Indexed Life Sales Smash More Records During 4Q 2021, Wink Reports

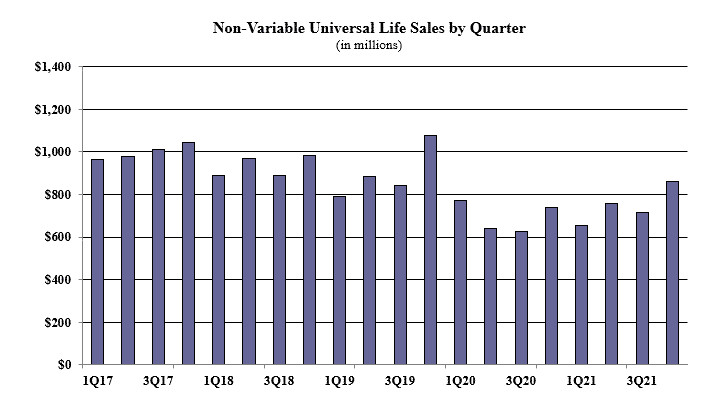

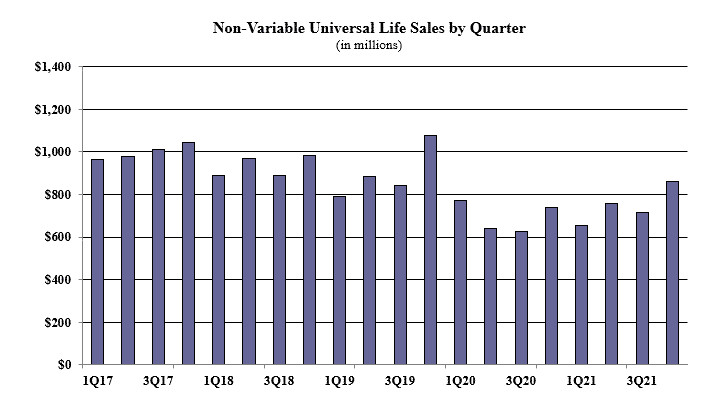

Non-variable universal life sales for the fourth quarter were $861.5 million, up 20% compared to the third quarter and 16.25% over 4Q 2021, according to Wink’s Sales & Market Report.

Total 2021 non-variable universal life sales were $2.9 billion. Non-variable universal life sales include both indexed UL and fixed UL product sales.

Noteworthy highlights for total non-variable universal life sales in the fourth quarter included Pacific Life Companies with the No. 1 overall sales ranking for non-variable universal life sales, with a market share of 10.8%. Transamerica Life’s Transamerica Foundation IUL was the No. 1 selling product for non-variable universal life sales, for all channels combined.

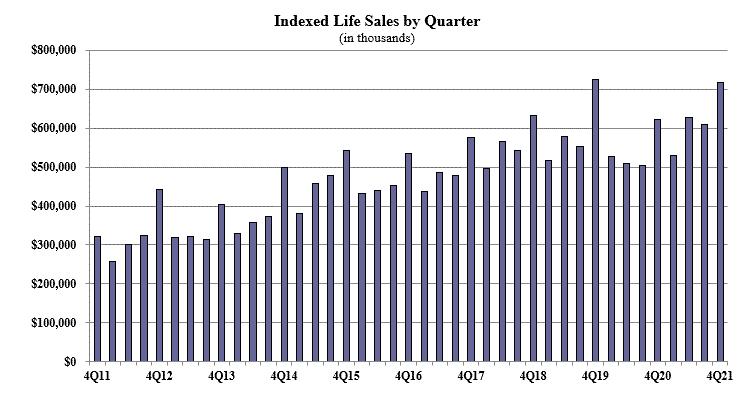

Indexed life sales for the fourth quarter were $718 million, up more than 19.1% when compared with the previous quarter, and up more than 15.5% as compared to the same period last year. This was a record-setting year for indexed life sales, with the total 2021 indexed life sales hitting $2.4 billion. Indexed life sales include both indexed UL and indexed whole life.

“It is great to see indexed life setting sales records again,” said Sheryl J. Moore, CEO of both Moore Market Intelligence and Wink, Inc. “The challenges of constant regulatory changes seem to be in the rearview mirror (for now).”

Items of interest in the indexed life market included National Life Group with the No. 1 ranking in indexed life sales, with a 12.7% market share. Pacific Life Companies, Nationwide, Transamerica, and John Hancock rounded out the top five, respectively.

Transamerica Life’s Transamerica Foundation IUL was the No. 1 selling indexed life insurance product, for all channels combined. The top pricing objective for sales this quarter was cash accumulation, capturing 79.6% of sales. The average indexed life target premium for the quarter was $11,868 an increase of more than 5% from the prior quarter.

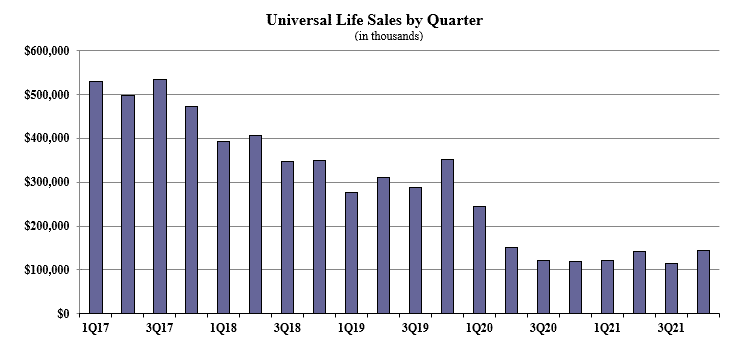

Fixed UL sales for the fourth quarter were $143.74 million, up 24.4% when compared to the previous quarter and up 19.7% as compared to the same period last year. Total 2021 whole life sales were $522.4 million. Noteworthy highlights for fixed universal life included the top pricing objective of no-lapse guarantee capturing 46.1% of sales. The average UL target premium for the quarter was $5,776; an increase of nearly 8% from the prior quarter.

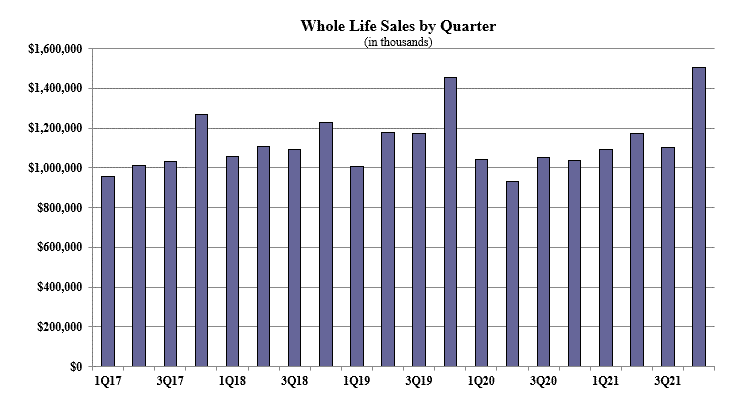

Whole life fourth quarter sales were $1.5 billion, up 36.7% when compared with the previous quarter, and up 45.5% as compared to the same period last year. Total 2021 whole life sales were $4.8 billion.

Items of interest in the whole life market included the top pricing objective of final expense capturing 41% of sales. The average premium per whole life policy for the quarter was $3,690, an increase of nearly 19% from the prior quarter.

“It isn’t surprising to see whole life sales fare so well," Moore said, "given that less than 20% of the market had sales declines, and more than half of the market experienced double-digit gains in sales.”

Wink currently reports on indexed universal life, indexed whole life, universal life, whole life, and all deferred annuity lines’ product sales. Sales reporting on additional product lines will follow in the future, Moore said.

COVID-19 Fueled Greater Interest In Long-Term DI, Survey Shows

Trade Associations Line Up In-Person Conferences For The Rest Of 2022

Advisor News

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

More Advisor NewsAnnuity News

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

More Annuity NewsHealth/Employee Benefits News

- SSI in Florida: High Demand, Frequent Denials, and How Legal Help Makes a Difference

- SilverSummit continues investment in rural healthcare

- Could workplace benefits help solve America’s long-term care gap?

- Long-Term Care Insurance: What you need to know

- DEMOCRATS: Iowa’s farm income projected to plummet in 2026, ag-related layoffs expected to continue. Who is here to help?

More Health/Employee Benefits NewsProperty and Casualty News

- Lawmakers call for expanding California FAIR insurance plan

- Rate pressure, customer churn set stage for auto insurance upheaval in 2026

- Insurer profits surge, but Connecticut homeowners shouldn't expect lower premiums

- Marsh McLennan Agency Launches Secure Harbor Group Captive to Help Senior Living Clients Manage Challenging Market Conditions

- LARGE SWATH OF U.S. FACES WINTER STORM LOSSES: WHAT INSURANCE COVERS AND HOW TO RECOVER

More Property and Casualty News