Millennials, Gen Z twice as likely to get financial advice online, study finds

Financial professionals should leverage social media to connect with millennials and Gen Z, as new research indicates they are twice as likely to get financial advice online than from a professional, says financial counselor Myles Ma.

“Advisors need to be where their clients are, and for these younger generations, that’s on social media,” said Ma, a certified personal financial counselor at Policygenius.

He noted that the willingness of younger generations to try popular “financial hack” trends from social media, and their openness to non-traditional financial assets, indicates they are interested in financial advice. However, he suggested that this should prompt advisors to incorporate more education on the fundamentals of financial planning and investing.

“It’s clear these groups are still interested in professional financial advice. No matter the generation, the most popular place to turn first for financial advice was financial professionals,” Ma said.

Social media takeover

According to the Policygenius 2024 Financial Planning Survey, 62% of millennials (ages 27-24) and Gen Z (ages 18-26) have tried at least social media “finance hack” trends such as:

- Day trading

- Infinite banking

- Maximizing credit card rewards

- Cash stuffing” or envelope budgeting

- The no-spend challenge

- Extreme couponing

In comparison, just 36% of older generations said they have tried these methods.

“We didn’t ask specifically about Americans’ priorities for financial advice, products or solutions, but given that these generations are the most likely to try ‘financial hacks,’ it’s clear they’re interested in finding ways to make their budgets stretch,” Ma said.

However, the percentage of millennials and Gen Z who first turned to a professional for financial advice was far lower than older ages.

Thirty-nine percent of baby boomers and 27% of Gen X said they would first turn to a financial professional if they had questions about their finances. In comparison, just 18% of millennials and an even lower 15% of Gen Z said the same.

These younger generations were far more likely to turn to their parents or to online for financial advice than the older generations were, with Gen Z being the most likely age group to get financial advice online.

“Advisors should establish a strong presence on platforms like Instagram, YouTube and TikTok, creating content that addresses common financial concerns for millennials and Gen Z and introducing financial concepts in easy-to-digest ways,” Ma said. “They may also want to partner with influencers who are popular with these demographics.”

Non-traditional investments

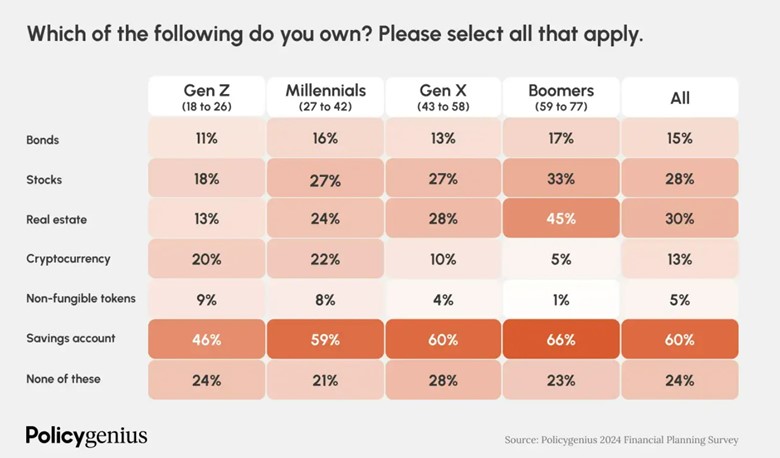

Policygenius also found the younger generation was more willing to consider investing in non-traditional avenues to wealth, such as investing in cryptocurrencies and “infinite banking,” than traditional avenues such as stocks and real estate.

Gen Z in particular was found to be more likely to own cryptocurrency than stocks. This age group was most likely to either have no investments aside from a savings account (24%) or to own cryptocurrency (20%).

Millennials were more likely to own stocks (27%) and real estate (22%) than cryptocurrency (22%), or to have no investments at all (21%).

In comparison, Gen X and baby boomers were most likely to own real estate and cryptocurrency and least likely to own cryptocurrency. Just 10% of Gen X and 5% of boomers who responded said they own this form of investment.

Another popular investment trend, non-fungible tokens (NFTs), were also more likely to be purchased by the younger generation than any other age group. Nine percent of Gen Z respondents and 8% of millennial respondents indicated they own NFTs, as compared to 4% of Gen X and 1% of baby boomers.

“Advisors should tailor advice to these generations, incorporating more education about the risks of these novel investments and also about traditional financial assets like real estate and the stock market,” Ma said.

Unique challenges face younger generation

However, Ma encouraged financial advisors to pay attention to the unique economic challenges millennials and Gen Z are facing.

He highlighted the North American housing shortage, which is making it more difficult for the younger generation to accumulate wealth compared to baby boomers.

“Advisors need to reckon with the barriers these generations have to traditional asset accumulation, like high interest rates, stagnant wages and low housing stock,” he said.

These challenges may leave younger Americans in a financial position they feel “ashamed” of, according to Policygenius’ survey. Ma suggested advisors take note of this in their approach to helping Gen Z and millennials explore alternative pathways to wealth accumulation and retirement planning.

“Based on the different levels of pride each generation feels about their financial management (Boomers feel the most pride, Zoomers and Gen X feel the least), advisors might need to provide more reassurance, education and tailored advice to young clients to boost their confidence in managing their finances,” Ma said.

Policygenius is an online insurance marketplace. Its 2024 Financial Planning Survey was conducted in October 2023 and carried out by YouGov, with results weighted to reflect the U.S. adult population.

Rayne Morgan is a content marketing manager with PolicyAdvisor.com and a freelance journalist and copywriter.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Rayne Morgan is a journalist, copywriter, and editor with over 10 years' combined experience in digital content and print media. You can reach her at [email protected].

Allianz focuses on accumulation market with new FIA

Can ChatGPT pass procurement?

Advisor News

- SEC: Get-rich-quick influencer Tai Lopez was running a Ponzi scam

- Companies take greater interest in employee financial wellness

- Tax refund won’t do what fed says it will

- Amazon Go validates a warning to advisors

- Principal builds momentum for 2026 after a strong Q4

More Advisor NewsAnnuity News

- How next-gen pricing tech can help insurers offer better annuity products

- Continental General Acquires Block of Life Insurance, Annuity and Health Policies from State Guaranty Associations

- Lincoln reports strong life/annuity sales, executes with ‘discipline and focus’

- LIMRA launches the Lifetime Income Initiative

- 2025 annuity sales creep closer to $500 billion, LIMRA reports

More Annuity NewsHealth/Employee Benefits News

- Lawmakers advance Reynolds’ proposal for submitting state-based health insurance waiver

- Proposal would help small businesses afford health insurance

- Lamont proposes 'Connecticut Option' to help small businesses afford health insurance

- Colorado lawmakers target 'ghost networks' to expand access to mental health care

- NCD WELCOMES COUNCILMEMBER BRIAN PATCHETT

More Health/Employee Benefits NewsLife Insurance News