COVID-19 Money Woes Push Americans To Tap Retirement Cash

Courtesy of LIMRA SRI

A new study by Secure Retirement Institute finds American workers who lost their jobs or experienced a drop in income due to the COVID-19 pandemic were at least twice as likely to take money from their qualified retirement savings accounts as those who weren’t impacted.

SRI surveyed more than 1,400 U.S. non-retired households with qualified retirement savings accounts and found almost half (49%) had experienced a reduction in work income (through job loss or decrease in hours and/or a pay cut). These households were more likely than those not directly affected to access their retirement plan balances.

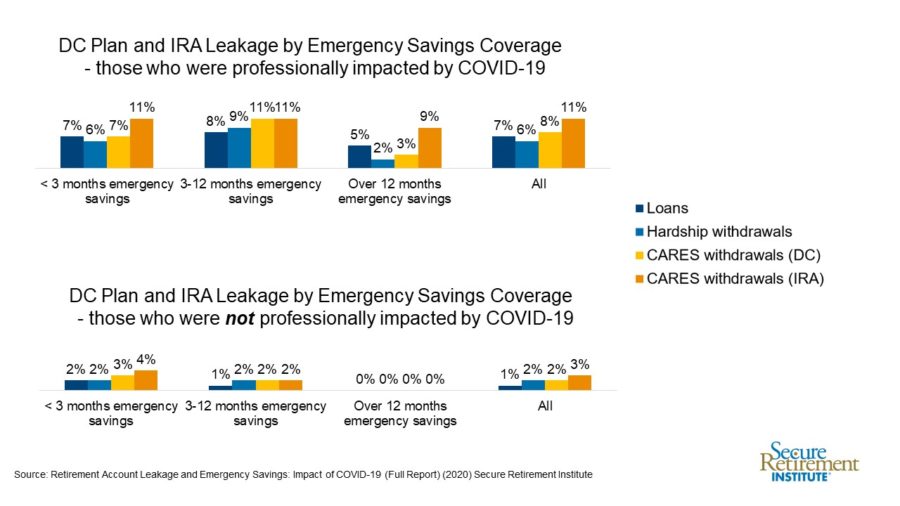

This finding was consistent across emergency savings levels and for all four types of leakage examined. Overall, CARES withdrawals from IRAs were used most frequently, regardless of whether the household was impacted by COVID-19-related work income reductions.

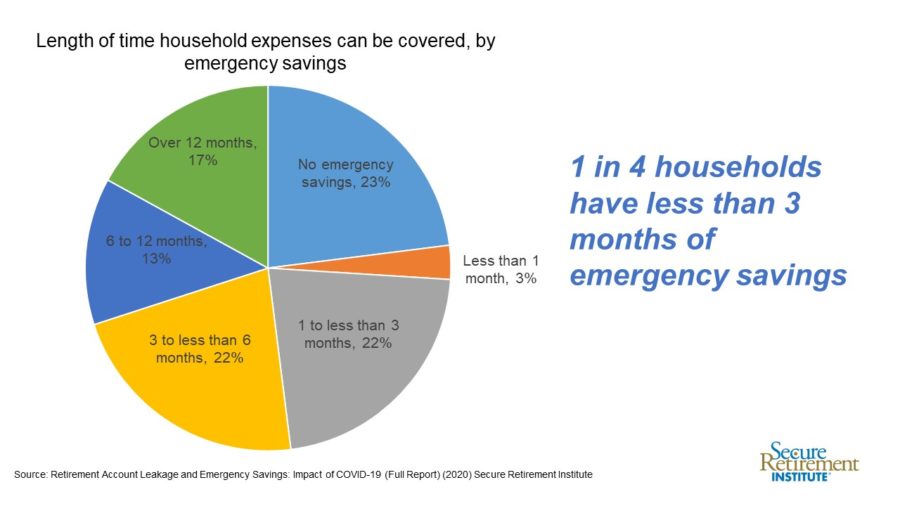

Part of the reason workers — both those whose income was negatively impacted by the pandemic and those unaffected — needed to access their qualified retirement savings accounts was the general lack of emergency savings.

More than a quarter of U.S. workers (26%) say they only have emergency savings to cover less than one month’s expenses and nearly half (48%) report having only enough emergency savings to cover three months’ expenses or less.

“Emergency savings represent the first line of defense for households experiencing a financial shock, such as major unexpected expenses or the loss of a job,” said Matthew Drinkwater, Ph.D., corporate vice president and SRI research director. “In theory, these savings will be tapped before touching any long-term savings, including funds in retirement savings accounts. The lack of emergency funds and the staggering job loss that occurred over the past few months, due to the COVID-19 pandemic, will have long-term ramifications on retirement security for many Americans.”

While the vast majority of households with retirement savings haven’t accessed their qualified retirement savings accounts since the pandemic outbreak, our study reveals households with larger emergency savings funds are less likely to tap into their retirement savings than those with less emergency savings.

In particular, households with emergency savings capable of covering more than a year of expenses are very unlikely to have tapped their retirement savings — this is true for regardless of household wealth.

Retirement account leakage is a significant issue in normal times. According to a Government Accounting Office report, an estimated $69 billion is withdrawn from qualified retirement savings accounts each year by individuals age 25 to 55.

DC plan providers trying to reduce the incidence of leakage should be encouraging employers to offer basic savings accounts along with their DC plans, and to promote additional savings for emergencies, even though such accounts may divert some plan contributions.

Methodology: In early May 2020, SRI conducted an online survey of 1,403 working and unemployed Americans who have retirement savings in a defined contribution plan or IRA to determine the impact of the COVID-19 pandemic on Americans’ retirement savings. The results are weighted to represent the U.S. adult population.

Allianz Life Rolls Out New Benefit To Help Employees With Student Loans Save For Retirement

Mutual Of Omaha Will Remove Native American Image As Its Corporate Logo

Advisor News

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

- Bill that could expand access to annuities headed to the House

More Advisor NewsAnnuity News

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

- Hildene Capital Management Announces Purchase Agreement to Acquire Annuity Provider SILAC

- Removing barriers to annuity adoption in 2026

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Reinsurance Group of America Names Ryan Krueger Senior Vice President, Investor Relations

- iA Financial Group Partners with Empathy to Deliver Comprehensive Bereavement Support to Canadians

- Roeland Tobin Bell

- Judge tosses Penn Mutual whole life lawsuit; plaintiffs to refile

- On the Move: Dec. 4, 2025

More Life Insurance News