Gen X Wants To Talk Annuities, Study Shows

Gen Xers know the value of creating their own pension as company pension plans fade and they realize they are on their own more than their older siblings and parents are, according to a new report.

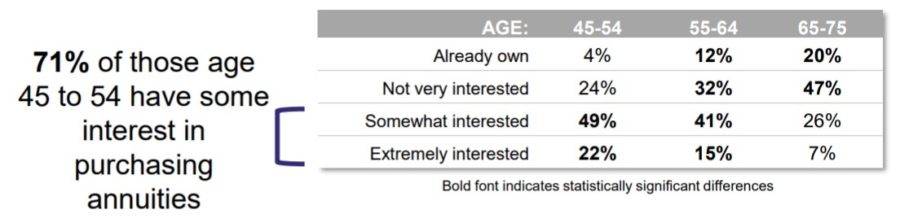

A large majority (71%) of 45- and 54-year-old investors are at least “somewhat interested” in purchasing an annuity, according to Protected Retirement Income and Planning Study, a joint project between Alliance for Lifetime Income and CANNEX.

The study combines two surveys conducted in March and April of 1,519 investors age 45-75 with more than $100,000 in investable assets and 602 financial professionals.

The organizations found a disconnect between investor interest and advisors’ perception of investor interest.

“The high-level of interest in annuities and protection among younger investors is extraordinary,” said Jean Statler, CEO of the Alliance for Lifetime Income. “Unfortunately, there’s still a large gap between what investors say is important to them and what financial professionals think is important.”

A majority (55%) of all investors in the survey said protecting income is “very important” to them, but only 39% of financial professionals agreed.

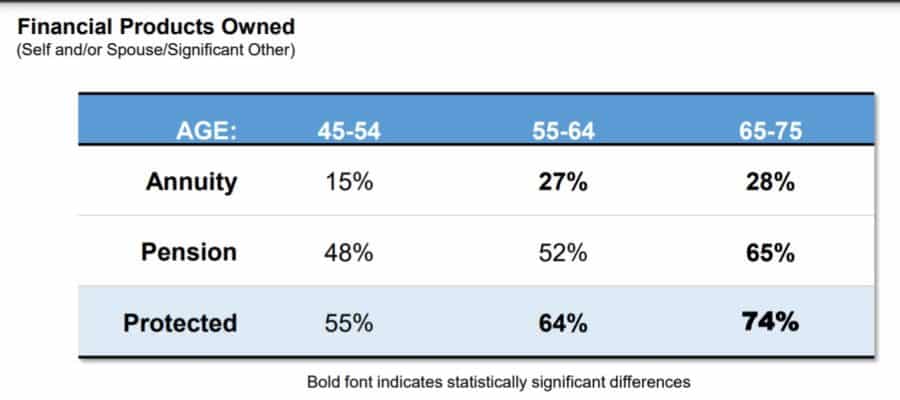

The issue is more pressing for the Gen Xers surveyed as less than a majority (48%) have a pension. Only 15% have an annuity.

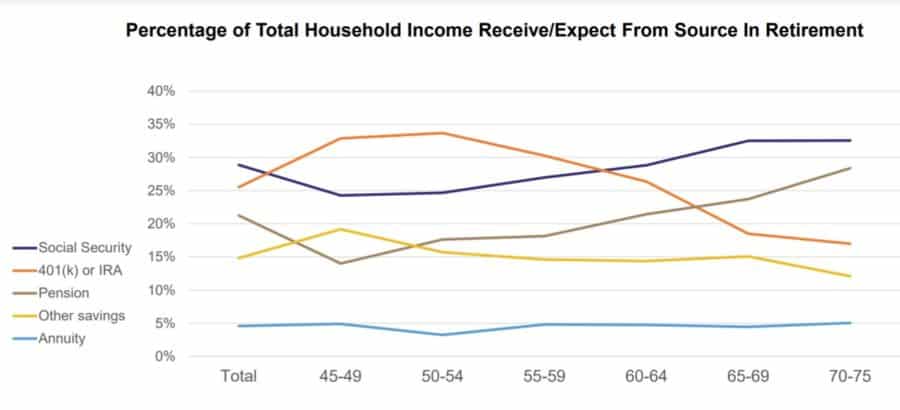

Younger investors expected that their retirement funds, such as a 401(k), will be more of a source of retirement money than Social Security. The youngest end of Gen Xers, 45-49, expect their “other savings” will be there for them more than pensions.

Gen Xers are three times more likely than those 65 and older to express extreme interest in purchasing an annuity as part of their retirement income plan, according to the report.

The pressure is rapidly building for younger generations to fortify their retirement funding as the percentage of retirees grows, putting the squeeze on Social Security. The retirement tsunami has always been a far-off wave but the researchers cautioned that Peak 65 is a mere few years away.

“The research also suggests that this trend will become even more pronounced as we approach Peak 65 in 2024, when more Americans will turn the traditional retirement age of 65 than at any other time in history,” according to the report. “Among those who have not yet discussed strategies for getting income from their assets with a financial professional, younger investors—aged 45-54—are the most interested in doing so.”

Advisors Catching On?

Financial professionals traditionally have been somewhat wary of annuities, but a majority (65%) shifted their approach to retirement planning during the pandemic. Low interest rates (71%) and reduced return on bonds (49%) were the top two reasons cited for the change.

Other findings on advisors:

• Financial professionals know the importance of retirement income planning and have had conversations about it with eight out of 10 clients who are age 55 or older Most investors who haven’t talked with a financial professional about retirement income have a desire to do so.

• Protection is a key driver underlying most financial professionals’ retirement income planning approach, and for most at least a moderately important dimension in growth strategies 52% of financial professionals say one of the benefits to retirement income planning is to create an income stream that lasts a client’s entire life.

• Financial professionals overestimate how complicated their clients think it is to optimize Social Security benefits. Forty-two percent of financial professionals believe their clients think optimizing Social Security is very complicated; while only 7% of investors actually believe it is.

• Forty percent of financial professionals say they are only somewhat knowledgeable or not at all knowledgeable about annuities. However, this rises to 50% among registered investment advisors.

• Eighty-seven percent of advisors use income through withdrawals from an investment portfolio at least a moderate amount of the time with their clients. Advisors who more explicitly use income protection strategies make different product selection choices—more often recognizing the value and importance of protected income through annuities.

The reliance on asset withdrawal and low annuity awareness are not completely aligned with client concerns, said Tamiko Toland, CANNEX director for retirement markets.

“Financial professionals continue to substantially underestimate how much their clients are looking for protected income in retirement,” Toland said. “The retirement planning environment will look completely different 10 years from now. While the majority of advisors changed their planning approach in response to the current fixed income environment, many still don’t fully appreciate the various ways that annuities can fill that gap. Furthermore, the strategies that many have traditionally used to generate retirement income for their clients just don’t work like they used to. This is all compounded by the long-term changes in product demand being driven by the interplay of demographics and disappearing pensions.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

F&G Introduces Dynamic Accumulator FILA

Delaware, NY, Debate Legislation To Join The Insurance Compact

Advisor News

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

More Advisor NewsHealth/Employee Benefits News

- House Dems roll out affordability plan, take aim at Reynolds' priorities

- Municipal healthcare costs loom as officials look to fiscal 2027 budget

- Free Va. clinics brace for surge

- Far fewer people buy Obamacare coverage as insurance premiums spike

- AT FTC'S REQUEST, COURT HALTS OPERATIONS OF DECEPTIVE HEALTH CARE TELEMARKETERS

More Health/Employee Benefits NewsLife Insurance News

Property and Casualty News

- Insurer profits surge, but Connecticut homeowners shouldn't expect lower premiums

- Pritzker pushes back at State Farm in escalating fight for tighter insurance regulations

- Trademark Application for “EVERY DAY, A DAY TO DO RIGHT” Filed by Hartford Fire Insurance Company: Hartford Fire Insurance Company

- Hochul details plans to crack down on auto insurance fraud

- Lapse in flood insurance program could stymie home closings in NC

More Property and Casualty News