Globe Life execs say internal audit cleared it of fraud, improper life sales

Main takeaway: Globe Life executives sought to put myriad allegations of fraud and agent misconduct in the rearview by announcing that an audit found no wrongdoing.

If co-CEOs Frank Svoboda and J. Matt Darden hoped that a statement read at the beginning of today’s second-quarter earnings call would put the issue to sleep, they were wrong.

Nearly every analyst peppered the CEOs with questions about the allegations and the internal audit, conducted with assistance from international law firm WilmerHale. Globe Life announced the audit during the first-quarter earnings call.

“The audit committee has completed its review and determined that the allegations of financial misconduct were not supported,” Svoboda said at the start of the call. The committee “reviewed and confirmed that the company has policies and procedures in place designed to safeguard the quality of the work experience.”

Many of the allegations are from recent short-seller reports accusing brokers at subsidiary American Income Life Insurance Co. of widespread insurance fraud, including writing policies for dead and fictitious people, and an alleged kickback scheme that netted millions for senior executives.

The CEOs blamed the controversies on short sellers trying to drive the Globe Life stock down. After a brief slide following the negative reports, Globe Life shares are up more than 7% over the past month.

In addition, Globe Life faces inquiries from both the Securities and Exchange Commission and the Department of Justice. Executives shared little information on those investigations other than remind analysts that no specific claims have been asserted.

Analysts repeatedly probed for additional details, without success as the CEOs repeated versions of their initial statement. Thomas Gallagher, senior managing director at Evercore, came closest when he asked if it is “a fair statement” to say that there have been no terminations of sales management people.

“That is not a fair statement,” Darden said, adding that he could say no more.

Additional takeaways

- Web portal breach. Globe Life executives provided little update on a June 13 web portal breach. In a June 14 Form 8-K filing, Globe Life said it was contacted by a state insurance regulator about the potential breach.

The insurer "initiated a review of potential vulnerabilities related to access permissions and user identity management for a Company web portal that likely resulted in unauthorized access to certain consumer and policyholder information," the filing said.

Upon being notified about the potential issue, Globe Life said it suspended access to the portal.

“We have initiated comprehensive investigation into the matter,” Svoboda told analysts Thursday. “The investigation is still ongoing, and we have yet to determine the full scope, nature and impact overall. But we do know that there has not been a material impact on the company's operations.”

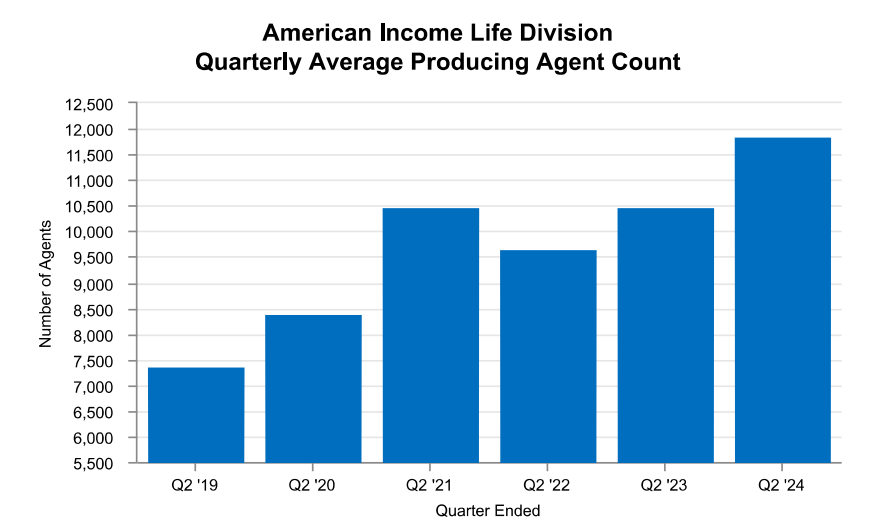

- Agent count. The CEOs touted Globe Life agent counts as a source of company strength. At American Income, the average producing agent count for the second quarter was 11,869, up 13% from a year ago.

The news was even better at Liberty National, where “growth in both the life and the health sales was due primarily to the increase in agent count,” Darden said. The average producing agent count for the second quarter was 3,700 at Liberty, up 16% from a year ago.

At Family Heritage, average agent count increased a modest 1% to 1,361.

“As we've said before we continue to emphasize recruiting and middle management development at Family Heritage,” Darden said, “and I am encouraged as we have started to see middle management growth, which is up 11% from year end.”

Management Commentary

“Globe Life takes unethical conduct and any allegations brought to our attention concerning harassment, inappropriate conduct or unethical business practices seriously, and we do not tolerate such behavior.”

– J. Matt Darden

Financial Overview

Total Revenue: $1.17 billion

Net Income: $2.97 per diluted common share

Share repurchases: 3.8 million shares repurchased during the quarter at a total cost of $314 million

Segment Performance

Life Insurance:

- Premium revenue: $815,500, up 4%

- Key Metrics: Sales increased by 10% for the quarter

Health Insurance:

- Premium revenue: $351,600, up 7%

- Key Metrics: Sales increased by 17% for the quarter

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Hurricane season could top last year’s $100B damage costs, experts say

1 in 7 Floridians lacks homeowners insurance despite major climate risks

Advisor News

- Take advantage of the exploding $800B IRA rollover market

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

More Advisor NewsAnnuity News

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

More Annuity NewsHealth/Employee Benefits News

- Idaho is among the most expensive states to give birth in. Here are the rankings

- Some farmers take hard hit on health insurance costs

Farmers now owe a lot more for health insurance (copy)

- Providers fear illness uptick

- JAN. 30, 2026: NATIONAL ADVOCACY UPDATE

- Advocates for elderly target utility, insurance costs

More Health/Employee Benefits NewsLife Insurance News

- AM Best Affirms Credit Ratings of Etiqa General Insurance Berhad

- Life insurance application activity hits record growth in 2025, MIB reports

- AM Best Revises Outlooks to Positive for Well Link Life Insurance Company Limited

- Investors holding $130M in PHL benefits slam liquidation, seek to intervene

- Elevance making difficult decisions amid healthcare minefield

More Life Insurance News