Consumers Want Financial Advice, Not Necessarily From Advisors

In a perilous time when financial advice is more important, consumers are talking to financial advisors even less.

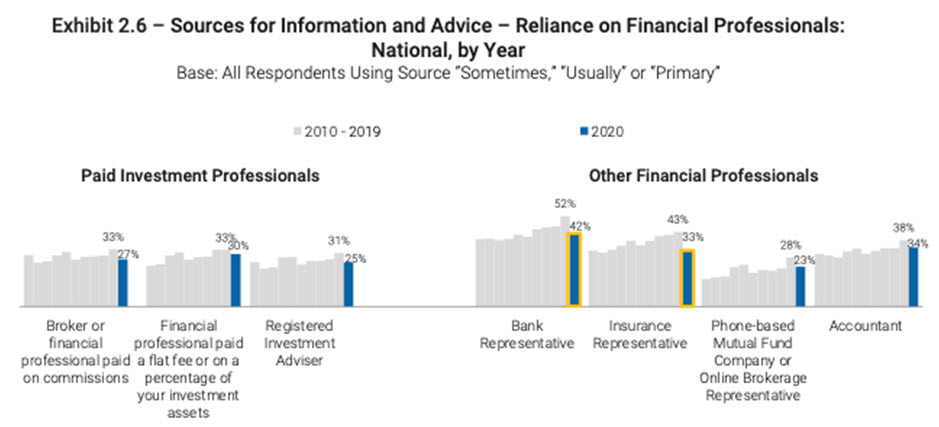

Fewer consumers report consulting financial professionals in 2020 vs. 2019, according to research from Hearts & Wallets.

The decline is bigger for “other financial professionals,” down from 68% to 59%, than “paid investment professionals,” down from 46% to 41%.

Bank and insurance reps show the biggest decline, a 10-point drop, in consumers turning to them as sources for investment information and advice. Fewer consumers also report using paid investment professionals as the “primary/go-to source.”

The decline in reliance on paid investment professionals occurred across all investable asset groups.

Notable is an 11-percentage point drop for consumers with $2 million-plus in investable assets who use paid investment professionals as their go-to/primary source year-over-year. In comparison to the prior year, households with $2M+ were less likely to turn to paid investment professionals as their go-to/primary source than households with $500,000 to less than $2 million.

It's not like consumers went without advice, rather they went online. A growing number of consumers are tapping into multiple sources of advice to make decisions even though consultations with financial professionals dropped over the past year, according to the report.

“Self-directed investors aren’t so self-directed,” said Laura Varas, CEO and founder of Hearts & Wallets. “As options for advice proliferate, consumer behavior shows more people are tapping into more sources of information and advice. This increases the urgency to explain clearly what advice options are available and how they fit together.”

Over the past 10 years, two thirds of consumers nationally have consistently said they want to “make decisions and manage money on my own.” Among those who want help, the appetite for “seeking input from various sources while making some decisions on their own” has increased to a 10-year high at 23%, up from 15% in 2019.

A preference for delegation to financial professionals has decreased to a 10-year low, dropping from 18% in 2019 to 14% last year.

Stated preferences are less predictive of behaviors as consumers of all decision-making preferences say they are turning to more sources for investment information and advice in comparison to 10 years ago.

From 2010 to 2020, consumers who want to “make decisions and manage money on my own” increased the number of sources they turn to from 3.2 to 5.1, while those who “seek input from various sources while making some decisions on their own” increased sources from 4.8 to 7.0. Consumers who “rely primarily on financial professionals to make decisions for me” increased sources from 3.7 to 5.8.

Multiple Sources

In 2020, the top two sources of information and advice investors rely on remain “myself” at 89% and “my spouse/partner[2]” at 80%. Coming in third is financial professionals of all types at 66%, followed by family 60% and online 53%. The sharpest 10-year increases are for online, up from 42% in 2010 to 53% in 2020, and employer-sponsored programs, going from 38% in 2010 to 45% in 2020.

Online Sources

The top online investment activities in 2020 at the national level are check/track accounts and use financial planning tools/calculators. One in four (24%) uses mobile to check/ track accounts, and 16% uses mobile for financial planning tools/calculators. Long-term growth areas related to content activities, such as planning tools and videos, are growing at a faster rate than transaction-related activities, such as get quotes, trade securities and aggregate accounts.

A slight downtick in use of financial planning tools and calculators year-over-year coincided with a switch in device of preference. Mobile is catching up to computer as the device of preference for online investment information and advice activities with one in three households now using a mobile device for at least 1 online investment information and advice activity. Households with $2M+ are engaged with both content and transactional activities and increasingly use online as a “usual” source.

Blending Behaviors

The majority of affluent and young consumers use “any financial professional” and online as sources for investment information and advice. Among consumers who integrate these sources, the most common behavior is to “do my own research first [and] then...validate my findings.” Other blending behaviors are covered in the report.

Methodology

Advice & Technology: Examining How Consumers Combine Professionals, Online and Other Advice Sources analyzes the preferred investment decision-making process, sources for investment advice, and use of technology. The research draws from the Hearts & Wallets Investor Quantitative Database, recognized as the largest single dataset with over 100 million data points on consumer buying patterns from 60,000 U.S. households. The latest IQ Database survey wave was fielded in August 2020 and includes 5,920 U.S. households.

Use HSAs To Maintain The Health-Wealth Connection

Conning’s High Dividend Equity Strategy Continues To Serve Institutional Investors Well

Advisor News

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

- Helping clients up the impact of their charitable giving with a DAF

- 3 tax planning strategies under One Big Beautiful Bill

More Advisor NewsAnnuity News

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

- Venerable Announces Head of Flow Reinsurance

- 3 tax planning strategies under One Big Beautiful Bill

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News