Indexed life sales continue record-setting pace in 2Q, Wink reports

Indexed life insurance sales continued a strong pace during the second quarter, according to the Wink’s Sales & Market Report.

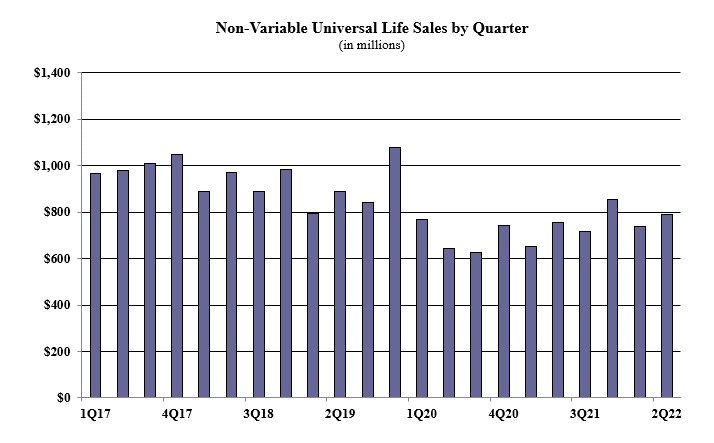

Non-variable universal life sales for the second quarter were $790.3 million, up 7.1% when compared to the previous quarter and up 4.4% as compared to the same period last year. Non-variable universal life sales include both indexed UL and fixed UL product sales.

Noteworthy highlights for total non-variable universal life sales in the second quarter included National Life Group with the No. 1 overall sales ranking for non-variable universal life sales, with a market share of 12.1%. Transamerica Life’s Transamerica Foundation IUL was the No. 1 selling product for non-variable universal life sales, for all channels combined.

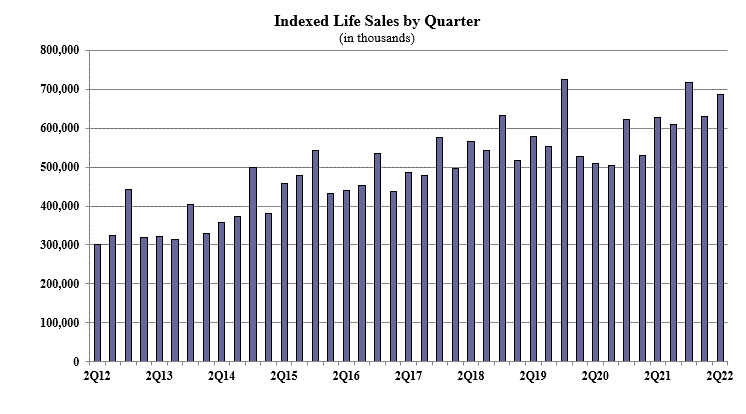

Indexed life sales for the second quarter were $685.5 million, up 8.8% when compared with the previous quarter, and up 11.5% as compared to the same period last year. Indexed life sales include both indexed UL and indexed whole life.

“Indexed life sales just cannot be stopped,” said Sheryl J. Moore, CEO of both Moore Market Intelligence and Wink, Inc. “This will be a record year for sales, and by a sizeable margin.”

Items of interest in the indexed life market included National Life Group with the No. 1 ranking in indexed life sales, with a 13.9% market share, Transamerica, Pacific Life Companies, Nationwide, and Sammons Financial Companies rounded out the top five, respectively.

Transamerica Life’s Transamerica Foundation IUL was the No. 1 selling indexed life insurance product, for all channels combined. The top pricing objective for sales this quarter was Cash Accumulation, capturing 80.2% of sales. The average indexed life target premium for the quarter was $12,138, an increase of more than 5% from the prior quarter.

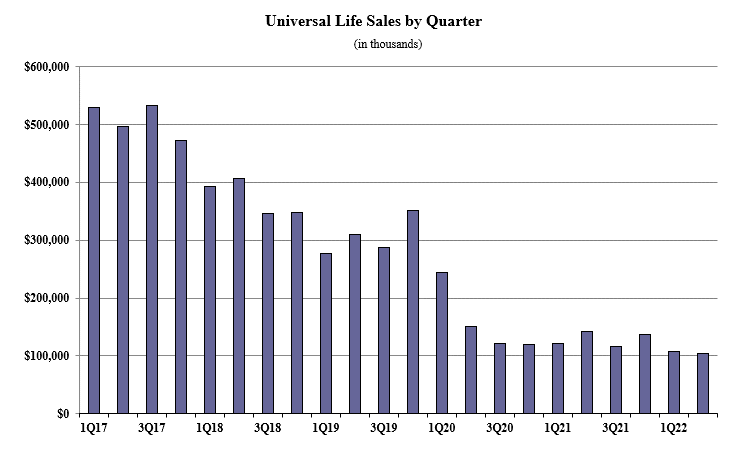

Fixed UL sales for the second quarter were $104.7 million, down 2.5% when compared to the previous quarter and down 26.5% as compared to the same period last year. Noteworthy highlights for fixed universal life included the top pricing objective of No Lapse Guarantee capturing 57.6% of sales.

The average UL target premium for the quarter was $5,145, a decline of less than 1% from the prior quarter.

“Even an improved interest rate environment cannot put a stop to the double-digit declines in traditional UL sales," Moore said. "It is sad.”

Whole life second quarter sales were $1.1 billion, down more than 3.8% when compared with the previous quarter, and down more than 5.8% as compared to the same period last year. Items of interest in the whole life market included the top pricing objective of Final Expense capturing 56.5% of sales. The average premium per whole life policy for the quarter was $3,513, an increase of nearly 11% from the prior quarter.

Wink currently reports on indexed universal life, indexed whole life, universal life, whole life, and all deferred annuity lines’ product sales. Sales reporting on additional product lines will follow in the future, Moore said.

3 simple actions to create a great workplace culture

Men press snooze on health care, survey shows

Advisor News

- Goldman Sachs survey identifies top threats to insurer investments

- Political turmoil outstrips inflation as Americans’ top financial worry

- What is the average 55-year-old prospect worth to an advisor?

- A recession could leave Americans humming 'Oh, Canada'

- Market volatility driven by fear, emotion

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Landry budget grows Medicaid

- GUEST COMMENTARY: We need a better system to pay for health care

- States try to rein in health insurers’ claim denials

- Insurance company CEO fired after Texas House DOGE hearing

- Supplemental health startup breaks new ground with wide coverage, quick cash payouts

More Health/Employee Benefits NewsProperty and Casualty News

- As number of wildfires explode, expert says mitigation is possible

- 2024 Annual Document Annual Letter

- From repairs to insurance, Trump's auto tariffs could make owning a car more expensive

- Pawdarling Introduces Innovative Pet Insurance Plans for Comprehensive Coverage

- Owner of CT tow truck company arrested for allegedly failing to provide workers’ compensation

More Property and Casualty News