Higher Rates, Fire Sales Power 2Q Index Annuity To Sales Record

Higher interest rates and fire sales among some insurance companies pushed index annuities to their highest quarterly sales ever, according to new data.

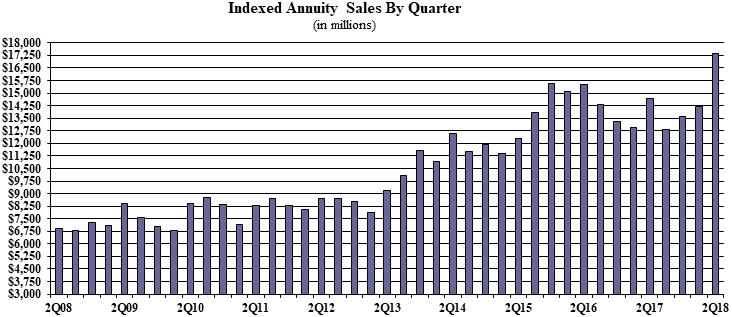

Second-quarter index annuity sales reached $17.3 billion, up 18 percent compared to the year-ago period and up nearly 22 percent compared to the first quarter, according to Wink’s Sales & Market Report.

“This is a record-setting quarter for index annuities,” said Sheryl J. Moore, president and CEO of Moore Market Intelligence and Wink Inc., publisher of Wink’s Sales & Market Report. “I’d say that indexed annuities are back in business with an increase that tops the prior record by more than 11 percent.

“We will likely see another record year for fixed index annuity sales, according to my projection,” she added.

The previous quarterly sales record hit $15.5 billion in the fourth quarter of 2015, but this latest quarter isn’t likely to establish a new “floor” for the index product category, she said.

Sales of index annuities least year fell 7 percent to $54 billion over 2016.

Index annuities, which protect principal in exchange for limited gain pegged to an external index, had been on a steady quarterly climb since the third quarter of last year.

Sales rose further when a federal court in March threw out the Department of Labor’s fiduciary rule, and benchmark lending rates rose by a quarter percent that same month, and by another quarter percent in May.

Higher interest rates allow insurance companies to make index annuities more attractive to buyers via higher participation rates, caps and premium bonuses credited to the annuity buyer.

On the seller side, insurance companies might also give agents more incentive to sell by raising commissions by half a percent, or implementing other sales incentives, Moore said.

For agents who may have been waiting on the sidelines, those incentives may have motivated them, she said.

“Some insurance companies are having fire sales – that would be an accurate description of what’s boosting annuity sales,” Moore said.

Allianz finished the quarter with a 12.7 percent market share in index product sales with Athene ranking second, trailed by Nationwide, Great American Insurance Group, then American Equity, Wink reported.

Allianz’s 222 index annuity was the No. 1 selling product in the category, for all channels combined, as well as the top seller in the independent distribution channel, Wink reported.

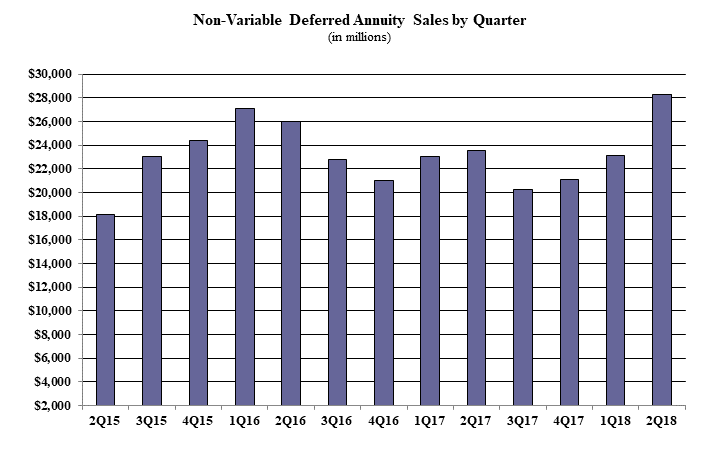

Sales of non-variable deferred annuities – which consist of indexed, traditional fixed and multi-year guaranteed products – jumped 20 percent to $28 billion from the year-ago period, and 22 percent from the first quarter, Wink reported.

MYGAs See Large Gains

Sales of multi-year guaranteed annuities (MYGA), which lock in an interest rate over several years, also rose, Wink reported.

Second-quarter MYGA sales rose 27 percent to $10 billion over the year-ago quarter and 23 percent over the first quarter.

New York Life, which has among the largest career distribution channels in the industry, was the top MYGA seller with a market share of 18 percent. Global Atlantic Financial Group was the No. 2 MYGA seller followed by AIG, Protective and Delaware Life, Wink reported.

Forethought’s SecureFore 5 Fixed Annuity was the top selling MYGA for the quarter for all channels combined, and Fidelity & Guaranty Life’s Guarantee-Platinum 5 was the top selling product in the independent channel, Wink said.

Typical MYGA rate durations last from three to 10 years, but offer a higher return compared to bank products against which they compete as MYGAs tie up money for a longer period.

Traditional Fixed Annuity Sales Fall

Sales of traditional fixed annuities, which pay a fixed interest rate for one year, fell 13 percent to $875 million compared to the year-ago quarter, but rose 20 percent compared to the first quarter, the Wink reported.

“It’s not surprising because traditional annuities suffer at the expense of index annuities,” Moore said.

Investors prefer taking a chance at earning, say, 4.5 percent with an index annuity than coming away with a 2 percent gain on a traditional fixed product, she said.

In the second quarter, Jackson National led sales in the product category with a 12 percent market share followed by Modern Woodmen of America, Global Atlantic, AIG and Great American, Wink reported.

The most popular product was Forethought Life’s ForeCare Fixed Annuity for all channels combined, and in the independent channel EquiTrust ChoiceFour was the top-selling annuity, Wink reported.

Sales of Buffer Annuities Rise

Second-quarter sales of structured, or buffered, annuities rose 12.6 percent to $2.4 billion from the previous quarter, when Wink first began tracking them.

The category, also known as registered index-linked annuities, is relatively new and the segment has benefited from rapid innovation, Moore said.

Overall industry sales of these annuities grew 25 percent last year were $9.2 billion over 2016.

AXA US finished the second quarter with a 40.2 percent market share in the segment and Brighthouse Financial’s Shield Level Select 6-Year was the top-selling structured annuity for all distribution channels combined, Wink reported.

InsuranceNewsNet Senior Writer Cyril Tuohy has covered the financial services industry for more than 15 years. Cyril may be reached at [email protected].

© Entire contents copyright 2018 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Cyril Tuohy is a writer based in Pennsylvania. He has covered the financial services industry for more than 15 years. He can be reached at [email protected].

Critical Illness Coverage Fills The Gap And Eases Client Concern

Total Annuity Sales Rocket Up 10 Percent In 2Q

Advisor News

- Building your business with generative AI

- Study: key gaps advisors miss in retirement planning conversations

- T. Rowe Price: Trends that will shape retirement in 2025

- Trump revives plan for tax deduction on car loan interest payments, pushes sweeping tax cuts

- U.S.: A significant negative wealth effect looms if the trade war persists

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Mark Farrah Associates Analyzed the 2023 Medical Loss Ratio and Rebates Results

- illumifin CEO Peter Goldstein Joins Alzheimer’s Association Board of Directors

- California has a lot to lose if Trump slashes Medicaid. Seniors, kids and more could face coverage cuts

- RFK Jr. pressed to reevaluate Pennsylvania’s Medicaid expansion

- New Mississippi Division of Medicaid director shares information with lawmakers, addresses concerns

More Health/Employee Benefits NewsLife Insurance News