COVID Slams Long-Term Care, But Not LTCI

The COVID-19 pandemic slammed long-term care in 2020 but not so much long-term care insurance, at least early in the pandemic.

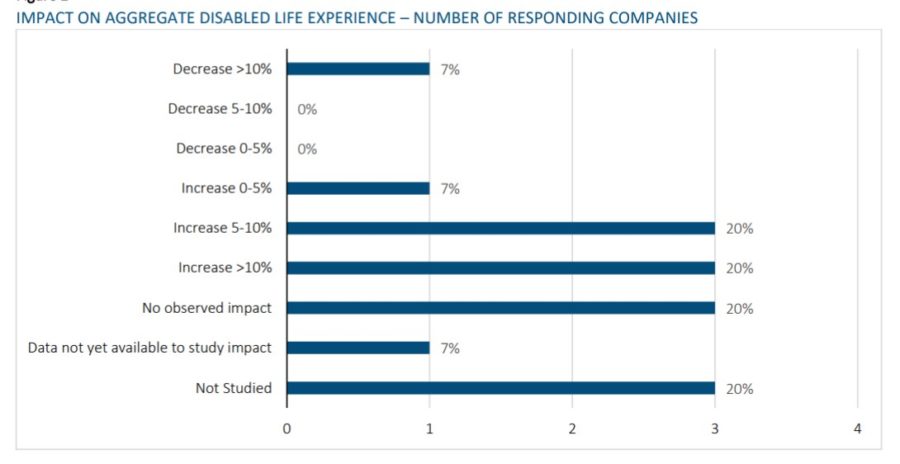

Deaths had increased, particularly among the disabled, according to a Society of Actuaries report. About half of the respondents reported an increase in deaths overall. Half also reported an increase in deaths among the disabled, with three companies showing a higher impact on the disabled over others, while two saw a decrease.

Claims decreased earlier in the year, relative to the carriers’ expectations going into the year.

It was a similar story on the life insurance side. The U.S. life insurance industry recorded its largest year-over-year increase in direct and net death benefits in at least 24 years as excess mortality due to COVID-19 triggered an unusual volume of claims during 2020.

SOA had some ideas about what contributed to the early drop in LTC claims.

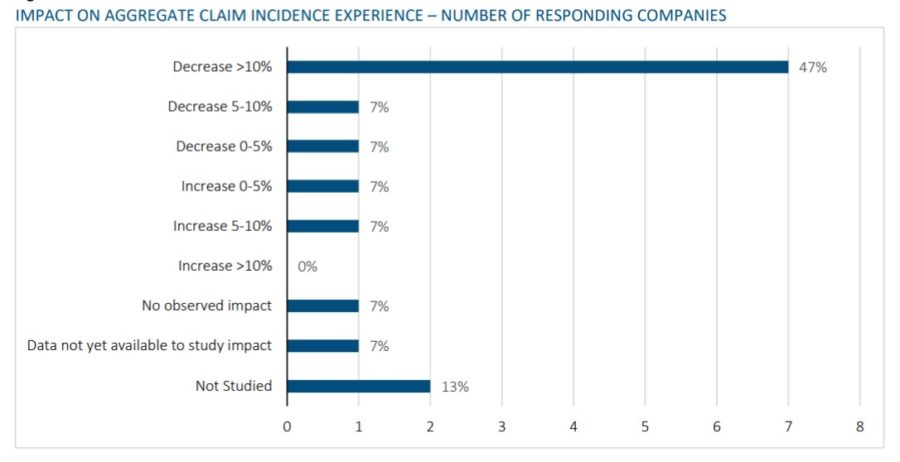

• The biggest impact on morbidity observed by companies thus far has been related to claim incidence. A majority of respondents saw lower claim incidence, with seven companies observing a large decrease (greater than 10%). Stay-at-home orders and lockdowns that occurred throughout much of the U.S. during the second quarter of 2020 likely contributed to this.

• Some companies indicated that claim incidence levels decreased initially but started to regress toward pre-COVID levels by September 2020.

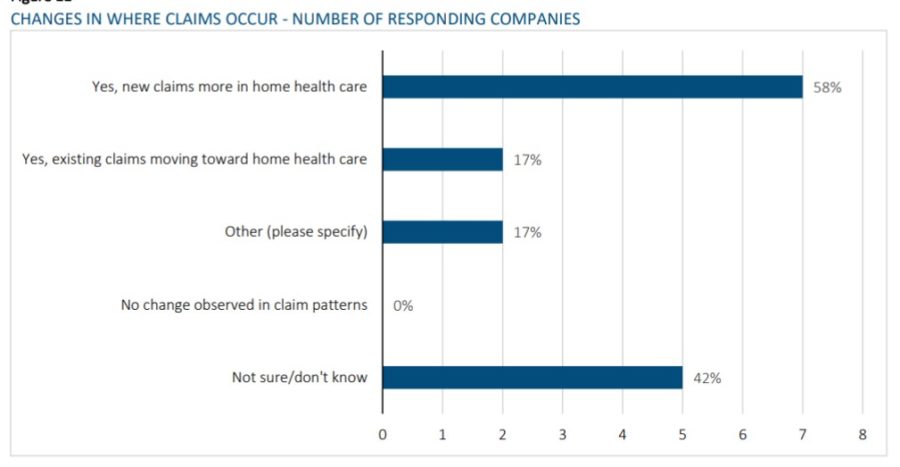

• Seven companies (58%) reported seeing a shift in claim situs toward a home health care setting. This was true for both existing claims and new claims but especially so for new claims.

Another group, the American Academy of Actuaries, agreed that data from mid-2020 showed that carriers were seeing reduced incidence rates, but added that was in the short term.

“At the same time, there will be factors that may increase incidence rates, such as complications or health impairments affecting COVID-19 survivors,” the academy said in a report. “Though there remains significant uncertainty concerning the long-term health impacts of COVID-19, certain complications may lead to higher incidence rates if survivors have decreased ability to perform activities of daily living (ADLs). While more speculative than empirical at this stage, it is hypothesized that, during the pandemic, more people will gain weight and be less fit due to increased stress partially driven by less social interaction, gyms being less accessible, and factors relating to other local restrictions.”

In fact, the American Association for Long-Term Care Insurance reported that carriers paid out nearly 6% more in 2020 over 2019, growing from $11 billion to $11.6 billion.

Many nursing homes and assisted living facilities closed to new residents, and care moved into homes. The SOA study showed that trend clearly.

Low Lapsing

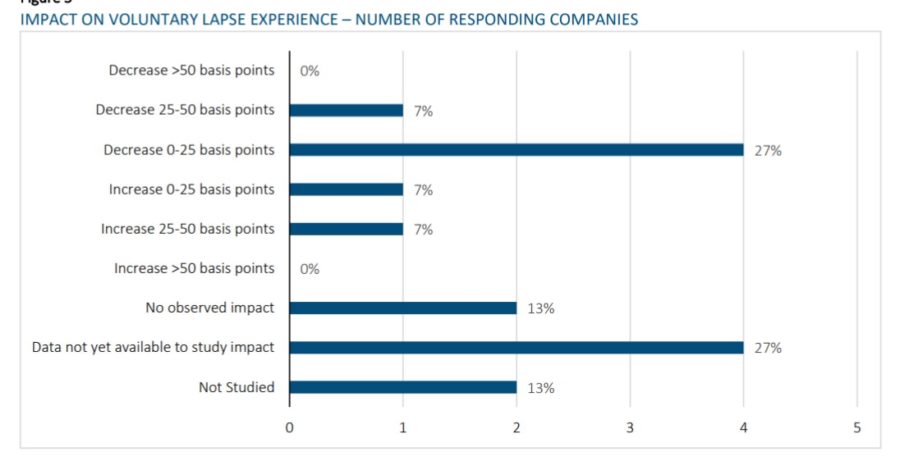

The results on voluntary lapse rates were mixed, with five companies reporting a decrease in lapse rates and two companies reporting an increase in lapse rates, SOA reported. But some companies indicated that they have not adjusted lapse rates for premium grace period extensions due to COVID-19, which may have contributed to the decrease in lapse rates.

The American Academy of Actuaries said in a report that early data did support the notion that LTCI claim terminations would increase in 2020, with one carrier (Unum) announcing that LTC claimant mortality increased by 30% in the second quarter of 2020.

But most of the deaths occurring during the pandemic might not be affecting carriers significantly because they might not have been LTCi insureds.

“With respect to an LTCI privately insured population,” the Academy said, “it bears mentioning that a significant portion of the COVID-19 deaths may be associated with Medicaid-funded homes, which might not house a meaningful number of insureds.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Industry CEOs Show Optimism In The Post-COVID World

JP Morgan To Finance Controversial Breakaway Soccer League

Advisor News

- Metlife study finds less than half of US workforce holistically healthy

- Invigorating client relationships with AI coaching

- SEC: Get-rich-quick influencer Tai Lopez was running a Ponzi scam

- Companies take greater interest in employee financial wellness

- Tax refund won’t do what fed says it will

More Advisor NewsAnnuity News

- The structural rise of structured products

- How next-gen pricing tech can help insurers offer better annuity products

- Continental General Acquires Block of Life Insurance, Annuity and Health Policies from State Guaranty Associations

- Lincoln reports strong life/annuity sales, executes with ‘discipline and focus’

- LIMRA launches the Lifetime Income Initiative

More Annuity NewsHealth/Employee Benefits News

- PLAINFIELD, VERMONT MAN SENTENCED TO 2 YEARS OF PROBATION FOR SOCIAL SECURITY DISABILITY FRAUD

- Broward schools cut coverage of weight-loss drugs to save $12 million

- WA small businesses struggle to keep up with health insurance hikes

- OID announces state-based health insurance exchange

- Cigna plans to lay off 2,000 employees worldwide

More Health/Employee Benefits NewsLife Insurance News