Gen Z Wants To Stack Early, Money Morning Survey Shows

It might be true that retirement saving should be thought of as a marathon, but a recent poll showed it is more of a sprint until the investor hits 45, then it’s more of a steady lope until the finish line.

Investors between 45 and 54 chose “save for retirement” as their top reason for investing, with 82% selecting it in a Money Morning survey of 800 knowledgeable investors. “Grow their net worth” was No. 2 at 70%.

Gen Z on the other hand is all about growing net worth with 86% of 18- to 24-year-olds choosing it, breaking away from No. 2, “additional source of income,” at 62%. Saving for retirement was a distant No. 4 at 35%.

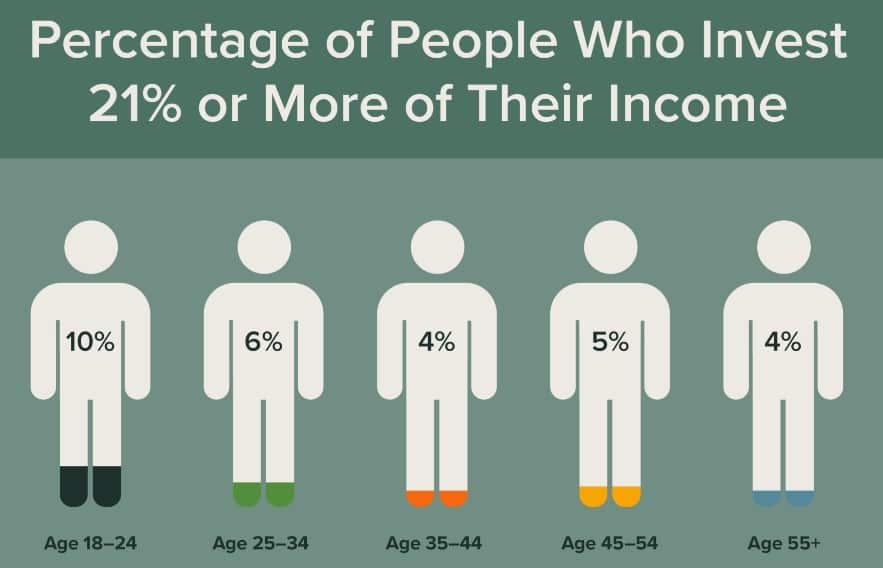

Also, twice as many Gen Zers than Gen Xers were willing to place bigger bets on their investments, with 10% of the younger cohort willing to invest 21% or more of their income vs. 5% of 45- to 54-year-olds.

Investing enthusiasm eases a bit in the Millennial years, with 6% stacking at least 21% into investments. They are in the early career, young family stage at ages 25-34.

Boomers are still in the game – well, at least 4% of them are.

Gen Zers and Millennials would be wise to put away a bit more money early because they are starting their careers at a disadvantage, according to a Stanford University report done even before the pandemic.

“Research shows that college graduates who start their working lives during a recession earn less for at least 10 to 15 years than those who graduate during periods of prosperity,” according to a policy brief by researcher Hannes Schwandt, who added that the disadvantage can even be deadly.

“In particular, recession graduates have higher death rates in midlife,” Schwandt reported, “including significantly greater risk of drug overdoses and other so-called ‘deaths of despair.’”

Add the pandemic effect and the impact is even greater, with Gen Z expected to lose $10 trillion in lifetime income because of the lockdowns, according to the Bank of America’s report, “OK Zoomer: Gen Z Primer.”

Rewards Of Risk

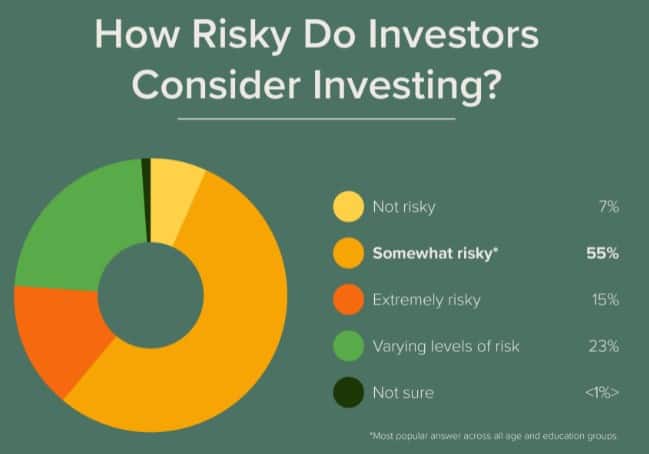

The Money Morning survey found that unlike the disparities among age groups with many of the other factors in investing, the generations were of a single mind on the perception of risk.

“Our data doesn’t show a correlation between the perceived risk of investing with age or education,” according to the report. “Over half of our respondents considered investing ‘somewhat risky’ while 15% of respondents pegged investing at ‘extremely risky.’ Just under 10% of respondents believed that investing was ‘not risky’ at all.”

There was a slight split between genders on risk assessment, with 16% of women describing investments as “extremely risky” compared to 14% of men, according to the report. Men also tended to be more all-in on investing, with 9% of men saying investments were not risky vs. 5% of women.

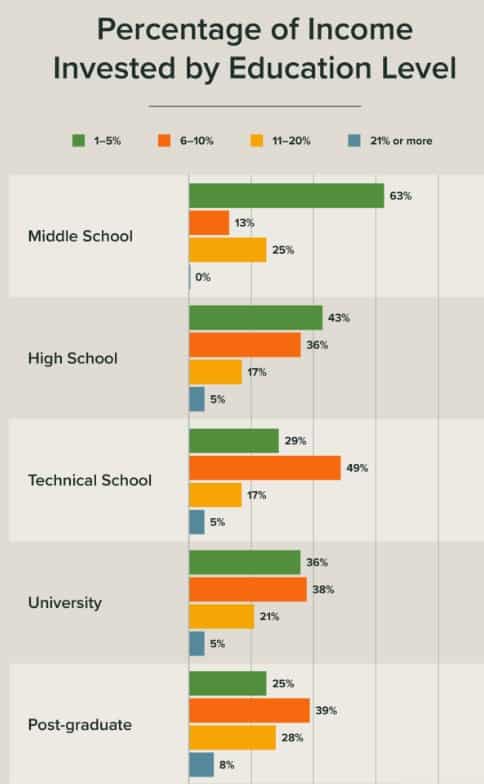

Beyond risk perception, income and graduation had significant correlation with investing.

In education, for example, 75% of respondents with a post-graduate degrees invested at least 6% of their income. That group was also more likely to invest the most, with 8% of them putting at least 21% into investments.

The pollsters said the difference could be related to the direct correlation between income and education. But they also pointed out that the higher income groups tended to invest equally.

“It may seem like common sense that investors with the highest income would be willing to invest the highest percentage of their money. After all, they likely have the most money after expenses to put into the stock market, mutual funds, and other investments,” according to the report. “However, our survey data found that the highest earners — those making $150,000 or more per year — reported investing 6% to 10% of their income. That’s the same percentage as respondents earning $50,000 to $74,999 per year.”

Where They Get Advice

The category of where people went for financial advice had good news for advisors but not so good for brokers.

“Our survey suggests that investors use multiple sources before making their investment decisions but that they trust those in their circle as well as financial professionals,” according to the report. “It’s notable to see which sources didn’t rank high. Aside from the ‘other’ category, the least chosen option was ‘brokers.’”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

‘Another Fight’ Brewing If DOL Revives Fiduciary Rule, Attorney Says

Cambridge Mobile Telematics Acquires TrueMotion, To Expand Auto Insurer Services

Advisor News

- Finseca and IAQFP announce merger

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

- Take advantage of the exploding $800B IRA rollover market

More Advisor NewsAnnuity News

- Somerset Re Appoints New Chief Financial Officer and Chief Legal Officer as Firm Builds on Record-Setting Year

- Indexing the industry for IULs and annuities

- United Heritage Life Insurance Company goes live on Equisoft’s cloud-based policy administration system

- Court fines Cutter Financial $100,000, requires client notice of guilty verdict

- KBRA Releases Research – Private Credit: From Acquisitions to Partnerships—Asset Managers’ Growing Role With Life/Annuity Insurers

More Annuity NewsHealth/Employee Benefits News

- Franklin County Seeks Administrator for Human Services Division

- Cigna hails pharmacy deal with the FTC, battles elevated cost trends

- Health care inflation continues to eat away at retirement budgets

- Pharmacy benefit manager (PBM) reform included in government funding package

- Health insurance CEOs say they lose money in Obamacare marketplace despite subsidies

More Health/Employee Benefits NewsLife Insurance News