When advising young investors, it’s all about ‘cutting through the noise’

Ron Tallou, the founder of Tallou Financial Services, says working as a financial advisor to young people is not about convincing them or persuading them of the virtues of saving and investing. It’s frequently not even about selling them products.

More often, it’s about talking them out of ideas and decisions that they’ve picked up who knows where.

“The younger generation is very much social media driven, and they can get caught up in what they see from others and not always realize it is an illusion and if you try to keep up with what you see you can set yourself back,” says Tallou, himself a comparative youngster at 35 years old. “I also find the younger generation does not have a good sense of where to invest. They get caught up in what someone posts online about a particular crypto, or stock, so I have to talk them out of not putting too much of their savings into speculative investments.”

It is a familiar refrain among financial planners who concede that young clients don’t come looking for information — they are awash in information from TikTok, Twitter, Instagram and the myriad social media platforms. The biggest challenge is getting them to tune out a lot of what they’ve heard or read.

“In my experience, a broad swath of the Gen Z cohort is hindered by two things — unrealistic expectations about income potential, and a propensity to spend rather than save and invest,” says Thomas Brock, CPA, a 20-year veteran of financial investments consulting, corporate finance and accounting. “Helping them increase their economic awareness and embrace a more disciplined financial lifestyle is the way to overcome these deterrents.”

But that’s so old school to many young investors given the myriad of social media “influencers” touting get-rich-fast gimmicks and a general fear of missing out, Brock says.

“Cutting through the noise requires strong personal relationships, consistent messaging and compelling illustrations of how prudent budgeting and long-term investing can drastically impact one’s financial well-being,” he says, in spite of the notion that the tried-and-true methods are the least interesting to the younger crowd.

Blake Pinyan, a senior financial planner and tax manager at Anchor Bay Capital Inc. in Carlsbad, Calif., has a checklist for dealing with Gen Z investors that combines old-school methods with significant upgrades and additions for the emerging cohort.

» Give them the “what” and the “why.” Education and transparency are important to Gen Z clients, but they tend to want to know more about how or why an advisor is making a recommendation. “They need to understand the rationale that goes into each of the advisor’s recommendations,” says Pinyan. “So, when working with these types of clients, it’s very important to clearly explain concepts in simple terms and then confirm that they understand what’s being recommended.” And some want short-term coaching engagements that empower them to be able to manage finances on their own.

» Forget about AUM fees. This age group is in “an accumulation phase,” with housing, children, college loans, and other costs and debts to worry about. They don’t have a lot of assets to manage, and they aren’t too keen on paying fees. “They don’t have money in retirement accounts for outside advisors to manage, but they certainly have a need as far as financial advice and are willing to pay for it, like an annual subscription, or a project, or even an hourly consultation basis,” Pinyan says.

» Be ready to be flexible. Gen Y and Gen Z are generations living busy lives, with full-time jobs, new family and many outside activities. “If you want to serve this market, you need to be open to accommodating meetings in the evening or the occasional weekend,” says Pinyan. “They have many more life changes than a retiree, so they want an advisor that can adapt to potentially meeting more frequently than once or twice a year as things come up within their life.”

» Be up to date with technology and alternative investments. This is a group that’s used to doing everything over the computer or phone, and advisors have to be prepared for that. “They’re fluent in technology, so they definitely expect their advisor and the associated company to be the same,” he says. “They wouldn’t want to be part of an organization that’s paper intensive and has little in the way of the latest software or technology.” Gen Zers are comfortable with secure portals and accustomed to everything being done digitally. “So, you have to have virtual meetings as an option,” Pinyan says. Moreover, they may already have some cybercurrency or cryptocurrency tucked away somewhere, and it is incumbent on the advisor to at least be conversant in that topic.

» The next-generation investors want next generation advisors. “They like the idea of an advisor that can grow with them over time and is not going to retire in a few years. Someone that can resonate with the struggles, challenges, risks and opportunities that they’re facing.”

Surveys indeed show stark differences in Gen Z expectations, desires and needs, compared with older generations when it comes to financial advice and management, Consumer research and data analytics firm J.D. Power, for example, finds that younger clients working with an advisor are much more likely to say they already have a financial plan that they put together themselves, or they want one, compared with other generations. And 60% of those younger consumers with a plan said that they were heavily involved in the process of building the plan (vs. an advisor building it for them) compared with 28% of baby boomers or older customers.

Only 16% of Gen Y/Z said that investment decisions are made by advisor on their behalf, which is about half the rate of boomers and older clients. And 66% of Gen Y/Z said their advisor has discussed the financial needs of their heirs vs. fewer than 50% of older generations.

Craig Martin, executive managing director and global head of Wealth & Lending Intelligence at J.D. Power, recalls the old Smith Barney TV ads with their impersonal slogan: “They make money the old-fashioned way. They earn it.”

“It was like, ‘we’re smart, we make money; you pay us because we make you money,’” Martin said. “Gen Z is much more about money as a means to an end. It’s much more about goals, peace of mind and fulfillment. Not just ‘How can I get the best return?’”

Moreover, the life paths of younger investors have changed greatly from the days of the traditional straight lines of temporarily living with parents, getting an education, starting a career, getting married, buying a house, having kids and working with one company until retirement. Today’s career path for Gen Zers looks more like a spiderweb, Martin said.

“It’s totally different now,” he said. “You start a career, change jobs frequently, maybe move back into your parents’ house for a while, you work at home sometimes, you move around a lot. So, if you think about that in the context of this generation, what they are looking for financially is very different than previous generations.”

In addition, a significant number of young investors want to put their money where it might generate some positive social benefits.

“Something I’ve noticed is that younger investors want their investments to have a positive impact instead of just generating a profit,” said Dre Villeroy, founder and CEO of Los Angeles-based investment manager Beyorch. “Individuals who are interested in investing in ESG (environmental, social and governance) want to know that their funds are making a positive impact on society.”

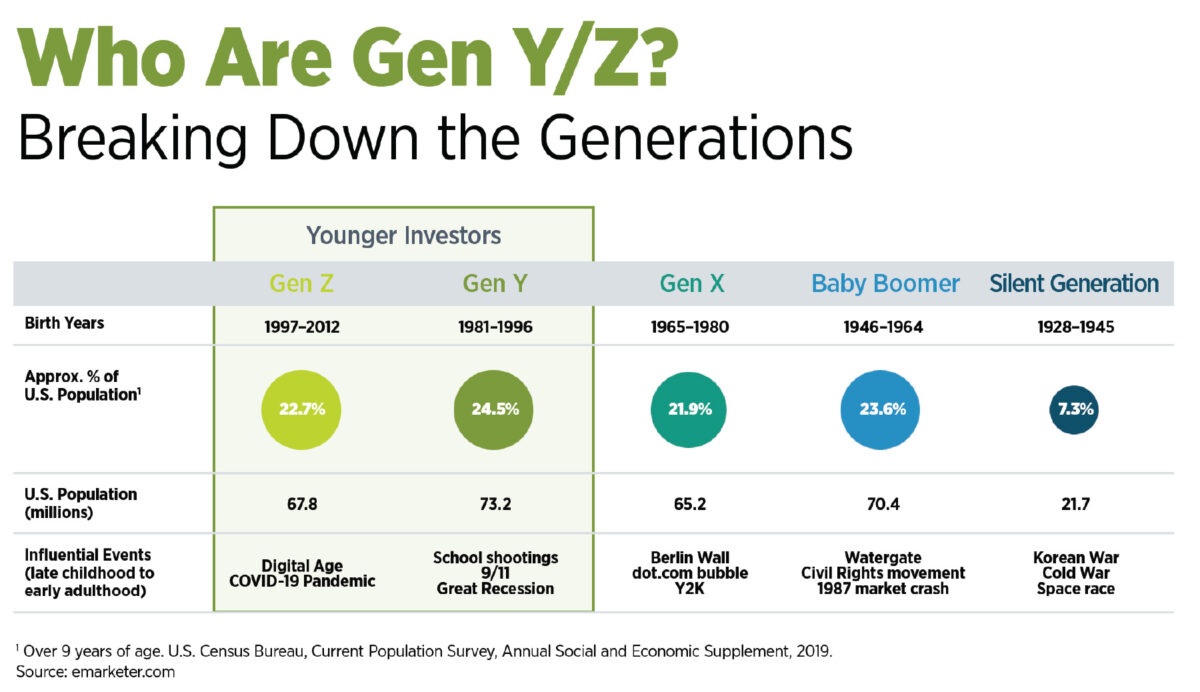

And it’s not like Gen Z and Gen Y don’t have money to spend or will have. Gen Y and Gen Z together make up more than 47% of the U.S. population, and Cerulli Associates of Boston projects wealth transferred between 2021 and 2045 will total $84.4 trillion (roughly $2 trillion per year for 20 years). More than two-thirds of Gen Y/Z investors have already received an inheritance or are set to receive an inheritance.

A recent study by Fidelity Investments confirms many of the comments and anecdotal offerings from investment advisors. Gen Y and Gen Z are more racially and ethnically diverse than previous ones. They have “evolving” paths and values and are more likely to purchase homes and start families later in life than older generations did.

They are digital natives and 45% said they are “online almost constantly.” They seek advice in different ways, with differing planning and investment needs, and they expect more frequent interactions and options for mode of interaction.

“A lot of the fundamental things still hold true, but what I find with this group is that they’re coming into the meeting with more a lot of information and education about you; they’re comfortable with researching for themselves,” said Kimberly Mamaril, vice president of Las Olas Capital Advisors in Fort Lauderdale, Fla. “And I think they really want to look at you as a partner in what they’re doing. My older clients are essentially looking at it as though they’re outsourcing. The young generation is looking for someone who wants to really partner with them and make good decisions together.”

Mamaril says she finds younger investors typically are underinsured, and haven’t thought much about things like life, health and disability insurance, retirement funds, and savings plans.

Fidelity found that among Gen Y/Z investors, 73% would like their financial professional to provide comprehensive services (vs. 30% of boomers). About 64% consolidate assets with a primary financial professional (vs. 21% of boomers). And they are focused on maximizing savings so they can retire early and pursue passions.

As a result of these differences 8 out of 10 advisors say that their firms have either changed or are contemplating a change in pricing models, considering subscription services or by-the-hour models among others.

Another major change Fidelity advises is that financial planners should consider modeling scenarios assuming the client might live to 105 or even longer.

Once clients have the short-term emergency fund saved up, they should explore investments that are going to be tax favorable like 401(k)s, IRAs and Roth IRAs, advises Tallou. “If their company offers a match, take advantage of it and make that the first place to invest. I always recommend to younger adults that are unsure how much to save to start with 10% of your income — ideally you should be able to live off 90% of your income — and if not 10% of gross, then make it 10% of your net paycheck, and slowly increase the increments by 1%. It’s easier to start off with a percentage of earnings because it can be tailored automatically as you make more or less money than carving out a larger dollar amount that might not be sustainable long term.”

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

Shooting for the stars — with AuguStar Retirement’s Clifford Jack

Experts warn insurance industry to buckle up for AI regulation, litigation

Advisor News

- Affordability on Florida lawmakers’ minds as they return to the state Capitol

- Gen X confident in investment decisions, despite having no plan

- Most Americans optimistic about a financial ‘resolution rebound’ in 2026

- Mitigating recession-based client anxiety

- Terri Kallsen begins board chair role at CFP Board

More Advisor NewsAnnuity News

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

- Jackson Financial Inc. and TPG Inc. Announce Long-Term Strategic Partnership

More Annuity NewsHealth/Employee Benefits News

- Healey taps $250M to offset rising health insurance premiums

- Why the Pittsburgh Post-Gazette’s closure exposes a growing threat to democracy

- TRAHAN SUPPORTS BIPARTISAN LEGISLATION TO END THE GOP HEALTH CARE CRISIS

- CT SENATE GOP: HEALTHCARE COSTS TOO MUCH IN CT, BUT ASSOCIATION HEALTH PLANS NEVER PASS

- Thousands in CT face higher health insurance costs after federal subsidies expired at start of 2026

More Health/Employee Benefits NewsLife Insurance News