DOL Not Budging On PTE 2020-02 Deadline

The Department of Labor appears to be listening to advisors and their representatives as they ask for a delay on the Dec. 20 enforcement of its newest investment advice prohibited transaction exemption, but the DOL is still not budging.

Advisors have been asking for an extension on PTE 2020-02 because they say they have not been able to get the compliance structure together, said Brad Campbell, Faegre Drinker partner and former DOL official, during the firm’s quarterly Inside the Beltway webinar on Thursday.

“They've been talking to DOL about that and DOL has been listening, but so far, no movement,” Campbell said. “We're already operating under the new guidance. Most rollovers are going to be fiduciary advice, and you need to be working on getting in compliance with an exemption by Dec. 20.”

PTE 2020-02 applies to recommendations for rollovers and other movement of retirement money. Broker-dealer representatives and investment advisors can use the exemption to collect compensation for transactions involving 401(k)s or IRAs. Insurance producers can still use PTE 84-24 for annuity and life insurance sales involving retirement funds.

But insurance producers should not get too comfortable with relying on PTE 84-24 and even the advisors who get in line with PTE 2020-02 should not breathe too deep a sigh of relief either because the DOL plans to shake the whole thing up again.

“Separately, DOL has said even though we've just issued this new guidance, newish guidance, we still think the rule itself needs to be changed,” Campbell said. “They've announced that in December, they're scheduled to propose a whole new fiduciary rule replacing the 1975 rule. … They're going to have a long debate over the course of next year about what the new regulation should read. And then we'll have to go through another round of compliance probably in 2023. So, the fiduciary rule is the gift that keeps on giving in terms of constant change, interpretation and things.”

Fred Reish, another Faegre Drinker partner on the call, clarified the four steps that advisors must take now to satisfy the current impartial conduct standard and a fifth one that the DOL plans to enforce on Dec. 20.

The four are: know the investor’s relevant information as in an investor profile, know the details of the plan that they are in, know the IRA that the participant might roll into and ensure that the recommendation would be in the best interest of the client in the judgment of a knowledgeable, objective third party.

The second step can be tricky, Reish said, because retirement plan participants often don’t know what an annual 404(a)(5) fee disclosure notice is, much less where to find it. That disclosure shows the fees the client is paying in the current plan, which is the base of comparison with compensation involved in the new investment or product. The DOL has been clear that they are not allowing exceptions in getting that information, Reish said.

The new fifth step is written disclosure as to why the rollover recommendation is in the participant’s best interest.

“And obviously, from a lawyer and a risk management perspective, that's a little scary,” Reish said, “because that piece of paper, if it's flawed in some way, and maybe not flawed, could come back to be the basis for a claim either a justifiable claim if it's flawed, or a non-justifiable claim, but a claim nonetheless.”

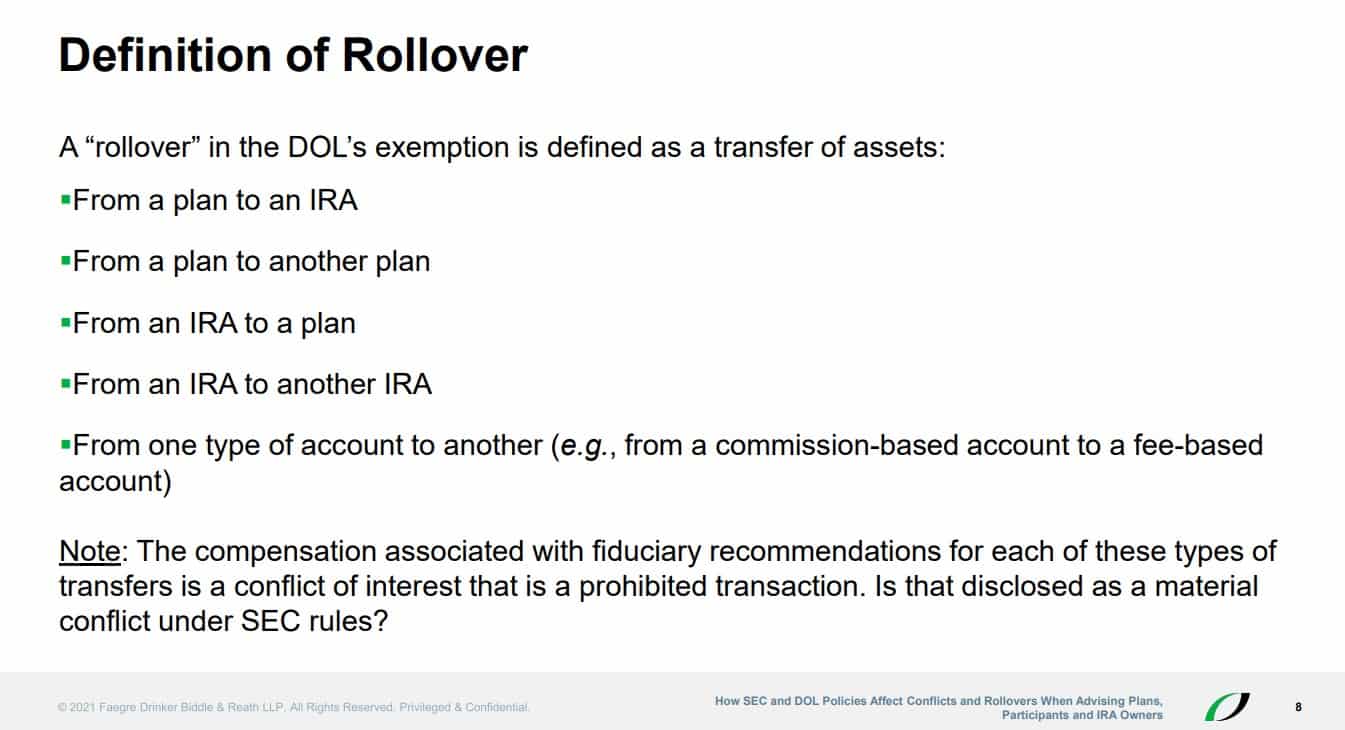

Advisors also should not get too limited in what they see falling under what the DOL calls a rollover recommendation, Reish said. Some examples are a rollover from an IRA to a plan, transferring an IRA from one firm to another and even switching from a commission-based account to a fee-based account within an IRA, he said.

Campbell added that Tim Hauser, considered the DOL’s chief operating officer, has been saying publicly that advisors should not think that they can go close to the line and not tip over into conflicted advice just because they did not actually say “therefore I recommend a rollover.”

“Basically, what he's trying to suggest is, well, if you're going to be managing the money on the other side, chances are you've probably been involved in making, whether you use the magic words or not, the recommendation on the rollover,” Campbell said. “And we at DOL are going to be watching. I don't think you can slide by on a technicality.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

CFP Board Adopts 5-Year Strategic Plan Framework

Biggest Raise In Decades For Social Security?

Advisor News

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

- Helping clients up the impact of their charitable giving with a DAF

- 3 tax planning strategies under One Big Beautiful Bill

More Advisor NewsAnnuity News

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

- Venerable Announces Head of Flow Reinsurance

- 3 tax planning strategies under One Big Beautiful Bill

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News