Closing The Life Insurance Gap For Millennials And Gen Z

By Adam Winslow

Many financial planning decisions benefit from early action.

When it comes to saving for the long term, millennials and Generation Z have time on their side. Although we are currently in a period of extreme market volatility, if millennials and Gen Z start investing early, there is the potential for their assets to compound and appreciate over the next 40-plus years.

Early action can be equally beneficial for another important financial decision — purchasing life insurance. Like budgeting, saving for the future and paying off debt, life insurance is an important part of a secure financial plan.

For many young Americans, the hardest part may be getting started. Consideration of term life insurance can become that important first step.

Age and health are the most significant drivers of policy cost and insurability. By purchasing a term life insurance policy at a low price when young and generally healthier, millennials and Gen Zers can lock in a level of immediate protection. Then, if the policy allows, which most do, they are able to convert it to a permanent policy before the term expires – even if their health declines while the policy is in force.

A Missed Opportunity

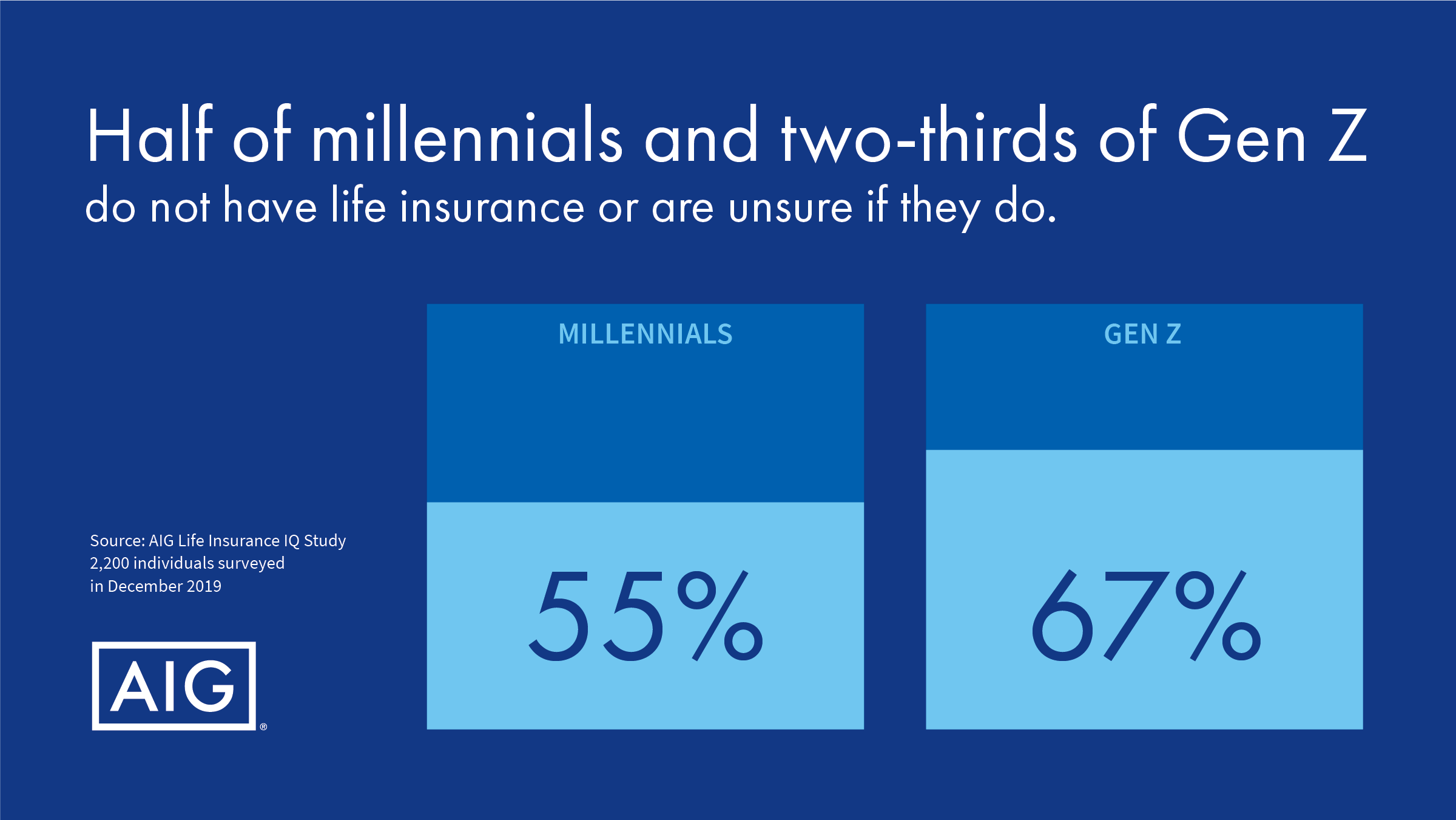

AIG Life & Retirement’s recent Life Insurance IQ Study shows that millennials and Gen Zers strongly believe in the value of life insurance. According to the research, seven in 10 respondents ages 18 through 38 said life insurance will protect their ability to live a long, financially secure life. Yet half of millennials and two-thirds of Gen Zers do not have life insurance or are unsure if they do.

For financial and life insurance professionals, this knowledge gap represents a missed opportunity to help young Americans develop a holistic financial plan that includes protection.

Caring For Others

Protection is clearly something that is important for millennials and Gen Z. Nearly half said they currently have someone who depends financially on their care, including a child (34%), pet (22%), spouse (17%), parent (10%), sibling (7%) or friend (6%). Further, more than half of respondents ages 18 through 38 said leaving money to a loved one after they’re gone is their driving motivation for buying life insurance.

Need For Education

A key barrier to helping young investors get started with term coverage is the knowledge gap associated with all forms of life insurance.

According to the AIG Life Insurance IQ Study, most millennials and Gen Zers do not have a solid understanding of the differences between term and permanent coverage. Nearly two-thirds (65%) indicated they did not know whether the death benefit for term life insurance is set at a fixed amount and does not change. Nearly all term life insurance purchased in the U.S. is level term, where the size of the policy stays at a fixed level for the length of the policy.

That’s one of the many misconceptions that financial and life insurance professionals can help bridge through education. Another misconception is unfamiliarity with the living benefits associated with permanent policies.

Fewer than two in 10 respondents ages 18 through 38 were aware that some forms of life insurance can be used to build a supplemental retirement income stream for themselves (17%), pay for a child’s or grandchild’s education (13%), cover nursing home or at-home health-care costs if they experience cognitive or physical decline (13%), or leave money to a charity (5%).

Start With Term; Convert To Permanent

For insurance and financial professionals interested in helping millennials and Gen Zers build a life insurance portfolio, term coverage can be an affordable starting point, and term is often preferred for temporary, short-term needs.

By educating millennials and Gen Z about the affordability of term coverage today – as well as the living benefits of permanent coverage for down the road – advisors can help young Americans flex “from term to perm,” when budgets allow.

Reasons for converting to permanent insurance over time include:

- Term coverage can typically be converted into permanent coverage without a medical exam or the need to prove insurability.

- The amount of coverage to convert can be flexible – you can often choose to convert all or just part of your term life insurance to permanent insurance.

- Permanent insurance generally has the option to build cash value. A term life insurance policy does not.

- The cash value accumulated within permanent insurance is tax advantaged, allowing assets to compound and grow while they remain within the policy.

- You can access the cash value of your permanent insurance during your lifetime.

A Call To Action

Fortunately, several of the misconceptions that used to deter 18- through 38-year-olds from recognizing the need for life insurance have faded with the times. Now, most millennials and Gen Zers say that life insurance isn’t only for breadwinners, married couples or parents of youngsters.

Eighty-six percent believe that stay-at-home parents can benefit from life insurance, and 81% believe that the primary earner shouldn’t be the only household member with coverage. Ninety-two percent say that parents still may need life insurance after their kids turn 18, and nearly seven in 10 (69%) believe singles may benefit from life insurance.

The challenge for insurance and financial professionals is to break down the barriers that stand between young Americans and the protection they value. Because of its affordability, term insurance can be an important way for millennials and Gen Zers to lock in future insurability and to begin the process of building a holistic financial plan that includes protection and security.

Adam Winslow is CEO of life insurance at AIG Life & Retirement. Adam may be contacted at [email protected].

© Entire contents copyright 2020 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

COVID-19 Cuts Into Insurance Agency M&A Dealing

Craig DeSanto Named President Of New York Life

Advisor News

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

More Advisor NewsAnnuity News

- Hildene Capital Management Announces Purchase Agreement to Acquire Annuity Provider SILAC

- Removing barriers to annuity adoption in 2026

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News