Inflation clicks higher than expected, ensuring rate hikes

A slightly higher than expected rise in January’s Consumer Price Index ensures that the Federal Reserve will crank up rates probably another two times this year to the 5% range.

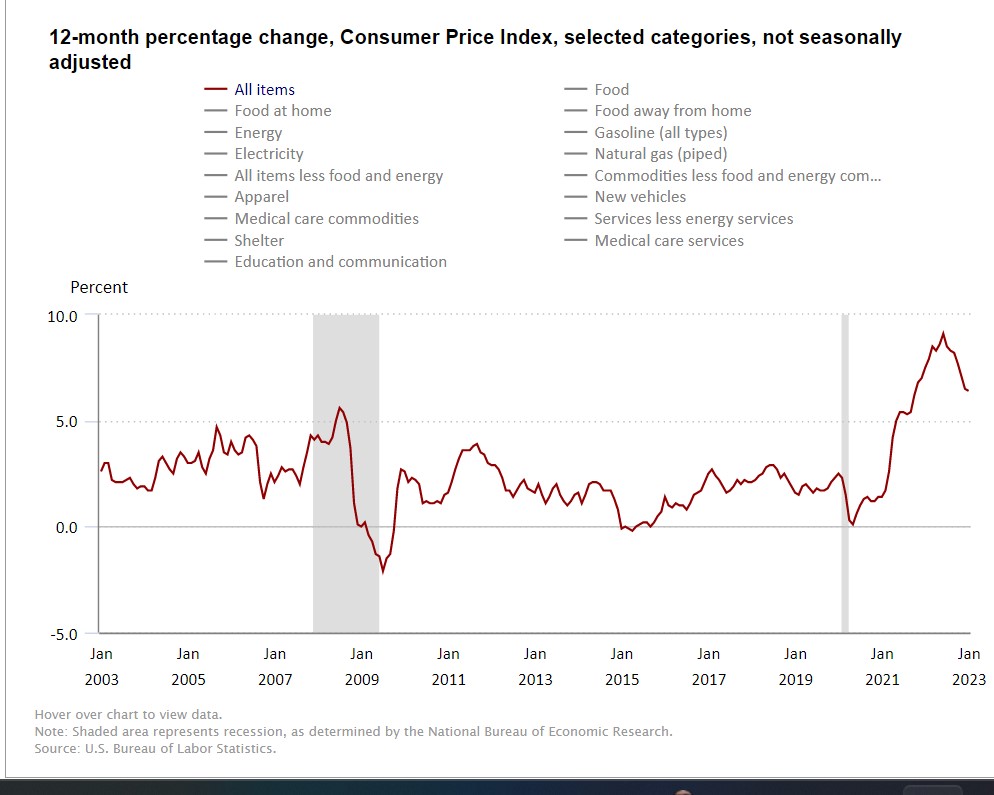

CPI rose 0.5% in January, a tick higher than the expected 0.4%, for a 6.4% increase over the past 12 months. A 0.4% increase would have meant a 6.2% average. The primary drivers were food, 10.1%, and energy, 8.7%. Without those two, the core average was 5.6%.

Although the increase was a smidge higher than expected, it represented a cooling from December’s 6.5% increase, and a significant drop from June’s high of 9.1%.

The increase solidifies the case that the Fed will raise rates at least two more times, and perhaps even more, according to a Reuters poll of economists. The rate is in the 4.5%-4.75% range. The Fed has been aiming for a 2% inflation rate.

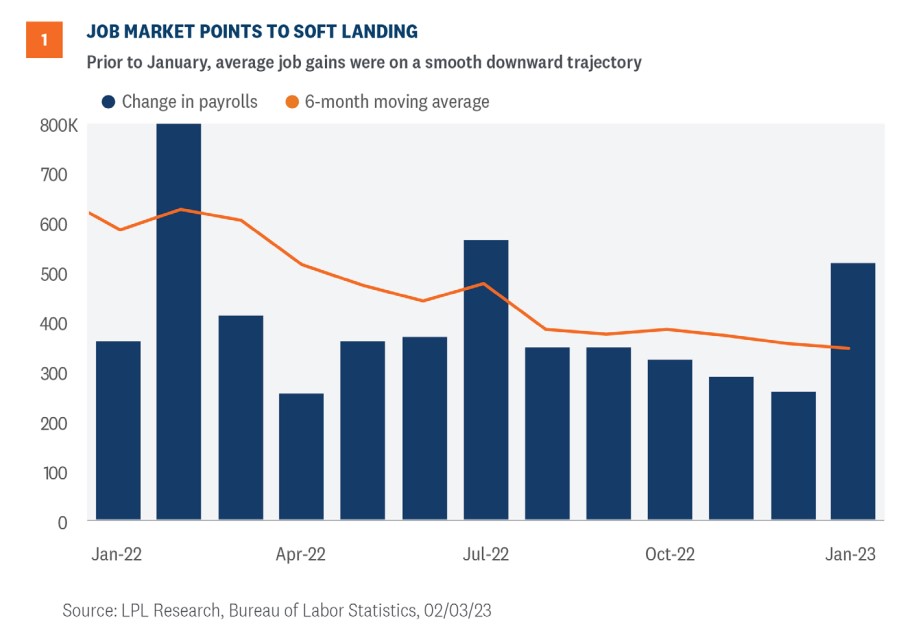

Although inflation has been cooling steadily since the June high, employment data spiked in January, indicating that the economy is still running a little hot for the Fed.

Fed on the pedal

Inflation might be slowing but the Fed is not breathing any deep sighs of relief. In an address last week, Fed Chair Jerome Powell said we are in the early stages of “disinflation,” indicating a bumpy ride down, according to The New York Times.

“There has been an expectation that it will go away quickly and painlessly — and I don’t think that’s at all guaranteed; that’s not the base case,” Powell said at an Economic Club of Washington, D.C., event last Tuesday. “The base case for me is that it will take some time, and we’ll have to do more rate increases, and then we’ll have to look around and see whether we’ve done enough.”

Powell said borrowing costs will need to remain high for “some time.” Investors had been hoping the central bank would lay off the rate hikes, but now expect increases in March and May, which the Times said pleased Powell.

Soft landing likely?

Although the jobs data showed a spike in January, LPL Financial analysts said at this point it is a bump in an otherwise smooth soft landing, according to the firm’s market commentary.

“Minimal turbulence in the trend line is consistent with a pathway to a smooth landing,” the analysts wrote. “In fact, the blowout jobs report did not alter the Federal Reserve’s (Fed) playbook.”

Spike aside, wage growth has been slowing, down to 4.4% annually in January, bad news for workers that brings a glimmer of joy to the Fed’s heart. The employment participation rate is still lagging, but business formation is higher than it was before the pandemic.

A bit of good news for overall economic health is consumer debt is still below pre-pandemic levels, partly because wage growth has helped support higher consumer spending. LPL expects that consumers will start heating up their credit cards soon, but the increase will not match pre-2008 debt levels.

Also adding to the soft landing case is the projection for an improving Chinese economy, most important for smoothing out the kinks in the supply chain.

The analysts say that a look at the stock market’s price-to-earnings ratio shows that a soft landing, or a short-lived, mild recession might already be baked into prices.

“Earnings are a bit depressed, supporting higher valuations, but the challenging near-term economic outlook with still-high inflation and more Fed rate hikes forthcoming, perhaps argue against that,” according to the report. “Upside risk to interest rates may also argue against that, though LPL Research sees manageable upside to yields this year from current levels at a 3.7% 10-year Treasury.”

Although a mild recession would dent earnings, it is unlikely to drag on valuations, the analysts said, opening the door for possible double-digit gains for stocks this year.

The big picture justifies an optimistic outlook on the economy, according to the report. The analysts expect the S&P 500’s year-end fair value target to land between 4,400 and 4,500. The index checked in at 4,150 at 10 a.m. Tuesday.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2023 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Fix of ‘family glitch’ could add to record 16.3M ACA exchange enrollees

Federal judge tosses out portion of DOL rollover advice guidance

Advisor News

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

- Most Americans surveyed cut or stopped retirement savings due to the current economy

- Why you should discuss insurance with HNW clients

More Advisor NewsAnnuity News

- Guaranty Income Life Marks 100th Anniversary

- Delaware Life Insurance Company Launches Industry’s First Fixed Indexed Annuity with Bitcoin Exposure

- Suitability standards for life and annuities: Not as uniform as they appear

- What will 2026 bring to the life/annuity markets?

- Life and annuity sales to continue ‘pretty remarkable growth’ in 2026

More Annuity NewsHealth/Employee Benefits News

- Hawaii lawmakers start looking into HMSA-HPH alliance plan

- EDITORIAL: More scrutiny for HMSA-HPH health care tie-up

- US vaccine guideline changes challenge clinical practice, insurance coverage

- DIFS AND MDHHS REMIND MICHIGANDERS: HEALTH INSURANCE FOR NO COST CHILDHOOD VACCINES WILL CONTINUE FOLLOWING CDC SCHEDULE CHANGES

- Illinois Medicaid program faces looming funding crisis due to federal changes

More Health/Employee Benefits NewsLife Insurance News