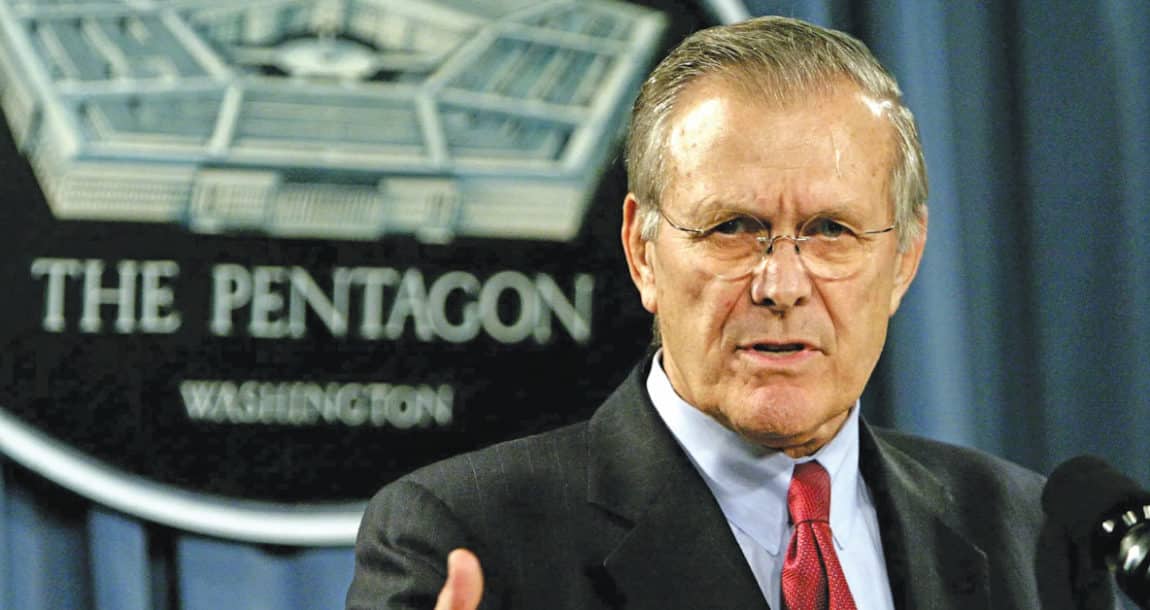

Donald Rumsfeld Would Have Made A Great Annuity Advisor

Former Secretary of Defense Donald Rumsfeld was nothing if not provocative in his press conferences. Twenty years ago, during the buildup to the Iraq war and the premise of Saddam Hussein’s regime harboring weapons of mass destruction, he addressed the news media in a 2002 press conference.

“As we know, there are known knowns. There are things we know we know. We also know there are known unknowns. That is to say, we know there are some things we do not know. But there are also unknown unknowns — the ones we don’t know we don’t know.”

When it comes to retirement income planning, it is good to be aware of each of these conditions and to plan accordingly.

Known Knowns

» We should know how much Social Security income our clients likely will receive, and whether they have any other sources of lifetime income such as pensions.

This information should be the foundation of a plan, with few to no surprises in store for clients.

Known Unknowns

» Two of the biggest unknowns that we know of are mortality and market performance — specifically the timing of mortality and the timing and scale of market performance.

Unknown Unknowns

» This one is a bit different. BusinessDictionary.com defines “unknown unknowns” as follows: “Future circumstances, events or outcomes that are impossible to predict, plan for or even know where or when to look for.”

From a current events standpoint, its fair to say that the COVID-19 pandemic that began in 2020 falls into this category. Nobody was anticipating anything like the virus ripping around the globe and shutting down economic activity for extended periods. Nor was anybody anticipating that the market would recover and reach new highs while the pandemic still raged.

It’s the middle category — the known unknowns — that would seem to be the area where planners can provide the most value to their clients. This is particularly true for planners with clients who are within about five years of retirement and have healthy retirement savings but no pensions waiting for them.

These clients are both lucky and unlucky at the same time — lucky to have had great careers, earned a good living and saved substantial sums, into the seven figures in many cases. But they are also unlucky in that without a pension, the bulk of their retirement cash flow must be generated from their own assets, with no guarantees.

And with no guarantees, two key unknowns loom large. The first unknown is the timing and scale of market performance on which their portfolios will rely for growth. Will markets climb before and during the early years of retirement and spare them the agony of a bad sequence of returns — or not?

The second known unknown is mortality. Will they live until age 75, 85, 95, 105? How about their spouse? Think of it this way — for a healthy 65-year-old couple, if you assume each of them dies within 30 years if they plan to age 95, there are 900 combinations of mortality timing (30 x 30) that are and will remain unknown. This means that planning with precision for income needs and wants over a 30-year period without guaranteed solutions is difficult at best and likely to be highly inefficient.

Easing The Known Unknowns

A fixed indexed annuity with a guaranteed lifetime withdrawal benefit removes the ill effects of those two known unknowns, improving the efficiency of the planning process. The FIA can be structured to provide guaranteed cash flow to both spouses for life. With some time to bake the guarantees for a few years prior to starting withdrawals, cash flow can be in the range of 6% to 7% of the purchase amount for life. In this super-low-yield environment, that’s a nice core cash flow to supplement Social Security.

More to the point, with rates likely to continue rising over time and hurting fixed-income values and with equity valuations today trading near all-time highs, assumptions about future returns from the capital markets should be looked at with a jaundiced eye.

For example, the last time the Shiller Cyclically Adjusted Price Earnings ratio (named for its creator, Yale University professor Robert Shiller) was at the levels it closed at on Oct. 29, 2021 (about 39), was in the tech bubble years of 1999, 2000 and 2001. (Source: Shiller PE Ratio by Year (multpl.com))

A $100,000 investment in the S&P 500 Total Return index on Jan. 1 of each of those years produced tepid results five years later. That $100,000 was worth $97,000, $89,000 and $102,000 by year-end 2003, 2004 and 2005, respectively. In contrast, the past five years have seen spectacular results, but the Shiller CAPE was much lower on Jan. 1, 2016, at 24. That same $100,000 invested on Jan. 1, 2016, more than doubled to $203,000 by the end of 2020. Recency bias, anyone? (Source: moneychimp.com, CAGR of the stock market)

As good a harbinger of future equity returns as the CAPE has been, nobody knows what markets will look like next week, let alone in five years’ time. But for clients looking for more certainty and less probability in their income planning, an FIA with a guaranteed lifetime withdrawal benefit can be a powerful tool. Today’s more competitive products can guarantee a lifetime cash flow of 6% or 7% or more of the original purchase payment, covering both spouses.

Think how comforting that kind of cash flow reserve would be in five years should markets lose steam, and how valuable that core cash flow can be in allowing any depleted portfolio values to be restored over time without being burdened by withdrawals while markets are down.

Donald Rumsfeld, we hardly knew ye, but your work on known unknowns remains a valuable tenet of retirement income planning for today’s pensionless masses. The annuity industry has a solution for addressing the two biggest known unknowns: mortality and markets.

John Rafferty is principal at Rafferty Annuity Framing, Spring, Texas. John may be contacted at [email protected].

Life Insurance: The Financial Offense vs. The Financial Defense

3 Reasons Your Clients Need You To Provide Medicare Advice

Advisor News

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

More Advisor NewsAnnuity News

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

- Assured Guaranty Enters Annuity Reinsurance Market

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

- Guaranty Income Life Marks 100th Anniversary

- Delaware Life Insurance Company Launches Industry’s First Fixed Indexed Annuity with Bitcoin Exposure

More Annuity NewsHealth/Employee Benefits News

- Recent Reports from National Yang Ming Chiao Tung University Highlight Findings in Women’s Health (Health-care utilization after domestic violence: A nationwide study in Taiwan comparing individuals with and without intellectual disability): Women’s Health

- WHAT THEY ARE SAYING: LOWERING PREMIUMS MEANS ADDRESSING THE TRUE DRIVERS OF HIGHER HEALTH CARE COSTS

- Health insurance increase of $1,100 (or around $4,000 for a family of 4) creates big questions

- Researchers at U.S. International University Publish New Data on Health Insurance (The Combined Effects of Digital Health Interventions on Universal Health Coverage Equity in Kenya: An Integrated Approach): Health Insurance

- In WA, thousands are forgoing health insurance this year. Here’s why

More Health/Employee Benefits NewsLife Insurance News