Equitable capitalizes on strong RILA sales environment during Q2

Main takeaway: Registered indexed-linked annuities remain one of the hottest annuity product lines and Equitable Holdings is leading the way.

There is even more room for RILAs to run in the market, Equitable executives told Wall Street analysts during a Wednesday morning call. In the first quarter, Equitable led all insurers with $3.4 billion worth of RILA sales, LIMRA reported.

“Americans growing retirement population is looking for new solutions, so we see them shifting out of target date funds, and into protected equity and income solutions,” said Nick Lane, president of Equitable Financial.

Equitable RILA sales are up 20% year over year and generated $1.9 billion in positive net flows, he added. As speculation grows that the Federal Reserve will slash interest rates in September, Lane said Equitable is unbothered.

“We reprice every two weeks to reflect interest rates, option pricing in the credit spread environment,” he said. “As a pioneer in this market over a decade ago in low interest rate environments, we think the core value proposition of protected equities continues to resonate out there.”

RILAs are selling and growing so strongly that several new entrants are rumored to be bringing products to the market. Lane took a magnanimous view of the competition.

“We still view any competition as raising advisor and consumer awareness, further growing the pie,” he said. “As a pioneer in the space, we believe we're in a privileged position given our distribution networks. … It's easy to file a product. It's very difficult to get a distribution network and it's very difficult to get advisors.”

Any additional takeaways

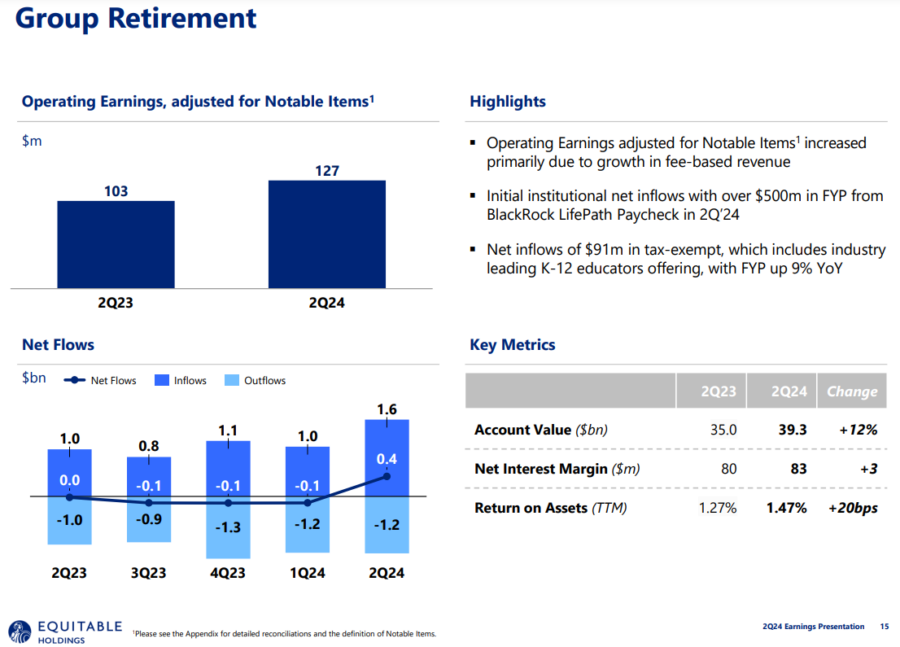

Mark Pearson, president and CEO of Equitable Holdings, stressed the enormous potential for in-plan annuities. Equitable reported its first revenue – more than $500 million -- from a partnership with BlackRock.

Earlier this year, the two companies announced LifePath Paycheck, which offers “guaranteed income” via a target date fund.

When a participant enters retirement, they will receive a guaranteed amount of funds in a paycheck-like manner that is meant to provide a stable source of income. By providing access to guaranteed income through a target date fund, LifePath Paycheck is meant to be more stable than a standard 401(k).

Pearson described the returns from BlackRock venture as “lumpy.” Equitable expects “minimal new flows” in the third quarter, with more plans funding in the fourth quarter and the first half of 2025, he added.

“We're also having discussions with other potential asset manager partners,” Pearson said. “And we're pleased to see the recognition across the industry of the need for guaranteed income solutions within defined contribution plans.”

Management Commentary

“Our predictable cash flow, half of which comes from non-insurance businesses, enables us to fund organic growth, while also consistently paying out 60% to 70% of our earnings to shareholders. Putting it all together, I believe equitable has the right business model and strategy to take advantage of the current favorable environment for growth.”

– Mark Pearson, president and CEO

Financial Overview

Total assets under management: $986 billion ($887 billion in Q2 2023)

Net Income: $428 million ($759 million in Q2 2023)

Earnings Per Share: $1.43 ($1.17 in Q2 2023)

Operating Income: $494 million ($441 in Q2 2023)

Share repurchases: Returned $325 million to shareholders

Stock price movement: $43.61, up 1% at the end of Wednesday

Segment Performance

Individual Retirement:

- Account Value: $101.9 billion ($83.9 billion in Q2 2023)

- Net flows: $1.9 billion ($1.5 billion in Q2 2023)

- Operating earnings: $234 million ($234 million in Q2 2023)

Group Retirement:

- Account Value: $39.3 billion ($35 billion in Q2 2023)

- Net flows: $408 million ($20 million loss in Q2 2023)

- Operating earnings: $123 million ($107 million in Q2 2023)

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Lincoln Financial’s strategic changes spur strong Q2

Corebridge Financial stuns analysts with 68% bump in annuity premium

Advisor News

- Most Americans optimistic about a financial ‘resolution rebound’ in 2026

- Mitigating recession-based client anxiety

- Terri Kallsen begins board chair role at CFP Board

- Advisors underestimate demand for steady, guaranteed income, survey shows

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

More Advisor NewsAnnuity News

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

- Jackson Financial Inc. and TPG Inc. Announce Long-Term Strategic Partnership

- An Application for the Trademark “EMPOWER PERSONAL WEALTH” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

More Annuity NewsHealth/Employee Benefits News

- St. Louis police regain lifetime health insurance. City officials are alarmed.

- Sorensen and Miller-Meeks disagree on ACA health insurance subsidies, oppose shutdown

- Idaho Gov. Brad Little says he won’t support repeal of Medicaid expansion

- As class-action lawsuit continues, advocates say Johnstown stuck in 'pharmacy desert'

- Mass. will spend $250M to lower health insurance bills after federal subsidies expired

More Health/Employee Benefits NewsLife Insurance News