Independent Agents And Brokers ‘Enjoying An Incredible Run’

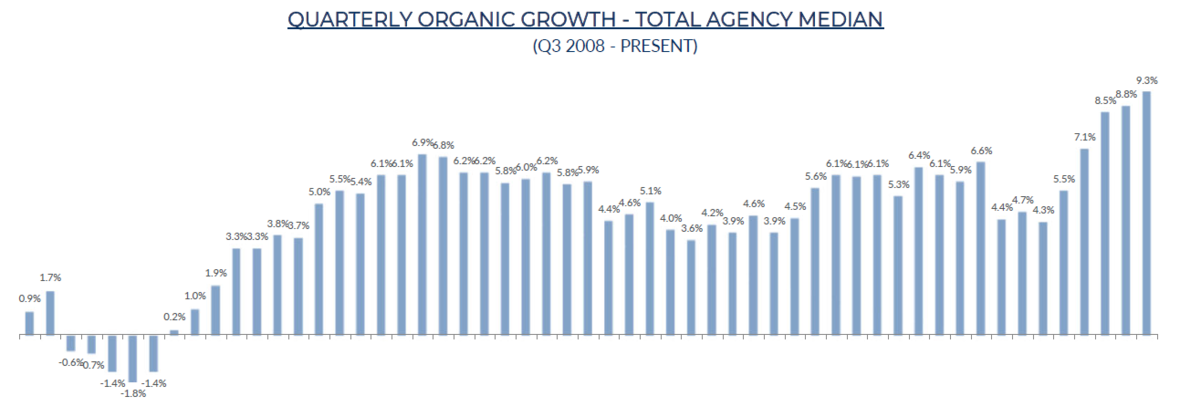

ATLANTA (May 17, 2022) — For a fourth consecutive quarter, independent insurance agents and brokers have set yet another organic growth record. That and other high markers are revealed by the latest Reagan Consulting Growth & Profitability Survey (GPS), which measured first-quarter 2022 industry performance. Agents and brokers “are enjoying an incredible run,” observes Brian Deitz, president and partner of the firm.

At 9.3%, the first quarter’s “median organic growth is 50 basis points higher than the previous record of 8.8% set just last quarter,” Deitz says, and “25% of Q1 participants grew organically at 15.9% or higher.”

Profits are at record levels as well, Deitz notes. Contingent income for the quarter grew at 18% year over year, “an incredible increase that generally drops straight to the bottom line,” allowing agents and brokers to leverage cost structures and expand margins, he says.

But the most impressive statistic of the quarter was a 26.2 median “Rule of 20” score, the highest in the survey’s history by nearly 4.5 points. A proprietary Reagan metric, the Rule of 20 benchmarks an agency’s shareholder returns, measuring the combined impacts of organic growth and profitability on value creation. A score of 20 or better means a firm likely is generating shareholder returns of 15% to 17% under normal market conditions.

Performance Of Individual Lines

As expected, commercial lines continued to outperform personal lines and group benefits in Q1 2022. With an 11.5% organic growth rate, commercial lines broke its previous record of 11.4%, set just the prior quarter. The organic growth rate of neither personal lines nor group benefits (4.2%) broke records, but at 4.3%, personal lines achieved its second-highest level.

Deitz characterizes the performance of group benefits as “middle-of-the road,” commenting that the benefits business isn’t “benefitting from a p-c-like rate environment.”

Will The Industry's Record Run End In 2022?

Signs of an impending slowdown are mounting ― instability in the bond market toward the end of Q1, a spike in inflation, a reduction in the gross domestic product, and ripples from the war in Ukraine. But “agents and brokers do not seem overly concerned,” Deitz notes. Q1 GPS participants are projecting 8.0% organic growth for the year and foresee 2022 as their most profitable year yet.

For further observations and commentary on the Q1 results, contact Deitz at Reagan Consulting, 404.865.2593 or [email protected].

The Reagan GPS was formerly known as the Organic Growth & Profitability (OGP) Survey. Each participating agency in the GPS receives a customized, confidential report of its performance compared with the overall survey results, along with Reagan’s quarterly commentary of industry trends affecting agents and brokers.

AHIP’s Policy Roadmap Aimed At Increasing Health Care Access, Affordability

Slow, Steady Insurance Companies Winning The COVID Race

Advisor News

- Principal builds momentum for 2026 after a strong Q4

- Planning for a retirement that could last to age 100

- Tax filing season is a good time to open a Trump Account

- Why aligning wealth and protection strategies will define 2026 planning

- Finseca and IAQFP announce merger

More Advisor NewsAnnuity News

- Half of retirees fear running out of money, MetLife finds

- Planning for a retirement that could last to age 100

- Annuity check fraud: What advisors should tell clients

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

- Great-West Life & Annuity Insurance Company Trademark Application for “SMART WEIGHTING” Filed: Great-West Life & Annuity Insurance Company

More Annuity NewsHealth/Employee Benefits News

- Stop VA Claim Sharks: Why MOAA Backs the GUARD VA Benefits Act

- Soaring health insurance costs, revenue shortfalls put pressure on Auburn's budget

- Medicare Moments: Are clinical trial prescriptions covered by Medicare?

- Blue Cross Blue Shield settlement to start payouts from $2.67 billion class-action suit

- Why the Cost of Health Care in the US is Soaring

More Health/Employee Benefits NewsLife Insurance News