (effective after 2023) will make discount rates and liabilities more sensitive to interest rate changes,” according to the report. “Low returns will cause challenges in meeting existing obligations for annuities and products with guaranteed returns.”

Back To ‘Normal’?

Although Yellen said interest rates have been too low for too long, she had a hand in holding back rates as the Federal Reserve chief until 2018. The Fed kept rates near zero to stimulate borrowing and spending during the long recovery from the 2008 economic collapse. Now Yellen is saying rates should rise to “normal interest rate environment.”

But one of Yellen’s predecessors, Larry Summers, is ringing the alarm on inflation as a response to the latest spending proposals. Summers was treasury secretary under Bill Clinton and the director of the National Economic Council under Barack Obama. He is just one of the critics warning against overheating the economy, causing inflation to boil over uncontrollably.

Prices have been spiking lately with the April Consumer Price Index showing a 0.8% increase. That was on top of the 0.6% rise in March, amounting to a 4.2% 12-month jump, the most since the runup to the September 2008 economic crash.

Many eyes will be on the May CPI report coming out on Thursday. Expect those eyes to widen for a few reasons: businesses across the board are struggling with supply shortages, which pushes prices, and the oil and gasoline shortage in May caused a price spike that is sure to bump the overall index.

Inflation hawks say injecting stimulus right now could fuel inflation to a roar.

The latest huge federal spending plans for infrastructure and family support have been wrapped into a $6 trillion budget proposal for 2022. Although the packages have been called stimulus spending, Yellen said she considered them an investment in America’s future.

Yellen said the spending packages would total about $400 billion per year, according to Bloomberg. She said that was not enough to cause runaway inflation, adding that any “spurt” in prices would ebb by next year.

The Fed has also pledged to dial down its $120 billion in monthly asset purchases as progress is made on inflation and employment. Yellen said she is confident that people controlling monetary policy will be able to turn down the heat on inflation if it becomes necessary.

“I know that world -- they’re very good,” Yellen said in the interview. “I don’t believe they’re going to screw it up.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at stevenamorelli@gmail.com.

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

New Jersey Moves Bill To Permit Insurers To Offer Pandemic-Related Riders

Majority Of Americans Support Sustainable Investing, Allianz Life Says

Advisor News

- Americans increasingly worried about new tariffs, worsening inflation

- As tariffs roil market, separate ‘signal from the noise’

- Investors worried about outliving assets

- Essential insights a financial advisor needs to grow their practice

- Goldman Sachs survey identifies top threats to insurer investments

More Advisor NewsHealth/Employee Benefits News

- Thousands of Missouri construction workers with Anthem health insurance left scrambling

- Don't let death penalty turn Luigi Mangione into a martyr

- More than 5M could lose Medicaid coverage if feds impose work requirements

- Don't make Mangione a martyr

- Boston Herald: Don’t make Luigi Mangione a martyr

More Health/Employee Benefits NewsLife Insurance News

- 2024 ModeSlavery Report (bpcc modeslavery report 2024 en final)

- Exemption Application under Investment Company Act (Form 40-APP/A)

- Annual Report 2024

- Revised Proxy Soliciting Materials (Form DEFR14A)

- Proxy Statement (Form DEF 14A)

More Life Insurance NewsProperty and Casualty News

- She’s the first Black woman to lead California’s GOP and a Silicon Valley native. Can she give Republicans a boost?

- Florida homeowners turn to this insurance strategy to save money. Agents say ‘be careful.’

- California’s insurance crisis prompts solution-minded legislation

- CAMICO Names John Zissu as its Vice President of Information Technology

- Proxy Statement (Form DEF 14A)

More Property and Casualty News