Commentary: The SECURE Act – An Advisor’s Friend or Foe?

By Lloyd Lofton

No bill is a cure-all for the challenges of retirement saving.

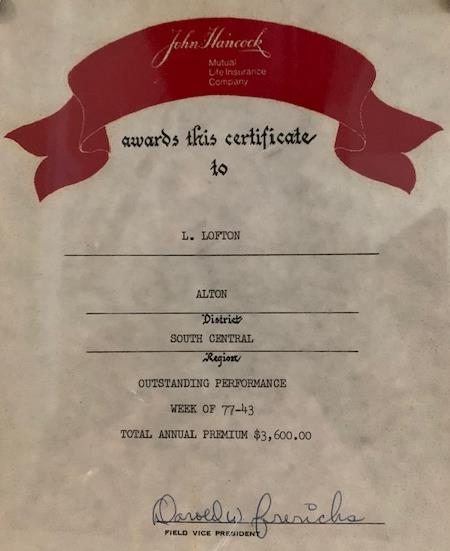

Traditional individual retirement accounts first became available in 1975. I have a plaque in my office from John Hancock recognizing me in weeks 77-43 (that’s 1977) for outstanding performance with a weekly total annual premium of $3,600.

The median household income in 1977 was $13,570, so doing that volume of business was no easy feat.

The maximum annual contribution limit in 1977 was $1,500 and people opened IRAs with taking advantage of only about half that limit.

And I must tell you, when the IRA legislation passed in 1974, agents had no clue what the heck it meant or what we were supposed to do with it.

No internet, no emails and you worked only in your little town. We didn’t even know anyone who knew about IRAs; most insurance companies hadn’t gotten a grasp on who the real market was. My niche became nonprofits, helping employees (low-paid ones at that) get a tax-sheltered annuity (available to nonprofit employees).

The New Cure-All

The SECURE Act, taking effect Jan 1., has been around for a while. The original “retirement enhancement” act was stalled, but as the SECURE Act, it was tacked onto a must-pass spending bill and ta-da!

Parts of it are being talked about as unwelcomed among financial advisors, and I don’t disagree some of the provisions seem counterintuitive for our customers.

For some the SECURE Act will be a foe, gnashing of teeth can be heard around advisors offices across the country. Gloom and doom will prevail for their clients.

For others, every adversity has an equal benefit.

I can hear some of you now, “Really Lloyd?”

What possible benefit am I talking about?

One thing you can always count on, the federal government keeps dissonance in the marketplace, making your role a value that is a constant.

People are either confused, concerned or unaware.

That’s a huge market that opened for you and actionable reasons to get back with all your clients.

2020 is and should be a banner year for your business.

The one question I always hear is, what’s the marketing message? Impact Media did a survey recently and found 70% of people make a purchasing decision to solve a problem, 30% make a purchasing decision to gain something.

The bigger market is those who have a problem to solve.

Don’t run from the SECURE Act! Embrace it, identify the problem your prospects will have because of it, sell them on those problems (not your product or service) and when they ask how they solve those problems –boom!

Here are marketing messaging and benefits of the SECURE Act from my point of view.

Remember – sell the problem people have, then tell them the solution!

Marketing Message – Benefits Of The SECURE Act

Among other provisions in the law, the chatter is the SECURE Act’s change in requirements over inherited IRAs has a downside. Instead of receiving distribution over a beneficiary’s lifetime, those assets must be distributed within 10 years.

Because this provision has potentially significant estate planning implications and advisors routinely struggle with a marketing message to draw in new prospects, here’s your marketing message, your script or your rebuttal talking points.

Client: “Oh, no, I didn’t intend for my loved one’s taxes to go up if they inherit my IRA or 401(k). Do I have any options now that the SECURE Act is law?”

You: “If you were planning to have your beneficiaries receive your assets over your lifetime, now may be the time to review how the SECURE Act impacts your estate plan. Who’s affected – people less than 10 years younger than the decedent, spouses, minor children or disabled individuals. Is that you or someone you know? If so, it’s time to update those estate plans”

Other messages for you to convey to clients:

- “Workers for small businesses can automatically enroll in safe harbor retirement plans through increased caps in 401(k) plans, now up to 15% of wages.”

- “Automatically enroll in an employer 401(k) SIMPLE IRA, receive up to $500 tax credit – each year.”

- “You have part-time employees who work 1,000 hours throughout the year? You have part-time employees who have three consecutive years with 500 hours of service, now they can sign up for a retirement plan!”

- “What portion of your plan do you want to protect against an insurer failing to meet its financial obligations? Now your workplace plan may be able to reduce this liability with an annuity!”

- “The Centers for Disease Control and Prevention report Americans are living longer, reporting life expectancy currently at 78, with women living 4.9 years longer than men. This is resulting in people working longer. Now they can push back taking their required minimum distribution to age 72.”

- “You’re in that window, you like working and you’re not going to let a number tell you it’s time to sit back. Now you can continue to contribute to your IRA past age 70½. So go ahead, contribute until you are 72, the SECURE Act gives you that chance now.”

- “Something unprecedented happened in 2011 - student debt crossed the $1 trillion mark. Today those debt levels are around $1.5 trillion, the average student borrower owes about $34,000 at graduation. Now 529 accounts can be accessed to repay these student debts - up to $10,000 annually!”

- “Millennials face unique challenges paying for the first year of parenthood. Those first-year expenses could total $21,248. Now the SECURE Act permits penalty-free withdrawals of $5,000 from their 401(k) accounts towards these first-year parenthood costs - including adoption!”

- “Did you know the SECURE Act requires a “progress report” for plan participants? The Department of Labor is developing those rules now. Let’s get your estate in order so any rule impact will minimize your risk.”

Lloyd Lofton is the founder of Power Behind the Sales. He is the author of The Saleshero’s Guide To Handling Objections, voted 1 of the 11 Best New Presentation Books To Read in 2020 by BookAuthority. Lloyd may be contacted at [email protected].

© Entire contents copyright 2020 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Gov. Charlie Baker Breaks With State Officials Over Mass. Fiduciary Reg

How Insurers Can Win Over Gen Z Consumers

Advisor News

- CFP Board announces CEO leadership transition

- State Street study looks at why AUM in model portfolios is increasing

- Supreme Court to look at ERISA rules in upcoming Cornell case

- FPA announces passing of CEO, succession plan

- Study: Do most affluent investors prefer a single financial services provider?

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Anti-LGBTQ+ policies harm the health of not only LGBTQ+ people, but all Americans

- New behavioral health clinic focusing on rural communities opens doors in Mankato

- Nebraska senators Brian Hardin, Mike Jacobson pitch Unicam bills on federal help for rural health care

- Jacobson, Hardin pitch Unicam bills on help for rural health care

- State Comptroller's audit reveals $16.2 million in improper Medicaid claim payments

More Health/Employee Benefits NewsLife Insurance News

- Aflac Northern Ireland: Helping Children, Caregivers and the Community

- AM Best Affirms Credit Ratings of Well Link Life Insurance Company Limited

- Top 8 trends that will impact insurance in 2025

- 59% of insurance sector breaches caused by third-party attacks.

- Pacific Life Announces Promotions of Karen Neeley and Patricia Thompson to Senior Vice President

More Life Insurance News