COVID-19 Erased Americans’ Financial Gains Of Past 3 Years

The economic fallout from the COVID-19 pandemic revealed how many Americans are financially fragile. We’ve already heard the dire statistics from the U.S. Department of Labor: a record-breaking 30 million people have been thrown out of work, and more than 100,000 small businesses are shutting down permanently.

More than half of U.S. adults saw their finances compromised as a result of COVID-19, according to the Prudential Financial Wellness Census. The study showed that the pandemic largely reversed the past three years of financial gains in the U.S. and brought the percentage of Americans who are financially healthy down to 50%.

Some 26% of respondents saw their income disrupted through furlough, reduced compensation or reduced work hours. Nearly one in five (17%) saw their household income fall by half or more in the months following the COVID-19 outbreak. Fourteen percent lost their jobs as a result of the pandemic. Of those with job loss or income disruption, 17% also lost employer contributions to their retirement plan.

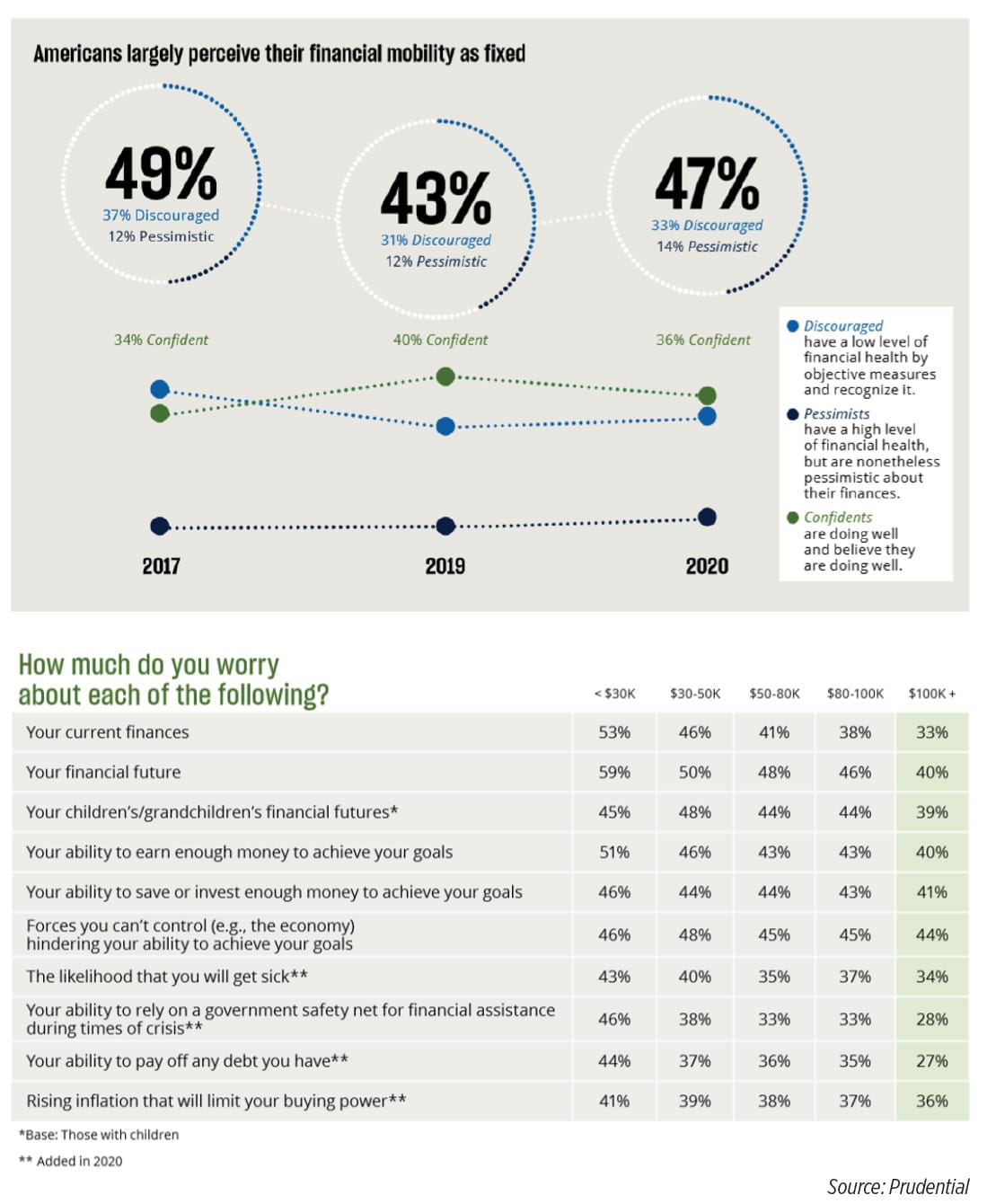

The Prudential study showed that since the pandemic hit, fewer Americans described themselves as “financially confident” as they did in 2019, while more said they are “financially discouraged” or “financially pessimistic” since last year. The percentage of “confident” shrank to 36% from 40% last year.

Meanwhile, the percentage of “discouraged” grew to 33% from 31% in 2019, and the “pessimists” increased to 14% this year from 12% the previous year, making a total of 47% who are unhappy about their financial prospects. That combined percentage of discouraged and pessimistic Americans remained relatively the same even in 2017 — 49% — during the longest economic expansion in U.S. history.

The fact that nearly the same percentage of Americans is dissatisfied about their finances over the 2017-2020 period “revealed a sense of financial inertia out there,” said Jessica Gillespie, senior vice president and head of distribution at Prudential Group Insurance.

“The pandemic is not necessarily the cause of the financial instability, but it has really exposed the cracks in Americans’ financial preparedness.”

The study showed lower-income Americans were hurt far worse by the crisis than were higher earners. More than one-third (34%) of those with annual household income of less than $30,000 have been unemployed during the pandemic, while only 8% of those with household income 0f more than $100,000 were jobless. The unemployment rate for Black Americans nearly tripled from a near-record low of 7% in December to 18% in May.

As a result, nearly half (48%) of Americans said they are anxious about their financial future. This was a jump from the 38% who reported the same feeling in 2019. The highest percentage of those who are worried about their futures are caregivers (58%), followed by retail industry employees, Black Americans and Latino Americans (56%); Generation X (53%); and women and millennials (52%).

The list of financial worries plaguing Americans varies by income group, the study showed. Nearly 60% of those with household incomes of less than $30,000 said they were most concerned about their financial future, compared with 40% who have more than $100,000 in income. But nearly half (48%) of those in the $30,000-$50,000 income bracket said they were most concerned about their children’s or grandchildren’s financial futures and about forces they can’t control (such as the economy) hindering their finances.

- Current finances: 53% of those with less than $30,000 annually; 33% of those with more than $100,000 annually.

- Ability to earn enough money to achieve financial goals: 51% of those with less than $30,000 annually; 40% of those with more than $100,000 annually.

- Ability to save or invest enough money to achieve goals: 46% of those with less than $30,000 annually; 41% of those with more than $100,000 annually.

- The likelihood of getting sick: 43% of those with less than $30,000 annually; 34% of those with more than $100,000 annually.

- The ability to pay off debt: 44% of those with less than $30,000 annually; 27% of those with more than $100,000 annually.

- Rising inflation that will erode buying power: 41% of those with less than $30,000 annually; 36% of those with more than $100,000 annually.

Despite this generally pessimistic view of their finances, Americans’ ability to save money prior to the pandemic appears to be paying off. The study showed 71% of respondents saved money for emergencies in 2019, an increase over the 61% who said they did the same in 2018.

Among those who had established an emergency fund, the median account balance rose to $9,000 from $5,800 in 2018. By May 2020, 86% of those with emergency savings said they still had emergency funds on hand.

“The pandemic has exposed, in sharp relief, the precarity of our public health and economic systems, the pervasive extent of racial and social inequity, and Americans’ low immunity to financial disruption,” the report said. “This crisis will not be the last test of our country’s financial health, and has raised the stark question of whether financial resilience is truly possible.

The answer is not a simple yes or no, so the prescription for recovery neither can be surface level. We must solve deep systemic vulnerabilities and boldly reimagine how people live and work, and how we earn, save, and protect against financial risks. In short, we must rebuild to enable inclusive and sustainable financial security.”

Among the recommendations made in the report are providing greater access to retirement savings vehicles and exploring ways to give all sectors of society the flexibility needed to withstand future economic disruptions.

Will Annuity Regs Get Trumped In November?

The Unexpected Benefits Of Writing A Book

Advisor News

- Americans increasingly worried about new tariffs, worsening inflation

- As tariffs roil market, separate ‘signal from the noise’

- Investors worried about outliving assets

- Essential insights a financial advisor needs to grow their practice

- Goldman Sachs survey identifies top threats to insurer investments

More Advisor NewsAnnuity News

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

- Sammons Financial Group “Goes Digital” in Annuity Transfers

- Somerset Reinsurance Announces the Appointment of Danish Iqbal as CEO

- Majesco Announces Participation in LIMRA 2025: Showcasing Cutting-Edge Innovations in Insurance Technology

More Annuity NewsHealth/Employee Benefits News

- ‘They won’t help me’: Sickest patients face insurance denials despite policy fixes

- Thousands of Missouri construction workers with Anthem health insurance left scrambling

- Don't let death penalty turn Luigi Mangione into a martyr

- More than 5M could lose Medicaid coverage if feds impose work requirements

- Don't make Mangione a martyr

More Health/Employee Benefits NewsLife Insurance News

- 2024 ModeSlavery Report (bpcc modeslavery report 2024 en final)

- Exemption Application under Investment Company Act (Form 40-APP/A)

- Annual Report 2024

- Revised Proxy Soliciting Materials (Form DEFR14A)

- Proxy Statement (Form DEF 14A)

More Life Insurance News