Execs, regulators debate merits of illustration rules, areas that need work

Insurance companies and consumer advocates have wildly different opinions on the efficacy of illustrations used to sell life insurance and annuities.

A state regulator group sought to understand those differences last week during the National Association of Insurance Commissioner's summer meeting in Chicago. The Life Insurance and Annuities Committee hosted a panel discussion on illustrations with executives from Securian Financial and Athene Life & Annuity.

"I feel like with illustrations, there's a gap between what I'm hearing from consumer representatives and insurance companies that's more significant than what I would otherwise expect, and I can't quite figure out why," said Michael Humphreys, Pennsylvania insurance commissioner. "I'd like us to be comparing illustrations with the same basic premise so we can all agree on whether they pass or fail, but we're not there."

Problems with illustrations go back decades. The combination of agents who often don’t fully understand the products, paired with often unrealistic illustrations, is frustrating regulators and consumer advocates alike.

Dick Weber, president and chief consultant for The Ethical Edge, and a 2024 NAIC consumer liaison, explained why there is a gulf between how carriers and consumer advocates view illustrations.

"It's a different way of looking at the illustration," he said. "Carriers produce illustrations in conformance with [NAIC Model Regulation] 582. The problem is 582 is 30 years old, and it didn't contemplate indexed products, products that use an outside reference rather than a discipline scale or declared rate."

IUL a concern for many

On the life insurance side, indexed universal life draws particular criticism.

Actuarial Guideline 49 was adopted in 2015 to address IUL products created after the original 1995 illustration model #582 was adopted. Insurers quickly got around it by offering IUL products with multipliers and bonuses.

That led to AG 49-A in 2020 and eventually, AG 49-B. Regulators referred to the latter update as “a quick fix” when adopted in 2023. Regulators have repeatedly shied away from an overall illustrations rule rewrite.

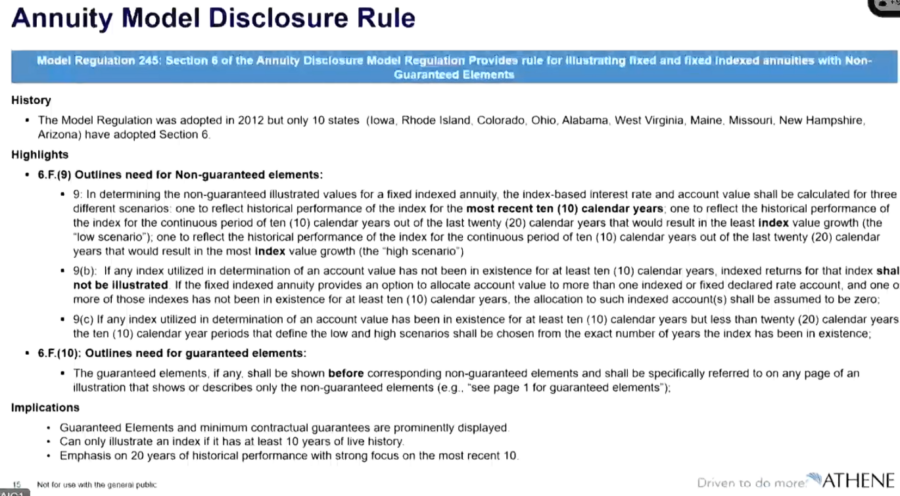

On the annuity side, the NAIC adopted the Annuity Disclosure Model Regulation in 2012. Section six covers illustrations for fixed and fixed-indexed annuities with non-guaranteed elements.

"One of the significant challenges we face is that only 10 states have adopted this specific section dealing with illustrations," explained Mike Considine, executive vice president and head of U.S. Government and regulatory relations for Athene. "Greater adoption across more states would ensure more consistency in how carriers approach annuity illustrations, providing a uniform standard that benefits both consumers and the industry."

Considine previously served as the CEO of the NAIC from January 2017 to May 2023.

Sample illustrations

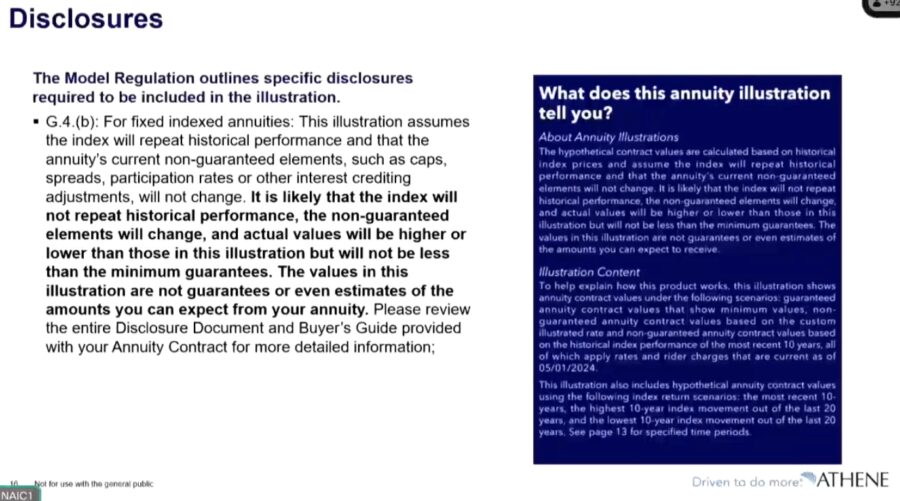

Adam Politzer is chief product officer for Athene. He shared both the disclosure and the illustration the insurer provides to producers who sell its Elite Performance 10 fixed-indexed annuity.

Politzer highlights three things from the disclosure: "One, I think it's very clear that it's hypothetical. Two, the illustration is there to explain how the contract works. And then lastly, I think it's pretty clear that it's not a promise of performance. I think all these disclosures are critical in the effectiveness of the illustration."

Athene's FIA illustrations show a full range of possibilities, Politzer noted.

One issue is the lack of history with many proprietary indices developed by insurers. A traditional index like the S&P 500 has decades of history to provide consumers with thorough illustrations based on historical performance. Newer indices don't have that, Politzer acknowledged.

"It's been a bull run over the last 10 to 20 years," he explained. "As a result, any reliance on that period of data is going to show a somewhat optimistic forecast of the contract. It's just the nature of how the math is completed. We've actually added an extra disclosure to our illustration as a result."

Politzer conceded that some illustrations were unreasonably high and said Athene pulled "a couple because we weren't comfortable putting them in front of customers."

Matt Gendron is general counsel and chief of market conduct at the Rhode Island Department of Business Regulation.

"I see there being problems in the marketing of these products, not necessarily by the companies," he said. "That said, I do think there might be some oversight that could be helpful from the companies to ensure that their representatives in the marketplace aren't taking bad steps and using their documents, not in a nefarious way, but in an overly aggressive way."

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

High interest rates put chokehold on whole life in flat Q2 , LIMRA finds

How to recognize – and get over – a sales slump

Advisor News

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

More Advisor NewsAnnuity News

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

- FIAs are growing as the primary retirement planning tool

More Annuity NewsHealth/Employee Benefits News

- Red and blue states want to lLimit AI in insurance; Trump wants to limit states

- Researchers from Boston University Report Findings in Managed Care (Unexplained Pauses In Centers for Disease Control and Prevention Surveillance: Erosion of the Public Evidence Base for Health Policy): Managed Care

- New Managed Care Study Results Reported from University of Houston (Impact of Adjuvant GLP-1RA Treatment on the Adherence of Second-Generation Antipsychotics in Nondiabetic Adults): Managed Care

- New Findings on Managed Care Reported by Lane Moore et al (State Disparities in Medicaid Versus Medicare Reimbursement for Hand Surgery): Managed Care

- New Kentucky House GOP budget fixes insurance issue, ups education spending

More Health/Employee Benefits NewsLife Insurance News